The payment card industry is among the top targets of breaches. According to CreditDonkey, approximately47%of Americans have experienced credit card fraud in the past five years. The same report states that card data theft incidents occur every two seconds.

PCI DSS, a set of security standards, helps prevent financial loss from card data theft for businesses and customers alike. Merchants can stay compliant to these standards using PCI compliance software.

Keep reading to learn all about top PCI DSS compliance software, its features, benefits, and more.

TL;DR

| PCI compliance software automates the more complex aspects of compliance, including asset discovery, continuous monitoring, vulnerability scanning, evidence collection, risk scoring, log management, configuration hardening, and reporting. |

| When choosing a software, evaluate based on integration coverage, in-house QSA support, audit-readiness features, and whether the platform supports ongoing compliance, not just point-in-time checks. |

| Among the top tools, only a few offer full-stack automation with integrated VAPT and real-time monitoring. Sprinto, Thoropass, and Scrut stand out for teams seeking fast, scalable PCI compliance. |

What is PCI compliance software?

PCI compliance software is the tool or mechanism that helps you implement, manage, and stay compliant with the 12 PCI requirements. It operates on the principles of letting users track audit trails, view event logs, address violations, automate critical changes, and manage configurations using a single platform.

Security administrators can use PCI DSS software to demonstrate a strong security posture, protect sensitive customer data, remediate breaches, generate reports and avoid costly penalties from incidents.

Why use a PCI Compliance Software?

Using PCI compliance software is beneficial because managing PCI compliance manually is time-consuming, prone to errors, and unsustainable. Software brings structure, scale, and audit readiness from day one.

Here are the top 5 reasons to switch to a PCI compliance software:

Replaces spreadsheets with systems that scale

Manual PCI compliance demands constant coordination, repetitive tasks, and fragmented updates. Software centralizes your compliance operations, reduces context switching, and frees up engineering bandwidth to focus on growth.

Gives complete, real-time visibility into compliance

A centralized platform shows what’s working, what’s drifting, and what needs attention, across all controls. This helps eliminate blind spots, reduce errors, and keep teams aligned with a single source of truth.

Accelerates audit readiness with structured workflows

The automated evidence collection and purpose-built auditor views that come along reduce back-and-forth and compress audit timelines. These features help you move faster, with less effort, and more confidence.

Extends compliance work across frameworks

With compliance software, controls mapped for PCI can be reused across SOC 2, ISO 27001, and other frameworks with overlapping requirements. This transforms compliance into a scalable function, rather than a repetitive project.

Helps move from point-in-time checks to continuous compliance

Automated alerts, real-time monitoring, and workflow triggers ensure your compliance posture remains up-to-date every day. They help transition from a reactive firefighting.

Get PCI DSS compliant faster with the help of Sprinto. Let’s connect!

Top 10 PCI compliance software

If you are looking for the best PCI compliance software and google the same, you will end up with dozens of results – all businesses claiming their solution is the best.

Confusing, right?

But worry not, we made your PCI compliance software shopping journey easier.

Here are the 10 Best PCI compliance software in 2024:

| Tool | Risk management | Continuous monitoring | Integrations | VAPT scans | QSA Support |

| Sprinto | In-depth risk assessment as per PCI 4.0 | Real-time scans and drift detection | 300+ | Through vetted partners | Qualified QSA & auditor network |

