If you are on a journey to undertake SOC 2 compliance for your business, it can be confusing to sort through the reams of information and arrive at some form of clarity.

This matter is made even more complicated by the prevailing Fear, Uncertainty, and Doubt in the market created by unscrupulous vendors who peddle myths to win business.

In this blog, we demystify the complexities of it all and give you the low down on SOC 2, how the AICPA views it, who is qualified to certify a business, and more.

Understanding AICPA and SOC 2 Compliance

The AICPA (American Institute of Certified Public Accountants) is the professional body that is responsible for accounting and certification standards in the United States; they have developed SOC 2 as a cybersecurity risk management framework to help communicate the effectiveness of their risk management programs. AICPA’s influence extends deeply into SOC 2 compliance.

By framing the SOC 2 standards, AICPA ensures these guidelines are robust, relevant, and in line with current technological and security demands.

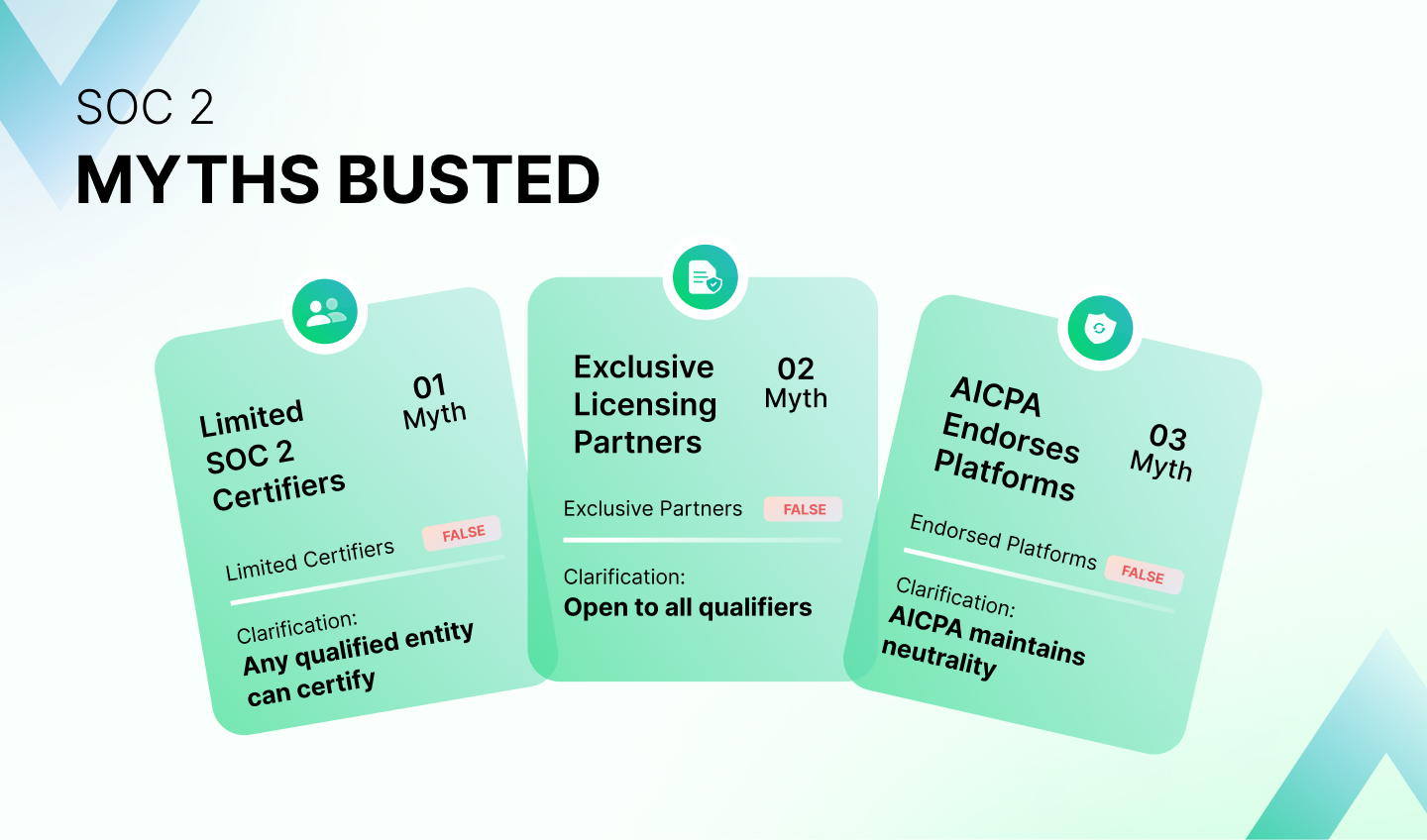

Common Myths Surrounding AICPA Licences and Attestations

Myth 1: AICPA commissions exclusive partners for SOC 2 licensing

A widespread misconception is that only a select few companies have exclusive rights to offer SOC 2 licensing and attestation. However, the reality is that SOC 2 licensing is an inclusive process accessible to all qualifying organizations. To clarify, a “qualified entity” in the context of SOC 2 attestation refers primarily to Certified Public Accountants (CPAs) and CPA firms.

