PCI DSS 4.0 (How to Prepare Yourself)

Meeba Gracy

Oct 01, 2023

PCI DSS 4.0 is probably a term you are familiar with—at least in the name. But what is it, and how will it affect the way you do business?

The PCI DSS has rolled out its recent update. With any major change, comes some uncertainty. Uncertainty and confusion around the Payment Card Industry Data Security Standard (PCI DSS) from the PCI Security Standards Council (PCI SSC).

In this blog post, we’ll be looking at what PCI DSS 4.0 is, key requirements to watch out for when preparing for its transition, as well as what customers can expect going forward.

Let’s dive right into how your business can prepare itself for this major update!

What is PCI DSS 4.0?

The PCI DSS 4.0 was formulated to strengthen and elevate payment card account data security, aiming to foster the widespread adoption of consistent global data protection measures.

The PCI-DSS 4.0, the newest version, was released in the first quarter of 2022. It contains a detailed set of rules for protecting systems that handle credit card information such as processing, storing and transmitting.

On March 31, 2022, the PCI SSC, a leader in information security governance worldwide, released an updated version of their renowned industry standard. This is the PCI DSS v4.0.

It’s a trusted benchmark for organizations to ensure comprehensive security practices and demonstrate compliance with regulations when safeguarding account data globally.

PCI DSS 4.0 will now be replacing the previous version of PCI DSS version 3.2.1, providing businesses with a refreshed approach to defending against cyber threats.

As an organization that manages customer payments, you should review the updated standard and Summary of Changes on the PCI SSC website for greater protection from today’s ever-evolving digital landscape.

This major update stems from the collaborative effort between 200+ organizations that contributed a total of 6,000 pieces of feedback over 3 years.

This broad exchange of perspectives allows us to ensure the standard remains up-to-date in today’s evolving payment security landscape. Now, let’s look at what’s new in this updated version.

What’s new in PCI DSS 4.0?

PCI DSS 4.0 allows organizations to choose between adhering to prescribed controls or taking a more tailored approach. By opting for custom implementation, you can easily demonstrate how your security measures meet the intent of PCI DSS requirements without having to provide technical proof.

Here are the details of the changes as updated on the PCI SSC website:

To help organizations keep up with the most recent PCI DSS standard, the PCI SSC Document Library includes resources such as a Summary of Changes v3.2.1 to v4.0, an easy-to-use Compliance Report Template, Certification of Compliance and Annex documents for quick reference — plus answers to Frequently Asked Questions about compliance requirements.

To foster greater worldwide adoption of PCI DSS, Self-Assessment Questionnaires (SAQs) and their accompanying standard and Amendment Summary will be published in multiple languages over the coming months.

Also, training for evaluators on the latest version – PCI DSS 4.0 – has also been made available to ensure an up-to-date understanding of these requirements internationally.

And wait, it doesn’t just stop there – organizations navigating the new changes of PCI DSS version 4.0 can breathe a sigh of relief, as they have two full years (until it is retired on March 31 2024) to assess their operation methods and take steps to implement any updates needed.

After completing an approved training focusing on PCI DSS v4.0, companies have more latitude in choosing which ruleset they want to abide by.

Furthermore, additional time is granted for preferences that need longer calendars for implementation. And with all the vital information regarding this timeline readily available on the PCI Perspectives Blog, preparing for this transition will be a breeze.

Also read: Complete guide on PCI DSS compliance

Do check out this video on top changes in PCI DSS 4.0 2024:

What are the new changes and requirements as per PCI DSS 4.0?

