SOC 1 vs SOC 2 vs SOC 3 Comparison — Overview & Comparison

Pritesh Vora

Apr 09, 2024

If you run a SaaS business and want to target mid-market or enterprise customers, you are going to be asked about the security posture of your company at one point or another.

You may try to pass through them by answering security questionnaires but when your sales deal is stuck and cannot move forward because your customer demanded a SOC 2 certificate, that is when you will realize how important it is to get compliant.

In our previous company “Recruiterbox,” when we had to undergo the SOC compliance process, we were confused and clueless about what was needed. We did not know where to even begin and which type of certification we were supposed to apply for — SOC 1 or SOC 2 or SOC 3.

It was nothing less than a nightmare. We somehow pulled it through and got ourselves certified after investing nine months of effort and more than $50K.

This exercise literally brought Recruiterbox to a standstill and we fretted at every possible instance of why in the world did we even take this up. Because of the shift in focus, our product development came to a grinding halt and impacted our other planned projects.

If you are in a similar boat, we get it! Implementing a compliance program is surely an uncertain, manual, and error-prone process. If you are confused, or frustrated because you have to undergo the compliance process, relax. Let’s dive in.

TL;DR – SOC 1 vs SOC 2 vs SOC 3

- SOC 1 is a financial audit report, SOC 2 is a security and controls report and SOC 3 report is similar to SOC 2 drafted to be presented to a general audience.

- As a service provider, you may find it challenging to understand the difference between all three SOC reports, below article helps you understand the types, benefits, and when to acquire them easily.

Types of SOC reports

SOC is a verifiable auditing report performed by a Certified Public Accountant (CPA) designed by the American Institute of Certified Public Accountants (AICPA) concerning the systematic controls in place at a service provider, including:

- Data privacy

- Cybersecurity

- Confidentiality

- Processing integrity

- Controls related to financial reporting

Meet our compliance experts

Compliance on Demand AMA

Get compliance questions answered live.

SOC reports help establish more credibility for you — a competitive advantage worth both monetary and time investments. There are three types of SOC reports — SOC 1, SOC 2, SOC 3 — wherein SOC 1 and SOC 2 are the most used.

The main difference between SOC 1 and SOC 2 is that the former focuses on financial reporting and the latter on operations and compliance. Whereas SOC 3 is less common and is a variation of SOC 2, designed for the company’s clientele.

Save 80% of man hours spent on SOC 2

Difference between SOC 1 vs SOC 2 vs SOC 3

Each SOC report—SOC 1, SOC 2, SOC 3—fulfills distinct roles within compliance assessments. SOC 1 primarily focuses on an organization’s internal financial controls, while SOC 2 and SOC 3 assess controls related to the Trust Services Criteria. Also, SOC 3 serves as a public-facing demonstration of an entity’s control effectiveness, in contrast to SOC 2’s more confidential nature among SOC report types.

Here is a quick difference between SOC 1 vs SOC 2 vs SOC 3:

So, now that you know the overview of SOC 1 vs SOC 2 vs SOC 3, let’s dive further into each report.

Everything You Must Know About SOC 1

Developed mainly for third-party service providers by the AICPA, a SOC 1 report gives your company’s clients assurance that their financial information is being handled safely and securely.

Types of SOC 1 reports

SOC 1 offers two types of reports: Type I and Type II. While Type I showcases that your company’s internal financial controls are properly described and designed at a point in time, a Type II report tests the effectiveness of your controls over a period (for example, six months).

Benefits of SOC 1 compliance

SOC reports help your clients acquire an objective evaluation of the effectiveness of controls that address the operations, compliance, and financial reporting processes of your organization. It:

- Assures your clients that their sensitive data is protected

- Evaluates policies and procedures that are key to your company’s operability

- Verifies that you have proper internal controls and processes in place to deliver high-quality services to your clients

Please Note

SOC 1 audit reviews internal controls over financial reporting rather than a review of your financial statements.

