Compliance Auditor: Becoming One & The Future

Pansy

Jan 02, 2025

Businesses spend somewhere between six to nine months to comply with cybersecurity standards. The majority of this timeframe is taken up by the compliance audit.

It’s a comprehensive process of to and fro calls between a business’s GRC team and the compliance auditor, who needs to ensure that evidence is gathered, all questions answered and controls are implemented correctly.

But what makes compliance auditors so essential, and how can you become one? Let’s explore their key responsibilities, technical expertise, and the deep compliance knowledge that sets them apart.

| TL;DR Compliance auditors conduct thorough audits, identify areas of non-compliance, recommend corrective actions, monitor changes, and report findings for compliance. Becoming an auditor requires the candidate to obtain a bachelor’s degree along with certifications, relevant experience, and continuous development. Common compliance auditors in the USA include Certpro, Barr Advisory, Security Metrics, Ken & Co, etc. |

Who is a compliance auditor?

A compliance auditor is a professional responsible for making sure that an organization adheres to external regulatory requirements and internal policies. Their role is crucial in various sectors such as healthcare, finance, manufacturing, and more.

Compliance auditors evaluate a business’s practices and processes and if they are aligned to regulatory requirements. They also identify potential risks and areas of non-compliance and provide the final certification or attestation, confirming that a business meets the required regulatory standards.

Roles and responsibilities of compliance auditors

A compliance auditor assesses, analyzes, and reports on compliance-related risks, missing or inefficient controls, and sets standardized processes. Their day-to-day activities can be summarized as per the following responsibilities:

- Conducting audits: Audits are one of the key responsibilities of compliance auditors. They assess whether all your policies and procedures comply with relevant laws, regulations, and industry standards while checking all security controls.

- Identifying issues: During audits, auditors also discover issues and incompetencies. They review documentation, interview staff, and observe operations to uncover areas of non-compliance that need addressing.

- Recommending improvements: After conducting audits, auditors provide recommendations for corrective actions. Here, they need to work closely with the management team to implement necessary changes to improve compliance.

- Monitoring changes: Identifying issues is not the end. They also track the implementation of compliance programs and monitor the effectiveness of controls over time. This is continued with regular follow-ups with the organization.

- Reporting findings: This is done hand-in-hand during audits, along with the organization’s help. These reports usually contain all the documents of their findings, along with compliance issues, measures to resolve them, controls implemented, etc.

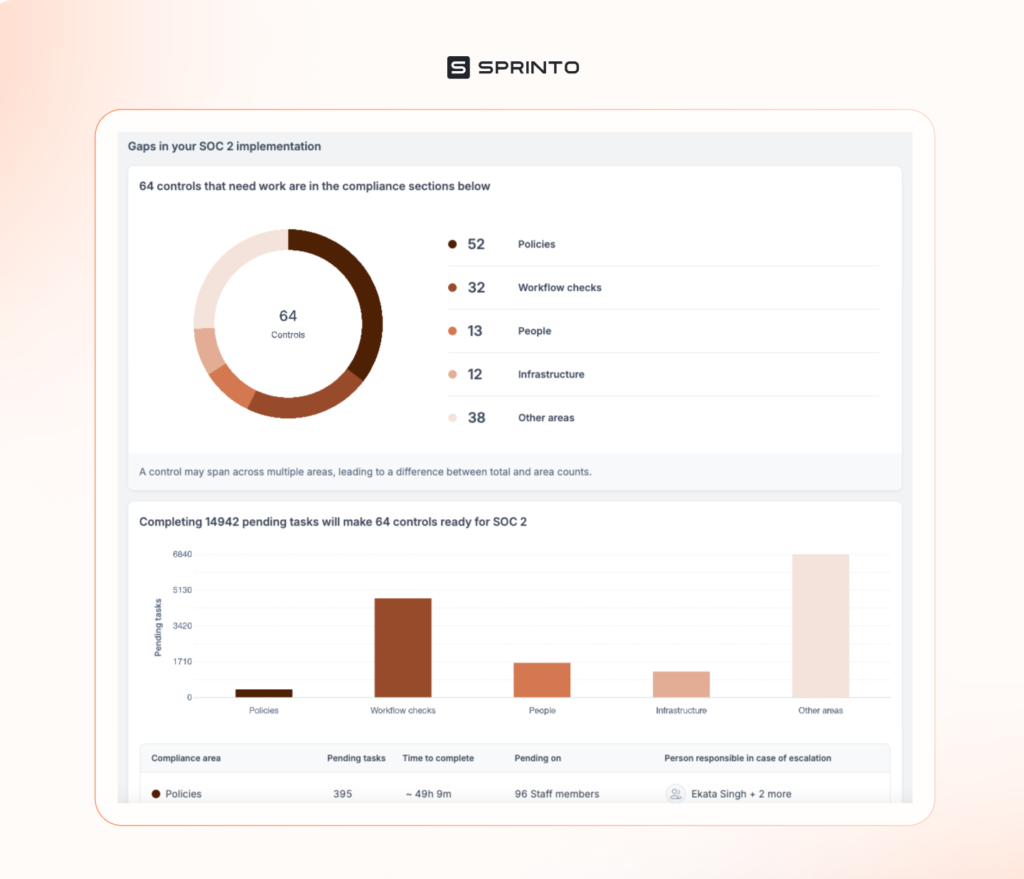

Here is an example of a compliance gap report:

Qualifications and skills needed to become a compliance auditor

A compliance auditor’s assessment carries decisive weight in the certification process. As a result, they need a solid educational background combined with relevant experience and training. Here are some prerequisites to becoming a compliance auditor.