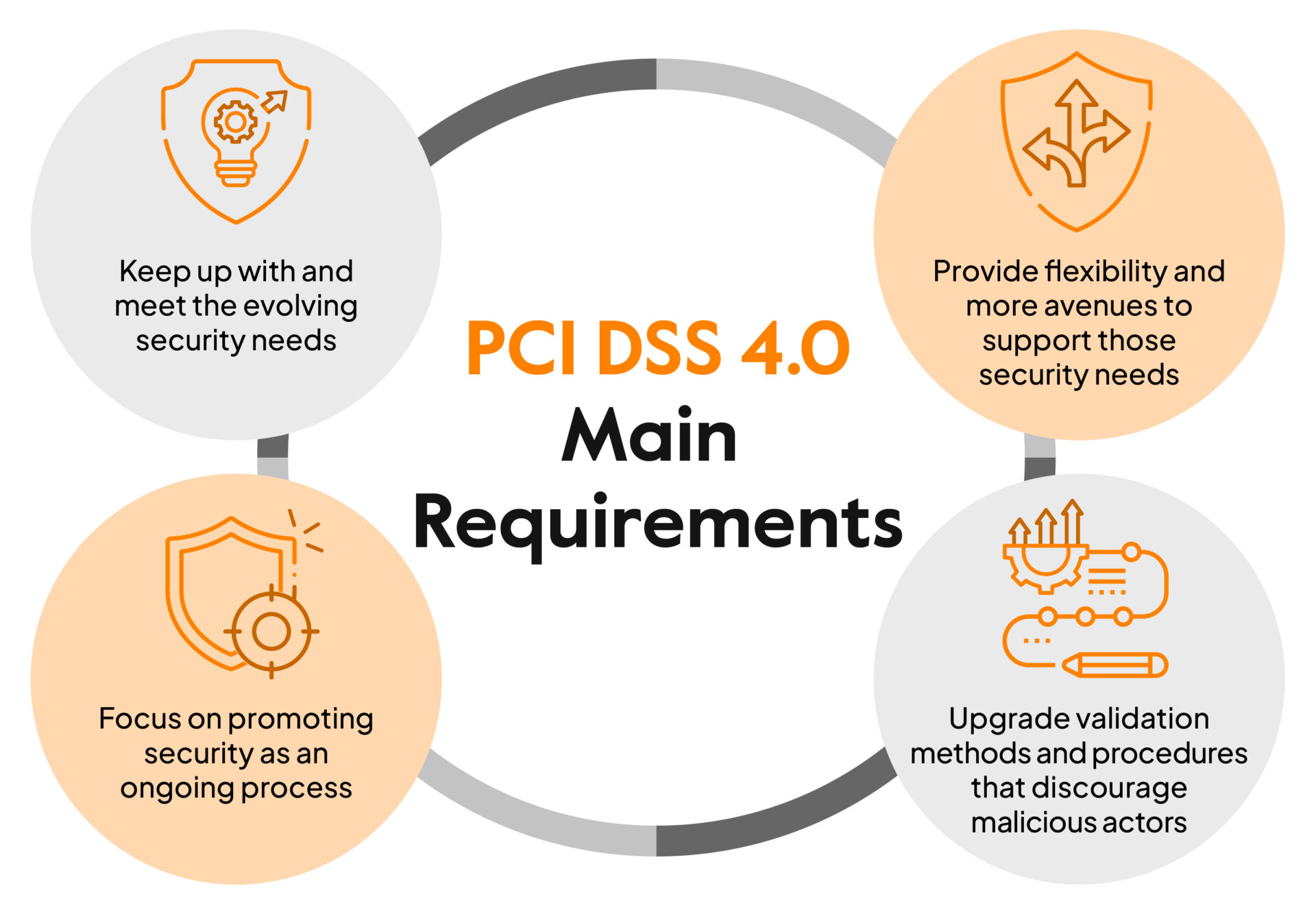

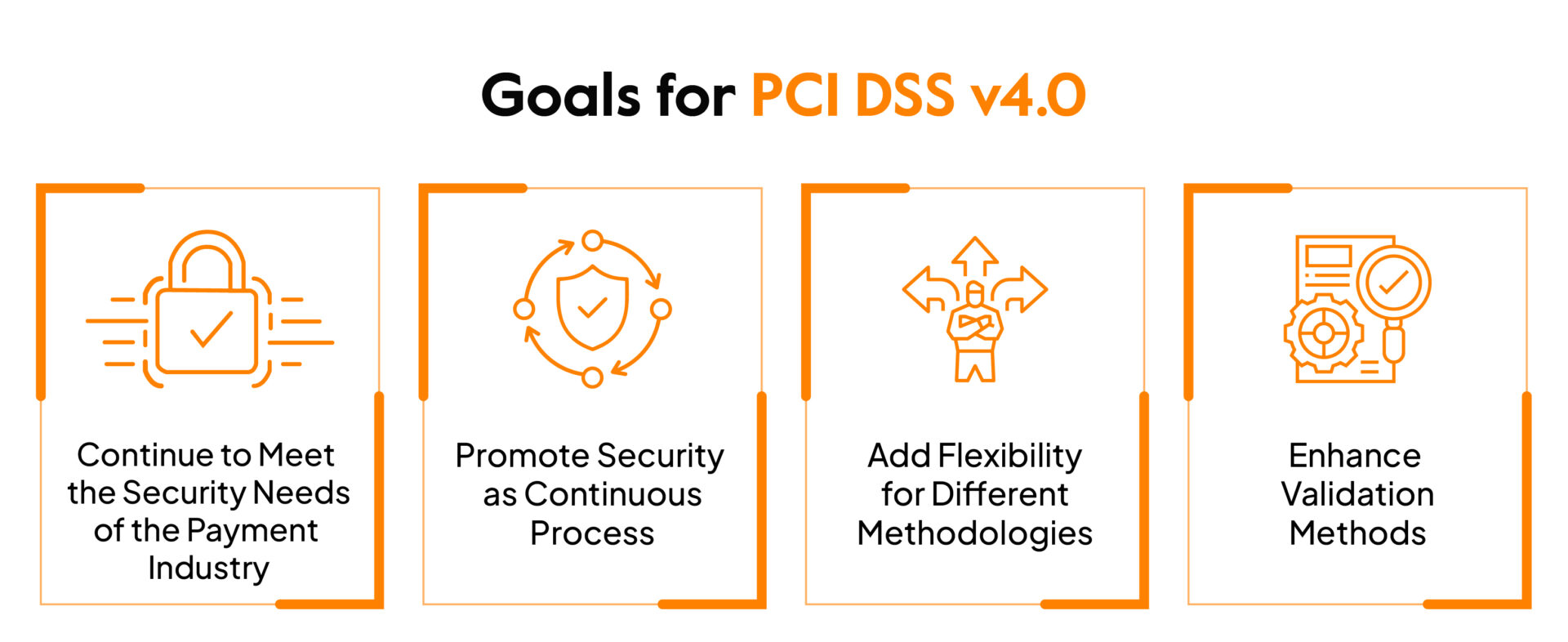

Aimed at protecting digital transactions, upgrading to version 4.0 offers four major requirements:

- The standard aims to keep up with and meet the evolving security needs of the payments industry.

- Provide flexibility and more avenues to support those security needs

- Focus on promoting security as an ongoing process

- Upgrade validation methods and procedures that discourage malicious actors from attempting to carry out fraudulent activities

With these key requirements, you can now ensure your customers’ information is safeguarded.

Now, let’s go deeper into understanding what is expected to include in the new PCI standards:

- Strengthening security protocols, including multi-layer authentication and stringent password requirements paired with updates to outwit potential threats, will help ensure your network is safe & secure.

- Revised security protocols to ensure the utmost standards for protection. Emphasized procedures that pinpoint improvement opportunities, offering an abundance of details suitable for auditors and program assessors, along with strategic roles and responsibilities tailored towards each requirement.

- Enabling organizations to strengthen their security posture through advanced procedures and risk analysis tailored for each account type – such as shared or group accounts – while unlocking innovative opportunities with modernized security processes.

- Provides organizations with the tools to demonstrate their commitment to security compliance through multiple approaches, such as developing a Report on Compliance, participating in self-assessments, and providing attestations of continued adherence.

- Organizations are expected to implement a consistent program of security control testing with increased regularity and accuracy.

- Increased focus on cybersecurity initiatives such as encryption and network security to safeguard customer credit card information while it’s in transit.

