Fintech companies handle sensitive financial data every day, often moving across multiple systems, partners, and geographies. For them, PCI DSS compliance is a legal requirement and a sign to customers that their payment information is safe.

These standards safeguard Cardholder Data Environments (CDE) against breaches, fraud, and misuse. Yet, meeting them can be challenging in a fast-paced fintech setting, where rapid product releases and complex integrations leave little room for error.

This guide breaks down how PCI DSS applies to fintech, what you need to check off, and how the right tools can take the heavy lifting out of staying compliant.

| TL;DR PCI DSS is for fintechs that store, process, or transmit cardholder data, covering payment processors, BNPL platforms, wallets, and payment apps. Compliance levels vary for merchants and service providers, depending on transaction volume and breach history, and there are different audit and reporting obligations. Achieving compliance involves identifying your level, completing the SAQ, reviewing payment tech, documenting processes, scanning for vulnerabilities, and ongoing monitoring. |

What is PCI DSS?

PCI DSS stands for Payment Card Industry Data Security Standard. It’s a set of rules created by the PCI Security Standards Council (PCI SSC) to keep payment card data safe.

It is a global security checklist for any company handling credit or debit card information. It covers encrypting financial data, controlling who can access it, testing systems for vulnerabilities, and keeping your secure payment infrastructure up to date.

Does PCI DSS apply to all financial-tech companies?

If your fintech business stores, processes, or transmits cardholder data, then yes, PCI DSS applies to you. It applies to any fintech entity that stores, processes, or transmits credit card data, including payment processors, digital wallets, BNPL platforms, and apps interacting with payment data.

Following PCI DSS proves that your business can handle sensitive transactions without increasing the risk of fraud, chargebacks, or regulatory penalties. It exists to protect your cardholder data environment (CDE) from hacks, leaks, or misuse.

What are the requirements of PCI DSS for fintech companies?

The PCI DSS requirements for fintech companies in 2025 focus on securing cardholder data and maintaining a secure environment for handling payment information.

Here are the 12 main requirements for PCI DSS for fintech businesses:

1. Maintain a firewall for business devices

A firewall acts as the first barrier between your network and potential attackers. In fintech, this means configuring firewalls to block unauthorized traffic to systems that handle payment data, including cloud-based applications. Your firewall rules should be reviewed regularly to ensure new services or APIs don’t open up risky pathways into your CDE.

2. Change vendor-supplied passwords

Default passwords and configurations are public knowledge and easy for attackers to exploit. For fintech teams, this includes resetting credentials on payment gateways, database admin accounts, and SaaS tools connected to your CDE. Strong, unique passwords combined with multi-factor authentication significantly reduce this risk.

3. Encrypt transmission of cardholder data

Cardholder data must be encrypted using strong protocols like TLS 1.2 or higher when it moves across open or public networks. For fintech businesses, this applies to transactions between your app, payment processors, and any third-party APIs. Proper key management ensures encryption keys are rotated and stored securely.

4. Protect stored cardholder data

If you store payment card information, it should be encrypted using strong algorithms like AES-256, tokenized, or truncated so that the entirety of the number is made inaccessible. Many fintech companies reduce their PCI scope by outsourcing storage to PCI-compliant providers, but you still need to validate how data is handled end-to-end.

5. Use updated antivirus software

Payment systems are prime targets for malware, especially in environments where employees use devices for both work and development. Fintech companies must deploy endpoint protection to detect and quarantine threats in real time, with automatic updates to catch the latest malware variants.

6. Maintain secure systems and apps

Every application in your fintech stack, from your customer portal to your internal admin dashboard, must be patched against known vulnerabilities. This includes running vulnerability scans, following secure coding practices, and removing unused software or plugins that could be exploited.

7. Make cardholder data available only on a need-to-know basis

Access to sensitive payment information should be restricted to specific roles. For example, a customer support rep may see partial card numbers for verification, but only the payment operations team can see full transaction logs. Role-based access controls and frequent access reviews help enforce this.

8. Create a unique ID for every person with business computer access

Shared logins make it impossible to trace activity, which is a significant risk in payment environments. Every developer, analyst, or support agent in a fintech company should have their credentials. This lets you track who did what and when, which is critical during an investigation.