1. Bachelor’s degree

A foundational requirement for most compliance auditor positions is a bachelor’s degree. Here’s a list of fields of study:

- Accounting: If someone plans to enter finance markets or industries, a degree in accounting while understanding financial principles and practices is essential.

- Business administration: Auditors need a broader understanding of organizational operations and management strategies, so business administration is a good skill to have.

- Law or legal studies: Knowledge of regulatory frameworks and legal implications can be particularly beneficial in understanding compliance obligations.

- Information technology: A degree in IT can be advantageous for auditors working in almost any environment or industry, as technology and data protection regulations are becoming increasingly important.

2. Relevant experience

The current world doesn’t value formal education and degrees without practical experience, and the same is true in the compliance world.

Practical experience in compliance, auditing, or risk management is a must. Many employers prefer candidates with several years of work experience in related roles, such as internal auditor, compliance analyst, or risk officer. Internships or entry-level positions with similar responsibilities can also help auditors land a job.

3. Certifications

Certifications can elevate an auditor’s qualifications and show that they have expertise in the field. Here are some common and widely recognized compliance auditor certifications that can be considered:

- Certified Internal Auditor (CIA): This credential is key for auditors and validates their ability to conduct internal audits and assessments.

- Certified Compliance and Ethics Professional (CCEP): Offered by the Compliance Certification Board, this certification focuses specifically on compliance and ethics, equipping auditors with necessary frameworks and principles.

- Certified Information Systems Auditor (CISA): The CISA certification is made for professionals who audit, control, and monitor information technology and business systems.

- Certified Risk Management Professional (CRMP): This certification focuses on risk assessment and management within compliance and emphasizes a proactive approach to identifying potential risk areas.

4. Continuous professional development

Given the ever-evolving nature of laws and regulations, continuous professional development is crucial for compliance auditors. This can involve attending workshops and seminars to stay updated on the latest compliance trends, regulatory changes, and industry best practices.

Engaging with other professionals in this industry brings in networking opportunities and access to a wealth of knowledge from experienced colleagues in the field. Join our newsletter for updates on events, news, webinars, AMAs, and more.

What does the future of compliance auditors look like in the USA?

The future of compliance auditors in the US is quite bright. However, you also need to keep in mind that to thrive in this field, you must be able to cope with complex regulatory requirements while constantly upskilling yourself with the latest technologies and tools.

With the upcoming of new technologies like AI, most countries are developing new frameworks to address ethical concerns. So, compliance auditor jobs are only likely to increase in the near future.

Similarly, a compliance auditor’s salary ranges anywhere from $44,721 to $116,659 per year, as per Indeed. However, it depends on which state you’re operating in, too. Currently, the highest-paying states for compliance auditors include Dallas, Chicago, Bloomington, New York, Fort Wayne, and Indianapolis.

Top 15 compliance auditors in the US according to 3 frameworks

As per our research on the best independent compliance auditors in the US, the list below is categorized by the most commonly known industry standards.

ISO 27001 compliance auditors

For businesses implementing ISO 27001 for information security, here’s a list of the best ISO 27001 auditors:

- CertPro

- Prescient Assurance

- Consilium Labs

- KirkPatrickPrice

- Sensiba

SOC 2 compliance auditors

There are a wide range of SOC 2 auditors and firms available in the US market. However, we’ve picked the best ones for you:

- Barr Advisory

- Johanson Group

- Prescient Assurance

- Sensiba San Filippo

- iRisk Assurance

PCI DSS compliance auditors

PCI DSS is a crucial standard for businesses that handle payment card information. The following auditors have been regarded as the best PCI auditors.

- Accorp Partners Inc

- KEN & Co

- Payment Software Company (PSC)

- Coalfire Systems Inc.

- SecurityMetrics

How does Sprinto help auditors?