- Organizations now have the power to customize their risk analyses and set intervals for when certain activities should be completed.

- Clear guidance is available to ensure its successful implementation, and a new reporting feature provides insight into compliance performance areas that need improvement.

Implications of Non-Compliance with PCI DSS

Failing to meet PCI DSS compliance can be expensive. You risk significant fines, chargebacks, higher transaction fees, and lose customers by not ensuring security of credit card data.

The consequences depend on the organization’s current processing level.

For instance, VISA has the right to upgrade your processing level if you fail to comply with the specified requirements of that level. This could mean skyrocketing transaction fees or facing larger penalties for non-compliance if you had previously been at a lower processing level.

For instance, if you fail to respect the level 4 compliance requirements, your organization will likely be demoted from level 4 to level 1.

Therefore, it is important to understand them and ensure continuous compliance with their regulations to stay compliant and protect your organization from devastating implications caused by ignorance of PCI DSS standards.

What will be the PCI DSS 4.0 transition timeline?

On March 31, 2022, the PCI SSC released a new version of their industry-leading PCI DSS. Version 4.0 marked the first update to these security standards since 2018’s 3.2.1 – four years ago.

The year ahead is critical for getting up-to-speed on all of the new requirements, so understand when these become mandatory and make the transition period as smooth and secure as possible.

Luckily, the PCI SSC has kindly outlined an implementation timeline to help you streamline this process – giving you time to become compliant without any unpleasant surprises.

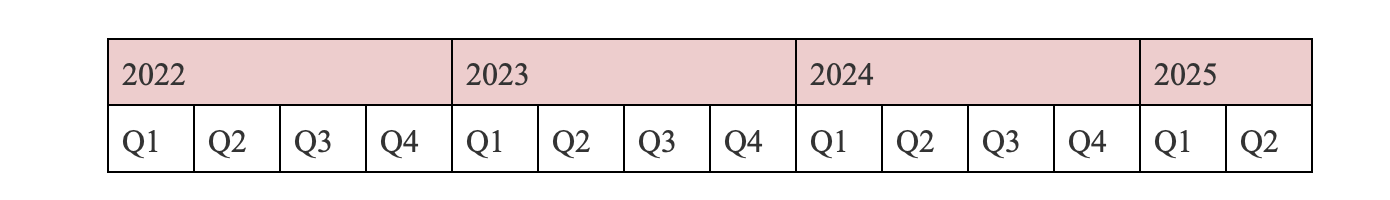

- Q1 of the 2022 timeline was when the new version was released.