9. Restrict physical access to network and cardholder data

Even in a cloud-first fintech company, on-prem devices like development servers, office networking gear, or point-of-sale hardware can store sensitive data. To keep unauthorized people out, limit physical entry to these systems with keycards, security cameras, or biometric authentication.

10. Monitor access to network and cardholder data

You should log every attempt to access systems in your CDE, whether successful or failed. In fintech, this often involves using SIEM tools or cloud logging solutions to detect anomalies, such as an admin account accessing data at unusual times or from suspicious locations.

11. Test data security regularly

Regular security testing ensures your protections work as expected. Fintech companies should run quarterly vulnerability scans, annual penetration tests, and targeted tests after significant changes like new API integrations or infrastructure migrations. This helps catch gaps before attackers do.

12. Create and maintain an information security policy

Your policy should clearly explain how your company secures cardholder data, including roles, responsibilities, and approved processes. This is especially important in fintech as teams multiply and new hires need a clear framework for handling sensitive data from day one.

PCI DSS compliance levels for Fintech companies

Fintech companies fall under PCI DSS as either merchants or service providers.

- Merchants directly accept customer card payments for goods or services and must secure their payment environment. A fintech app selling services and processing customer card payments is an example.

- Service providers process, store, or transmit cardholder data for other merchants, such as payment processors or infrastructure providers. They typically work with businesses, not cardholders.

Some fintechs accept direct payments and offer payment-related services to others.

For service providers, there are two levels:

- Level 1: 300K+ transactions/year or history of breach. The business needs an annual onsite audit by a QSA (or signed internal audit), quarterly ASV scans, and Attestation of Compliance (AOC).

- Level 2: Under 300K transactions/year. The business needs an annual Self-Assessment Questionnaire (SAQ), quarterly ASV scans, and AOC.

For merchants, there are four levels:

- Level 1: 6M+ transactions/year or history of breach. The business needs an annual QSA audit (or signed internal audit), quarterly ASV scans, and AOC.

- Level 2: 1M–6M transactions/year. The business needs an annual SAQ, quarterly ASV scans, and AOC.

- Level 3: 20K–1M transactions/year. The business needs an annual SAQ, quarterly ASV scans, and AOC.

- Level 4: Under 20K transactions/year. The business needs an annual SAQ, quarterly ASV scans, and AOC.

“Sprinto keeps us honest. Sprinto flags alerts for everything – be it missed scans on an unsecured employee laptop or a new code vulnerability. Even after the PCI audit, Sprinto’s helping us keep the certification.” – Marine Suttle, Managing Director at The Boxoffice Company.

Steps to achieve PCI DSS compliance in the Fintech industry

For a fintech startup or small business, PCI DSS compliance can initially feel like a lot. But it becomes a competitive advantage once you break it down into these steps and build security into your processes:

1. Identify your compliance level

Start by figuring out which PCI DSS level applies to your business. This depends on the number of card transactions you process annually and your breach history, if any.

For example:

- Processing a few thousand transactions might place a business in Level 4 or 3.

- Processing millions of transactions is likely to place a business in Level 1 or 2.

Getting this right helps you understand the depth of assessments, reporting, and audits needed.

2. Complete the Self-Assessment Questionnaire (SAQ)

Once you know your level, the next step is to complete the SAQ. This detailed form asks how your business stores, processes, and transmits cardholder data.

Assign the SAQ to someone on your team who understands your technology setup and operational workflows. Avoid guessing answers in the SAQ, as this can create compliance gaps later.

3. Review your payment technology

Look closely at your payment processing methods and tech stack. Your payment systems, including third-party providers, need to be PCI-compliant.

- Confirm your payment gateway is PCI DSS certified.

- Use tokenization wherever possible to avoid storing raw cardholder data.

- Ensure encryption (TLS 1.2 or above) is enforced end-to-end during data transmission.

Secure API calls to your payment processor for fintech apps should be non-negotiable.

4. Document your compliance and security processes

Auditors and banks expect written proof of your security measures. In startups, processes often live in people’s heads. Without documentation, you risk inconsistencies and failed audits.

Create clear policies around data access, encryption, vulnerability management, and vendor risk management. It helps to keep a well-documented incident response plan that spells out who takes action, how they respond, and the timeline for doing so.