These professionals are uniquely authorized to attest SOC 2 reports, a process that involves verifying and providing an independent assessment of the controls about security, availability, processing integrity, confidentiality & privacy, Trust Service Criteria of a Service organization system

Myth 2: Only certain companies or consultants can grant SOC 2 attestation

SOC 2 licensing is not monopolized; it is a standard that any qualified entity ‘CPA or CPA firm’ can attest to, following the guidelines for processing integrity set by AICPA. However, the distinction between individual CPAs and CPA firms is significant. Individual CPAs are licensed professionals who meet the educational, examination, and experience requirements set by their jurisdiction’s Board of Accountancy.

CPA firms, on the other hand, are business entities consisting of one or more CPAs who provide accounting, auditing, and other related services. While both can perform SOC 2 attestations, firms may offer broader resources and a team-based approach.

While only CPAs and CPA firms can grant SOC 2 attestation, this doesn’t mean the process is monopolized. Rather, it’s a specialized service that requires specific professional qualifications.

Note:

When undertaking compliance with a platform such as Sprinto, you get to choose from a range of qualified CPA firms for your attestation in a mode of engagement that minimizes friction and maximizes your chances of audit success.

Myth 3: AICPA endorses specific platforms for compliance

AICPA maintains neutrality, ensuring an equal playing field for all platforms meeting rigorous standards. They do not favor or endorse any platform. The AICPA’s approach to SOC 2 compliance framework is fundamentally inclusive.

Rather than endorsing specific assessors or platforms, the AICPA provides a framework and set of standards – the Trust Service Criteria – that any qualified third-party assessor can use to evaluate an organization’s compliance and prepare a readiness assessment or attestation report.

This open approach ensures that various third-party assessors can provide SOC 2 attestation services, promoting access, competition, innovation, and choice in the compliance market.