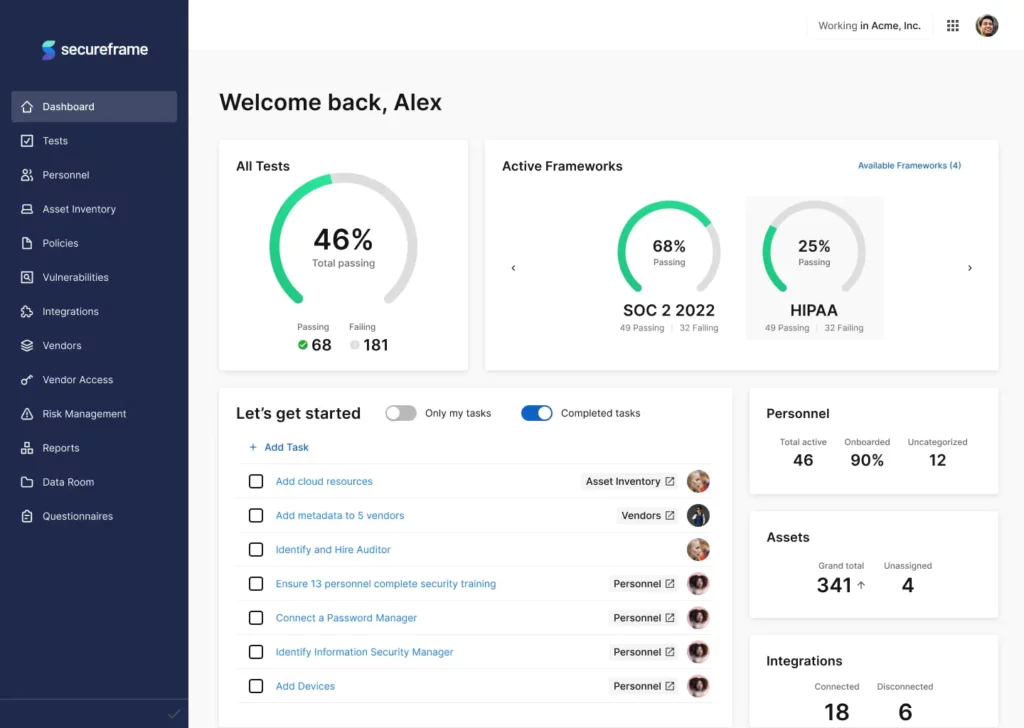

| Secureframe | Risk register with risk scoring | Alerts on non-conformities | 300+ | Coordinates with third-party VAPT services | Yes, through partners |

| Drata | Pre-mapped PCI controls, risk visibility | Continuous control monitoring | 170+ | Integrates with third-party VAPT tools | Yes, through partners |

| Auditboard | Comprehensive enterprise risk management | Basic monitoring; not real-time oriented | 200+ | No native VAPT functionality; external processes required | Yes, through partners |

| Vanta | Automated risk assessments | Ongoing security posture checks with rule-based triggers | 300+ | External VAPT supported via partnerships | Yes, through partners |

| Thoropass | Risk dashboard, security assessments | Continuous compliance updates with real-time reporting | 100+ | Provides internal services + works with partners | Certified QSAC; conducts assessments in-house |

| Compliance manager GRC | Risk scoring, IT policy tracking, | Continuous logging and monitoring | Number not specified | Integrates with third-party tools | Yes, through partners |

| 6clicks | PCI-specific risk templates; remediation tied to audit trails | Configurable rule-based monitoring | 100+ | Partners for VAPT scans | Yes, through partners |

| Scrut | Compliance readiness scoring; centralized risk dashboard | Real-time monitoring with alerts | 100+ | In-house VAPT scans | Yes, through partners |

| Netwrix Auditor | Granular risk analysis via user behavior and configuration auditing | Logs and alerts for risky activity; not PCI-native monitoring | Custom integrations | No | No dedicated QSA network |