When to get SOC 1 compliance

If you are a newly-started business, SOC 1 is not likely to be on your radar. However, the timing of your compliance is essential as you do not want to be scrambling to get certified when a deal is in jeopardy. Here are three SOC 1 report examples:

- Your client asks for a “right to audit”

- Your company is going to be publicly traded

- You need to apply with another regulation (e.g., SOX)

Who should go for SOC 1 auditing

If you are a service provider such as a payroll or medical claims processor, loan servicer, data center company, and SaaS provider that stores and processes your clients’ financial or sensitive data, you must become SOC 1 compliant.

Everything You Must Know About SOC 2

In comparison to SOC 1, SOC 2 is a framework that helps businesses demonstrate their data center and cloud security controls. After SAS 70 started being used to measure the effectiveness of an organization’s security controls, SOC 2 was developed with an emphasis on security.

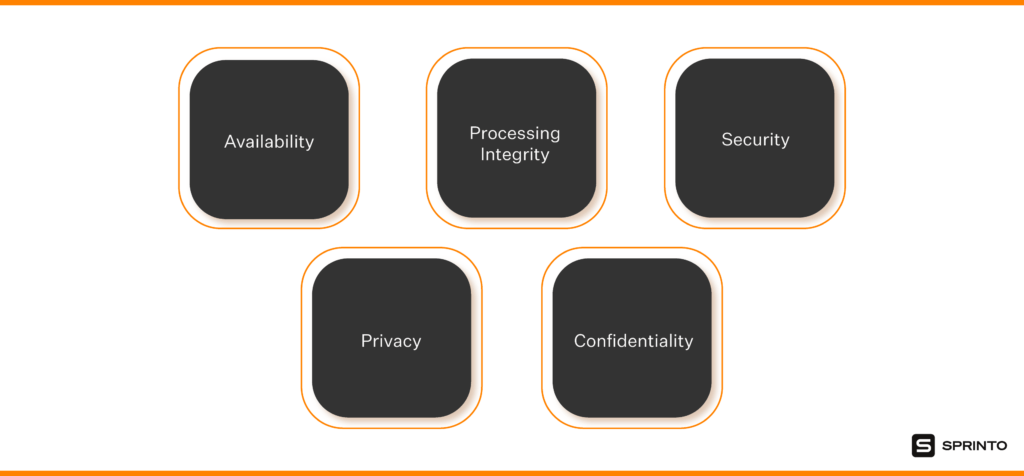

SOC 2 is rooted in the criteria called the Trust Services Criteria, which the AICPA defines as:

- Availability: Systems must be available for use.

- Confidentiality: Information marked as “confidential” should be adequately safeguarded.

- Privacy: Any personal information collected must be used, retained, disclosed, and discarded properly.

- Processing integrity: Systems processing must be accurate, timely, and authorized.

- Security: Systems and data should be protected against all cyber threats that compromise confidentiality, availability, integrity, and privacy.

Types of reports under SOC 2

Similar to SOC 1, SOC 2 also has Type I and Type II reports. SOC 2 Type I compliance audit covers design controls’ suitability and effectiveness and provides a point-in-time snapshot of the organization’s controls.

On the other hand, SOC 2 Type II compliance audit looks at the effectiveness of the same controls over a period, say, six months or a year, and takes longer for service providers to prepare for it.

Benefits of SOC 2 compliance

A SOC 2 audit plays a crucial role in regulatory oversight, corporate governance, and internal risk management processes. Any client that needs detailed information and assurance about the controls deployed at the service organization may request a SOC 2 audit.

SOC 2 compliance ensures:

- Your company’s information security measures align with the evolving requirements of data protection in the cloud.

- You have the infrastructure, tools, and processes to protect your clients’ sensitive information from unauthorized access.

- Your system maintains high availability, and their processing occurs as intended on time.