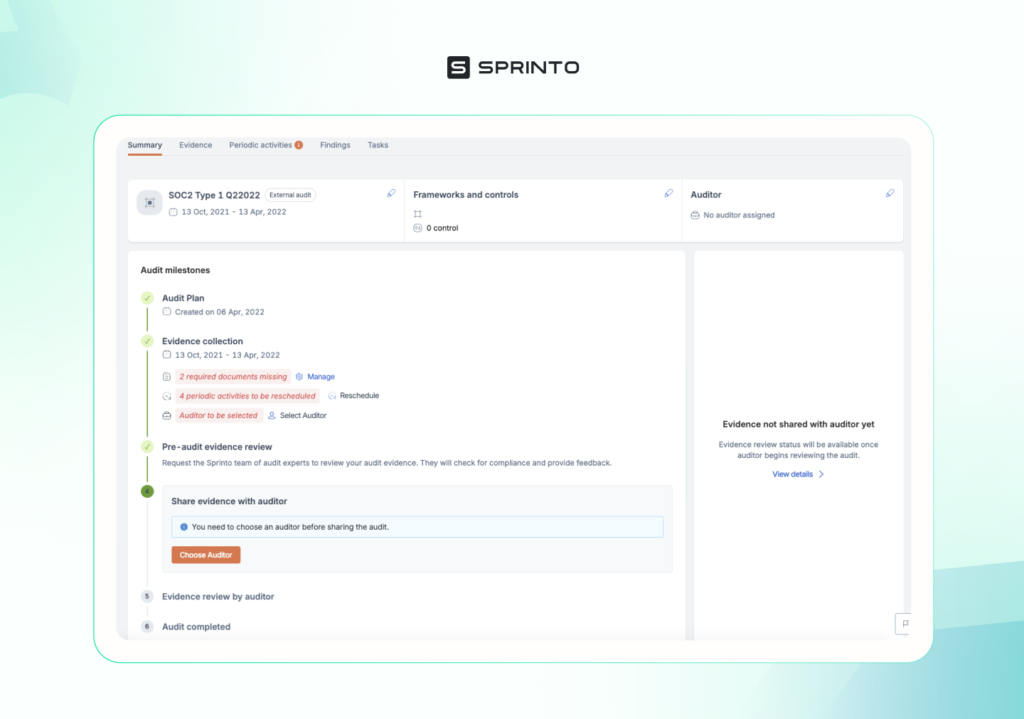

Sprinto, a GRC automation platform, can quite helpful to streamline the compliance audit process for auditors in multiple ways:

- Auditor-client connections: The platform has an extensive network of organizations that ensures that auditors can easily connect with clients and vice versa.

- Auditor-ready programs: By the time you (the auditor) step in, controls are mapped, evidence is collected, and security risks are addressed, setting the stage for a smooth audit process.

- Easy-to-consume evidence reports: The independent auditor dashboard provides organized, ready-to-review evidence that avoids chasing internal teams or sifting through scattered information.

- Simplified feedback loops: Collecting feedback and prioritizing actions becomes faster and clearer, reducing confusion and delays.

- Minimized back-and-forth: Well-prepared organizations mean fewer follow-up requests, saving valuable time for both parties.

- Faster review-to-compliance cycle: Sprinto significantly reduces the gap between the review phase and proving compliance by streamlining evidence review and decision-making.

It’s all there in the platform, ready for you to inspect, without needing additional context or back-and-forth explanations. Here’s a glimpse:

Sprinto significantly eliminates the guesswork involved in the certification process.

By the time you step in, the platform has already identified and addressed most compliance gaps through its comprehensive compliance gap report. This allows you to focus on verification rather than troubleshooting, making the audit process smoother and more efficient.

Frequently asked questions

1. What is the main purpose of a compliance audit?

The main purpose of a compliance audit is to evaluate whether an organization adheres to applicable laws, regulations, industry standards, and internal policies. It identifies compliance gaps, assesses risk, and ensures the organization is operating ethically and within the required framework to avoid penalties and safeguard its reputation.

2. How do I get into compliance auditing?

To become a compliance auditor:

- Education: Obtain a degree in accounting, finance, business administration, or a related field.

- Certifications: Pursue certifications like Certified Internal Auditor (CIA), Certified Public Accountant (CPA), or Certified Compliance & Ethics Professional (CCEP).

- Experience: Gain experience in auditing, risk management, or compliance-related roles. Entry-level roles in internal audit or compliance departments are a good start.

- Skills: Develop strong analytical, communication, and attention-to-detail skills. Familiarity with industry-specific compliance frameworks (e.g., SOC 2, ISO 27001, HIPAA) is advantageous.

3. Who performs a compliance audit?

Compliance audits are performed by:

- Internal auditors: Employees within the organization tasked with ensuring internal compliance with policies and regulations.

- External auditors: Independent third-party firms or individuals hired to provide an unbiased assessment of the organization’s compliance.

- Regulatory agencies: Government bodies or industry regulators conducting audits to enforce compliance with laws and standards.

4. How much does a compliance auditor earn in Texas?

In Texas, the average annual salary for a compliance auditor ranges from $83,181 to $107,645, depending on experience, certifications, and the industry. Senior auditors or those with specialized certifications can earn upwards of $139,304 annually. (Indeed)

Use Sprinto to centralize security compliance management – so nothing

gets in the way of your moving up and winning big.