5. Complete your Attestation of Compliance (AoC)

Once the SAQ and supporting documentation are ready, complete your AoC. This is a formal statement that you meet PCI DSS requirements. For Level 1 businesses, a Qualified Security Assessor (QSA) usually reviews and signs this.

6. Conduct vulnerability scanning

It is worth investing in regular security scans to stay ahead of risks. Using an Approved Scan Vendor (ASV) for quarterly vulnerability scans is a good starting point. These scans help uncover weak spots in your systems, including outdated software versions and misconfigured firewalls.

Consider scanning after any major system change rather than waiting for the quarterly cycle. Addressing issues immediately keeps your environment secure and shows auditors and payment partners that you take threats seriously.

7. Submit all required documentation

Treat your documentation package as a showcase of your compliance efforts. This typically includes:

- A clear summary of your audit results and findings.

- Basic business information includes ownership details, company structure, and contact points.

- An overview of your card payment infrastructure, including diagrams or architecture maps.

- A complete list of third-party vendors or service providers that handle or have access to cardholder data.

You should review the package multiple times to ensure consistency and accuracy. Even minor discrepancies can raise unnecessary questions or delay approval. You might also want to keep a central repository for compliance documents so updates are easy and nothing slips through the cracks in future audits.

8. Test and monitor regularly

In fintech, where code deploys happen weekly (sometimes daily), changes can introduce vulnerabilities fast.

- Run periodic penetration tests.

- Review access control lists quarterly.

- Refresh security training for all employees handling payment-related tasks.

Remember that, if your systems change, your compliance scope changes too.

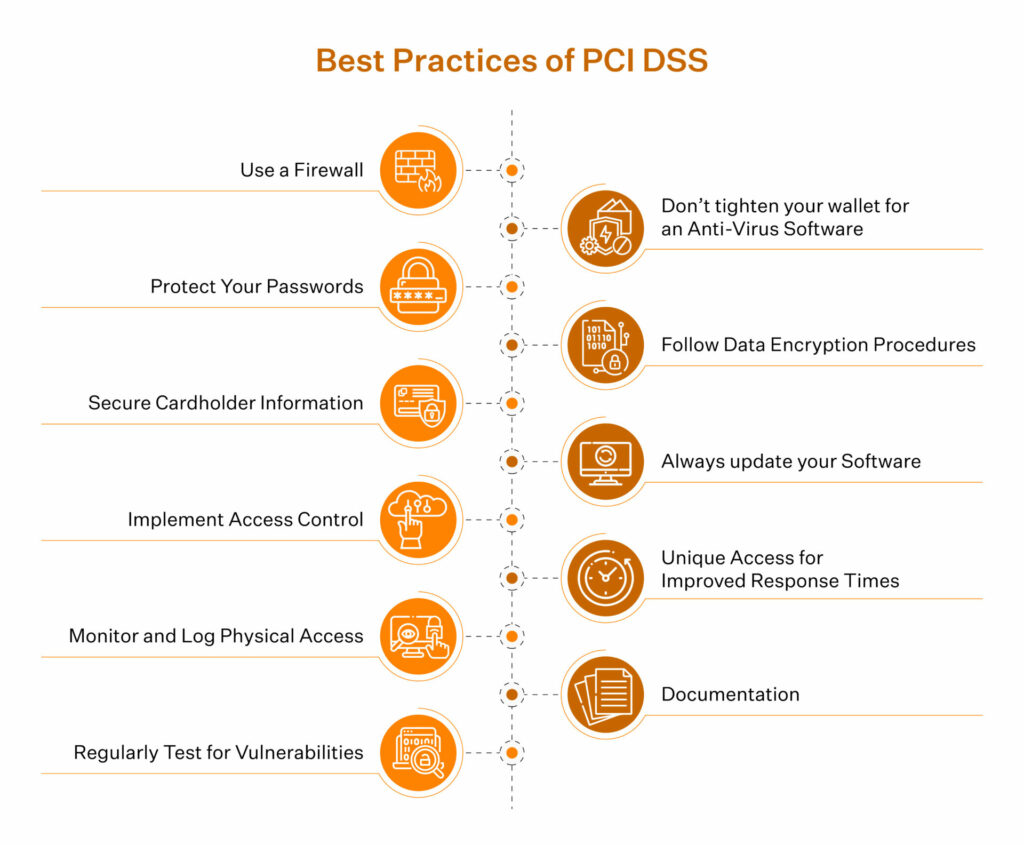

Note: PCI DSS best practices often become far more manageable with the help of compliance automation software. Such tools can continuously monitor your systems, flag gaps in real time, and automatically collect evidence for audits.