- The transition period is from Q2 of 2022 to Q1 of 2024

- From Q2 of 2024 to Q2 of 2025 is when the PCI DSS v4 will be mandatory.

- The retirement date for PCI v3.2.1 will quickly approach – March 31, 2024, marks the end of its use to make way for the mandatory adoption of version 4.0.

How to prepare for PCI DSS 4.0?

As the world prepares for PCI DSS v4.0, you can take proactive steps to ensure you reap its rewards by assembling a specialist team dedicated to making this upgrade happen as smoothly and efficiently as possible.

Although compliance with PCI DSS v4.0 has yet to be mandated, now is the perfect time to start taking action towards meeting its requirements and demonstrating your adherence to it.

Here are some of the steps you take to meet the new requirements:

- Review and comprehend the updated regulations of version 4.0. Identifying and understanding the criteria vital for achieving compliance is key

- Existing policies, procedures and security-related activities should be compared against the new version for a successful result

- Establishing a team to update security activities effectively – especially policies, procedures, technologies and personnel expertise – will ensure compliance with version 4.0

- Protect against damage or theft, and delete all superfluous data from the impacted systems – particularly confidential information

- Assure that essential systems are safe from malicious actors attempting to gain unauthorized access

- Systematically evaluate your network perimeter to uncover potential threats or vulnerabilities that could lead to a security breach

- Strengthen security protocols by consistently monitoring and keeping records of all safety practices

- Analyze security protocols and levels of cardholder data to guarantee its protection and access

- Ensure that all data safety practices are frequently tested and reviewed as necessary. The outcomes of these tests should be properly recorded to demonstrate performance during audits

- Senior management must be regularly updated about the security team’s actions to guarantee adherence to the security protocols

Also check out: Complete guide on PCI DSS audit

What’s Next?

While many businesses are aware of the potential for upcoming data security standards changes, few completely understand the true impact these changes will have.

Of course, it is important to be prepared before any new protocol is implemented. Organizations should review their process and security controls beforehand to ensure they meet any growing guidelines upon implementation.

Preparing in this way will help facilitate an easier transition when the new regulations come into effect.

If you are devoted to protecting your payment data, Sprinto is the go-to company for assistance. We have been working in PCI DSS consulting and auditing since the beginning, with an impressive client base of hundreds who have used our audit services– including various payment brands!

Working with compliant solutions can be expensive if not done right, as many organizations have found out the hard way. Through unexpected fines or disruption of services, neglected compliance efforts can quickly spiral into costly and time-consuming ordeals.

Fortunately, a compliance automation tool like Sprinto is in the market to take care of your different compliance requirements.

Ensure your systems comply with PCI DSS standards by turning to Sprinto’s automated solutions. Our team is highly skilled at helping you adhere to the industry requirements you must meet.

FAQs

What is PCI DSS used for?

The PCI DSS provides a strict set of security protocols that guarantee all organizations handling credit card information have established secure conditions. This includes companies accepting, processing, storing or transmitting such sensitive data.

Has PCI DSS 4.0 been released?

The PCI SSC recently unveiled the much anticipated Version 4.0 of its PCI DSS, effective from March 2022 and superseding version 3.2.1, which remains in effect until 2024.

How many levels of PCI are there?

There are four levels of PCI compliance, based on the number of transactions a company processes annually and how it stores, transmits, and processes credit card data. These levels are:

- Level 1: merchants processing over 6 million transactions per year

- Level 2: merchants processing 1 million to 6 million transactions per year

- Level 3: merchants processing 20,000 to 1 million transactions per year

- Level 4: merchants processing fewer than 20,000 transactions per year

Meeba Gracy

Meeba, an ISC2-certified cybersecurity specialist, passionately decodes and delivers impactful content on compliance and complex digital security matters. Adept at transforming intricate concepts into accessible insights, she’s committed to enlightening readers. Off the clock, she can be found with her nose in the latest thriller novel or exploring new haunts in the city.

Grow fearless, evolve into a top 1% CISO

Strategy, tools, and tactics to help you become a better security leader

Found this interesting?

Share it with your friends

Get a wingman for

your next audit.

Schedule a personalized demo and scale business

Sprinto: Your growth superpower

Use Sprinto to centralize security compliance management – so nothing

gets in the way of your moving up and winning big.