Get SOC 2 compliant on a budget

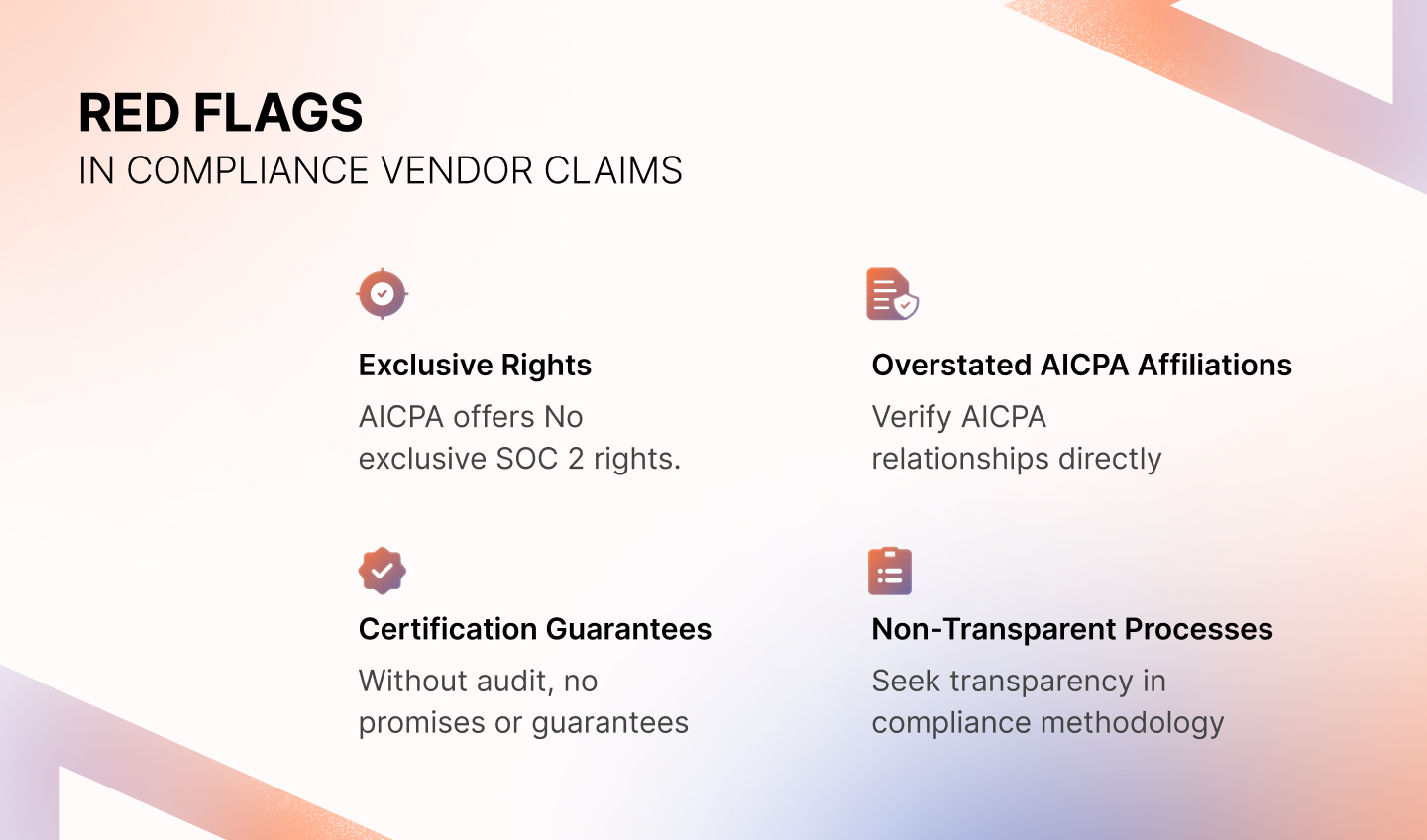

Identifying Malpractices and Misguidance By Vendors

Exclusive Rights Claims: Any vendor claiming exclusive rights to provide SOC 2 auditing services should be approached skeptically; this is a false claim, and anyone making such a claim to win new business is misleading customers.

Overstated Affiliations: Be cautious of vendors who exaggerate their relationship with the AICPA. While many vendors work within the framework set by AICPA, claiming an endorsed or preferential relationship is misleading.

Guarantees of Attestation: Vendors that guarantee SOC 2 attestation without a thorough evaluation process of the control environment should be looked at through a lens of suspicion. SOC 2 report requires a comprehensive audit of the asset environment and cannot be guaranteed upfront.

Lack of Transparency: Vendors should be transparent about their auditing process, qualifications, and adherence to the Trust Services Criteria. A lack of transparency in the process that they use to ensure audit readiness is a significant red flag.

Impact of Unscrupulous Vendor Claims

Misleading practices do more than just harm the individual organizations that fall for them; they undermine the trust and integrity of the entire compliance and regulatory sector.

Erosion of Industry Trust

When vendors engage in unethical practices, it casts a shadow over the industry, leading to skepticism and doubt even towards legitimate providers. This erosion of trust can make it challenging for service organizations to discern credible compliance partners and external auditors, complicating their compliance journey.

Compromised Compliance Integrity

Misleading practices can lead to inadequate or incorrect SOC 2 audits, resulting in a false sense of security. Organizations may believe they are compliant when, in reality, significant gaps or vulnerabilities remain unaddressed in their risk assessment and attestation process. This compromises the very goal of SOC 2 compliance, which is to ensure robust data security and privacy practices.

Legal and Financial Repercussions

Falling victim to misleading practices can have legal and financial repercussions for service organizations, especially if it leads to a breach.

How To Screen Vendors Better?

Organizations should engage in due diligence, verify credentials, and prioritize ethical compliance partners. The National Association of State Boards of Accountancy (NASBA) maintains a list of licensed CPA/CPA firms that can be used to verify the credentials of your audit partner. Find out more here.

Download the ultimate vendor due diligence checklist:

Also, inquire about their audit process to understand their approach towards auditing and the methodology behind how they plan to assess your controls and help you manage any gaps.

Resources for Verifying Claims About AICPA Licenses

AICPA’s Official Website: Check if the consultant or firm is listed on the official list of licensed CPA/CPA firms

Industry Forums and Groups: Engage with industry forums about the vendor’s background.

Independent Reviews and Testimonials: Look for independent reviews or testimonials about the compliance partner’s services.

How Sprinto Maintains Transparency & Integrity?

No miss-selling: At no point in the sales process will fake claims be made regarding the exclusivity of agreements with AICPA or any other certifying body to misrepresent the product.

Clear Communication: We ensure clients are fully informed about every step of the compliance process, giving an accurate picture of the work involved and being transparent about timelines and success rates.

Educational Support: We provide resources and support to help organizations understand SOC 2 and learn the why before moving forward with the audit.

Continuous Compliance Monitoring: Sprinto offers tools and solutions for ongoing compliance monitoring, ensuring organizations stay compliant even as regulations evolve.

Frequently Asked Questions:

Can a company be SOC 2 certified by a body that is not an AICPA member?

No, a company cannot be SOC 2 certified by a body that is not an AICPA member. Only its Certified Public Accountants (CPAs) and audit firms are authorized to conduct SOC 2 audits.

Does SOC 2 have an official or exclusive compliance vendor?

No, SOC 2 does not have an official or exclusive compliance vendor. Instead, the AICPA provides the Trust Services Criteria framework, which independent and qualified assessors or audit firms can utilize to assess an organization’s compliance.

Where can I report a company that claims exclusive rights to AICPA attestation?

If you encounter a company falsely claiming exclusive rights to AICPA attestation or SOC 2 audits, you should report them directly to the AICPA via their official website or via their customer service channels.

Vishal V

Vishal, Sprinto’s Content Lead, masterfully weaves nuanced narratives and simplifies convoluted compliance topics with seasoned expertise. His perennial curiosity fuels his pursuit of fresh angles in every piece. Off-work, he’s an avid photographer, birder and a music buff, he blends expertise and exploration seamlessly in work and life.

Explore more SOC 2 articles

SOC 2 Compliance Overview

SOC 2 Preparation and Documentation

SOC 2 Audit and

Reporting

SOC 2 Differences and Similarities

SOC 2 Updates & Management

SOC 2 Industry-Specific Applications

research & insights curated to help you earn a seat at the table.