Talk to our experts if you are looking to get SOC 2 compliant

When to get SOC 2 compliance

The marketplace will influence how much you need to be compliant for SOC 2. The bigger the client you pursue, the more likely you will need it. If you process or host non-financial data, you should pursue SOC 2 at some point.

Please note that SOC 2 is not required by big-time compliance frameworks like PCI DSS or HIPAA. However, with the number of data breaches, enterprises especially will want to see SOC 2 compliance before finalizing a deal.

Who cares about SOC 2 compliance

Unlike SOC 1, where the report is prepared for the clients’ auditors and controller’s office, SOC reports are shared by the service providers, under an NDA agreement, with the clients, managers, and regulators.

Who should go for SOC 2 auditing

Companies that should go for SOC 2 audit include services such as data hosting and processing, cloud storage, colocation, and SaaS.

If you are a service provider storing, processing, or transmitting any information, you may need to get compliant to gain a competitive edge in the market, much like the decision to have an ISO 27001 certification.

SOC 2 audits may also be performed as part of your regular security program or if you suspect a data security issue.

Moreover, if you do not materially impact your clients’ Internal Control over Financial Reporting (ICFR) but do provide critical services to them, you will need to be SOC 2 compliant.

To know more about Sprinto’s work – Check out our case studies

How Sprinto enables SOC 2 Compliance

Acquiring SOC 2 Type 2 certification requires at least six months of meticulous planning and implementation if done independently. However, Sprinto’s compliance automation significantly reduces this timeframe. Here’s how we expedite your journey towards certification:

- Automating 90% of compliance tasks, Sprinto allows focus on core business goals while ensuring efficient compliance.

- Supporting 100+ integrations, Sprinto facilitates seamless setup of controls for all cloud applications.

- The intuitive dashboard offers real-time insights into control statuses and security adherence.

- Prompt notifications for irregularities ensure swift action on security gaps or missed training.

- Continuous 24/7 monitoring conducts over a million monthly checks, ensuring ongoing control assessment for cloud services.

Over the next two weeks, StepSecurity completed its audit and received SOC 2 Type 1 audit report. “Thanks to Sprinto, we pulled it off with such finesse!” adds Ashish, Founder of StepSecurity.

Check out How StepSecurity got SOC 2 compliant in 4 weeks

Everything You Must Know About SOC 3

In comparison to SOC 2, According to the AICPA, a SOC 3 report is prepared to meet the requirements of those who want assurance about the controls — related to security, processing integrity, availability, confidentiality, or privacy — of a service provider but do not need the knowledge to use a SOC compliance report effectively.

In simple words, SOC 3 comprises the same information found in SOC 2, but it is drafted to be presented to a general audience.

Businesses often use SOC 3 reports to post on their website, along with a stamp or seal that indicates compliance. A SOC 3 report is always a Type II, and the auditor testing of controls is not described in the report.

When to get SOC 3 compliance

Any time you want to add another layer to your company’s marketing, you can do a SOC 3 audit to showcase your commitment to excellent service. Look at SOC 3 auditing as a way to reinforce your SOC compliance report’s results.

It is considered a brilliant marketing tool to attract new customers who instantly recognize the stamp of approval from a credible third-party auditor.

Who cares about SOC 3 compliance

This report is designed for those who want assurance on your company’s controls but do not have the expertise or knowledge to understand the detailed and comprehensive SOC report. A SOC 3 report is easy to understand by the general public.

Who should go for SOC 3 auditing

If you are a cloud service provider (SaaS, PaaS, IaaS) housing third-party data, a data center colocation facility, or an IT systems management and you want to communicate your controls effectively minus the complexity of a report, in that case, SOC 3 auditing is for you.

How to Get Your SOC 2 Certification With Sprinto in 4 Simple Steps

As you know, when we started our first company and had to get a SOC 2 attestation while running the business, we spent months and tens of thousands of dollars in the process.

We soon realized that there were many companies facing the same issue and so Sprinto came into existence with a mission to help companies get their SOC 2 compliance certificates with little hassle.