Common challenges fintech companies face with PCI compliance

Fintech companies often hit roadblocks with PCI DSS 4.0’s Targeted Risk Analysis (TRA) requirements. Many are unaware that a TRA is mandatory for certain criteria, leading to gaps that auditors will flag.

Even when they know about it, teams struggle to:

- Identify all credit card data–related security risks.

- Map these risks to specific PCI DSS controls.

- Document every TRA parameter as acceptable audit evidence.

Tooling limitations make things more complicated. For instance, some platforms hide TRA parameters behind higher-tier plans or fail to display them fully for auditors. This leaves teams unable to provide complete visibility during audits.

Those who do know about the requirement often assume their PCI DSS 4.0–ready platform will deliver TRA out of the box. When it doesn’t, they face last-minute scrambling, delays, and extra stress.

How does Sprinto help?

Sprinto turns PCI DSS 4.0 from a requirement into an advantage. It makes Targeted Risk Analysis a part of your compliance operation, so you stay ahead without slowing down.

- Auditor-grade TRA templates come pre-mapped to every applicable PCI DSS 4.0 control, so your team always knows exactly what’s required and can avoid rework during crunch time.

- Live mapping of risks to controls through over 200 integrations with your payment gateways, cloud infrastructure, and code repositories, helping you close visibility gaps before auditors flag them.

- Complete TRA parameter tracking in a dedicated auditor dashboard, where every assumption, frequency, and acceptance criterion is documented, time-stamped, and exportable in the formats auditors expect.

- Continuous monitoring with clear, tiered alerts so you can address emerging risks before they impact cardholder data security or transaction integrity.

- Direct access to PCI-certified compliance experts who understand the realities of high-volume financial environments and work alongside you and your auditor to validate and defend your TRA.

The result: You protect cardholder data, pass audits with confidence, and maintain the trust your customers and partners expect.

Frequently asked questions

While there are several PCI standards, the most relevant four for fintech companies are:

1. PCI DSS (Data Security Standard): The main framework setting out 12 key requirements to safeguard cardholder data for any entity that stores, processes, or transmits payment information.

2. PCI P2PE (Point-to-Point Encryption): Ensures that sensitive cardholder data is immediately encrypted at the point of interaction so that it cannot be intercepted in transit.

3. PCI Secure Software Standard: Provides security requirements for payment software used by fintech companies, ensuring secure design, management, and operation.

4. PCI PIN Security: Focuses on protecting PIN data during online and offline card transactions, including ATM or POS PIN entry and hardware requirements.

Yes, PCI compliance is mandatory for any business that handles, processes, stores, or transmits cardholder data, regardless of size. While not always enforced by national law, it is required by card network rules and contractual terms with payment providers and is necessary to maintain the ability to process card payments.

For large organizations, getting a PCI DSS Report on Compliance (RoC) can cost between $50,000 and $200,000. Smaller businesses processing under 1 million card transactions a year usually spend $5,000 to $20,000.

Non-compliance with PCI DSS exposes your business to significant risks:

1. Fines by payment networks can reach $100,000 per month.

2. You may lose your ability to process payments, be added to payment industry blacklists, and suffer legal liabilities or lawsuits.

3. Data breaches are more likely, potentially causing severe financial loss, reputational harm, and customer trust erosion.

Pansy

Pansy is an ISC2 Certified in Cybersecurity content marketer with a background in Computer Science engineering. Lately, she has been exploring the world of marketing through the lens of GRC (Governance, risk & compliance) with Sprinto. When she’s not working, she’s either deeply engrossed in political fiction or honing her culinary skills. You may also find her sunbathing on a beach or hiking through a dense forest.

Explore more

research & insights curated to help you earn a seat at the table.