SOC 2 auditing is complicated as it requires you to implement numerous security policies. Piecing together policies and procedures from the internet with dense language can be quite a hassle. Unlike generic compliance platforms, Sprinto is designed specifically for cloud-based companies.

Here is how you can get your SOC 2 certification in just four steps:

1. Connect your systems

Sprinto integrates with a wide range of systems, which takes just minutes to get all set up.

2. Bespoke to your needs

Sprinto is designed to meet your company’s specific needs. Once integrated, the tool continuously monitors your systems and gathers evidence, further cataloging the evidence as per SOC 2 criteria via standard read-only API access. Thanks to managed implementation by Sprinto’s compliance experts, this step is a breeze.

3. Tend to alerts

Once the platform is up and running, Sprinto detects new gaps and sends trigger alerts for you to fix them.

4. Pick an audit partner

Sprinto does the heavy-lifting for you and partners with accredited (AICPA/ISO) third-party audit firms to conduct your audits. It also trains auditors on the platform, so you get a hassle-free experience.

Hey there!

Before taking any further action talk to our experts and understand how Sprinto can really ease your process – Get SOC 2 compliant with ease

Conclusion

In conclusion, selecting the right SOC report can be quite a challenge for service providers because each serves a different purpose. Deciding between SOC 1 or SOC 2 often comes down to whether your controls impact a client’s financial reporting.

For those already SOC 2-compliant but unsure about SOC 3, remember that SOC 2 provides detailed reports limited to specific use, offering comprehensive system and control details. On the other hand, SOC 3 is a more generalized report aimed for public consumption, useful as a marketing tool.

If you’re certain about needing SOC 2 compliance, it’s time to take that step forward. Simplify your compliance journey, save time, and efficiently manage issues with Sprinto’s hassle-free SOC 2 compliance automation software.

FAQs

Is SOC 3 the same as SOC 2?

SOC 3 is a curtailed, publicly sharable version of the SOC 2 Type 2 report. SOC 3 is meant for a general audience and is hosted by organizations on their websites, whereas SOC 2 report is confidential and circulated on a need-to-know basis to stakeholders.

Is SOC 2 better or SOC 3?

SOC 2 Type 2 report is the basis for the SOC 3 report. While SOC 2 is detailed, private and meant for a knowledgeable audience, SOC 3 is the public version of SOC 2. It is meant for a general use purpose audience.

Who needs a SOC 3 report?

SOC 3 reports are meant for general audiences who need assurance regarding the security, availability, confidentiality, processing integrity or privacy of an organization.

What are the two general types of soc reports?

SOC reports can be categorized into two main types: SOC 1 and SOC 2. SOC 1 primarily concerns controls that affect financial reporting, especially important for service organizations impacting clients’ financial statements.

On the other hand, SOC 2 assesses controls related to security, availability, processing integrity, confidentiality, and privacy, showing how well controls operate in systems beyond financial reporting areas.

What is the difference between SOC 2 and SOC 3 certification?

The key difference between SOC 2 and SOC 3 reports is their confidentiality and detail level. SOC 2 reports provide in-depth, confidential information about a company’s systems and audits, shared only with specific parties upon signing non-disclosure agreements. In contrast, SOC 3 reports offer less detail and are non-confidential, designed for public distribution, and often used as marketing materials.

Pritesh Vora

Pritesh is a founding team member and VP Growth & Marketing at Sprinto. He comes with over a decade of experience and is a data-driven dynamo in growth strategy, sales, and marketing! His strategies have crafted the success of not one, but two early-stage SaaS startups to 7-digit revenues within a year – he’s your go to guy for all things growth.

Grow fearless, evolve into a top 1% CISO

Strategy, tools, and tactics to help you become a better security leader

Found this interesting?

Share it with your friends

Get a wingman for

your next audit.

Schedule a personalized demo and scale business

Sprinto: Your growth superpower

Use Sprinto to centralize security compliance management – so nothing

gets in the way of your moving up and winning big.