1. Sprinto

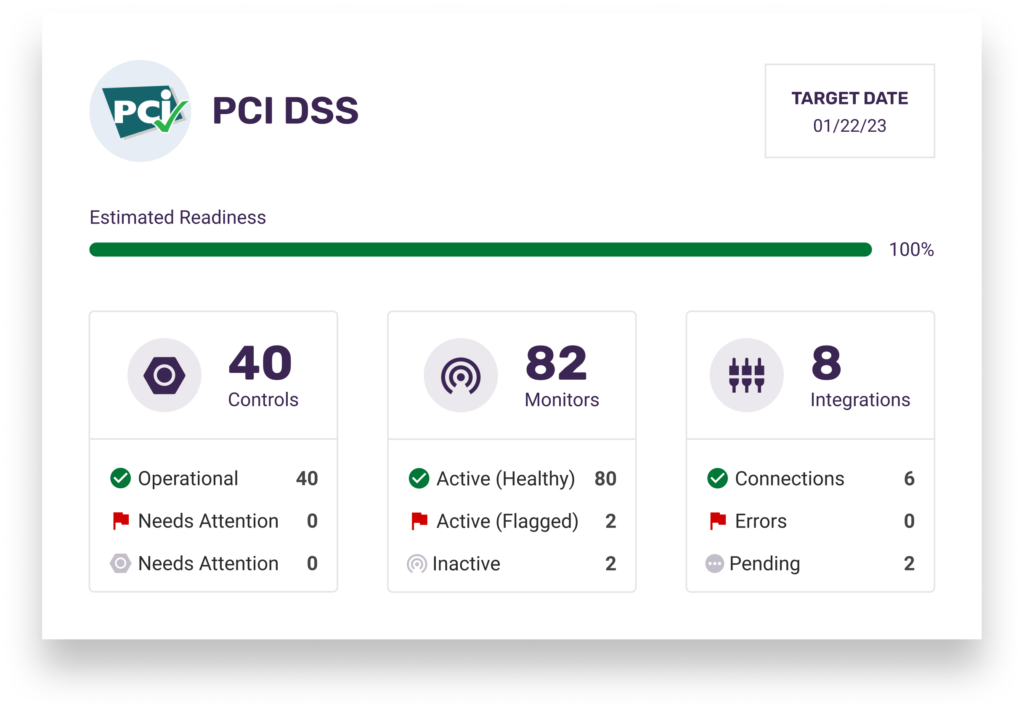

Sprinto is an AI-powered, full-stack compliance automation platform that helps cloud-native companies achieve and maintain PCI DSS compliance with dramatically less manual effort. Sprinto automates evidence collection, scoping, continuous monitoring, quarterly scans, control mapping, and auditor-ready documentation, enabling teams to manage their cardholder data environment (CDE) with confidence and precision.

By leveraging Sprinto AI, organizations eliminate up to 95% of manual workloads, streamline SAQ completion, accelerate RoC reviews, and maintain a continuously compliant PCI DSS posture.

Sprinto PCI compliance software features:

- AI-driven control mapping: Automatically maps systems, policies, and checks to PCI DSS requirements and flags gaps early.

- Continuous monitoring: Runs automated security checks across your infrastructure to detect drift, misconfigurations, and non-compliant controls.

- Evidence automation: Collects, validates, and organizes PCI DSS evidence in an auditor-ready format, significantly reducing back-and-forth with QSAs.

- Vulnerability & quarterly scan readiness: Simplifies internal/external scans with guided workflows and connects you with trusted ASVs and VAPT partners.

- Policy intelligence: Provides PCI-ready policy drafts, highlights policy gaps, and auto-links policies to PCI DSS controls for faster audit prep.

- Vendor & third-party compliance: Evaluates vendor documentation, security questionnaires, and service provider controls to ensure PCI obligations are met.

- Faster audit & SAQ completion: Streamlines SAQ responses and accelerates RoC/AoC reviews through automated evidence, summaries, and QSA collaboration.

- Pricing: Fill out the form on the Schedule Demo page to receive pricing details.

Get PCI DSS compliant faster with the help of Sprinto. Let’s connect!

2. Secureframe

Secureframe is a security and privacy compliance platform that helps enterprises streamline their PCI DSS certification process. It helps to process, store, and transmit card data to secure online transactions.

Top PCI compliance software features:

- Review status: Level 1 merchants, service providers, and organizations can simplify their assessment process by collecting evidence to meet all control requirements in a centralized location.

- Seamless integration: Easily integrates with existing vendors and gathers security and privacy data to map data flows and check security controls. Surfaces vulnerabilities and provides instructions to maintain security.

- Custom policies: Leverage library templates to create custom business policies. Enables employees to review and accept policies using the secureframe platform.

- PCI training: Efficiently track and train employees on cardholder data security and secure coding best practices.

- Continuous compliance: Continuously monitors the environment and triggers alerts to notify on due tasks and non-conformities. Automatically collects editor evidence and configuration data collection.

- Industries: Serves all industries.

Bonus: Here’s a free resource for you to see how eligible you are for PCI DSS compliance.

Download Your PCI DSS SAQ Eligibility Form

3. Drata

Drata helps organizations be audit ready by automating the end-to-end compliance process. Users can manage PCI DSS controls and requirements from a centralized dashboard to achieve, maintain, and scale compliance.

Top PCI compliance software features:

- Compliance program: Offers out-of-the-box controls to boost security and compliance posture. Combines compliance expertise and an all-in-one solution to automate manual tasks.

- Automation: Enables users to use pre-mapped controls, automate monitoring, collect evidence, track assets, and access control visibility from a centralized dashboard.

- PCI playbook: Offers tools to quickly access compliance requirements and a single source for documentation. Eliminates errors due to manual tracking using pre-mapped controls.

- Industries: Serves all industries.

How Sprinto is better than Drata? Find out how

4. AuditBoard

AuditBoard is a risk management platform that helps organizations streamline their risks, controls, policies, frameworks, and more.

Some of its core capabilities include easy collaboration, automation, business intelligence, and workflow enhancement.

Top PCI compliance software features:

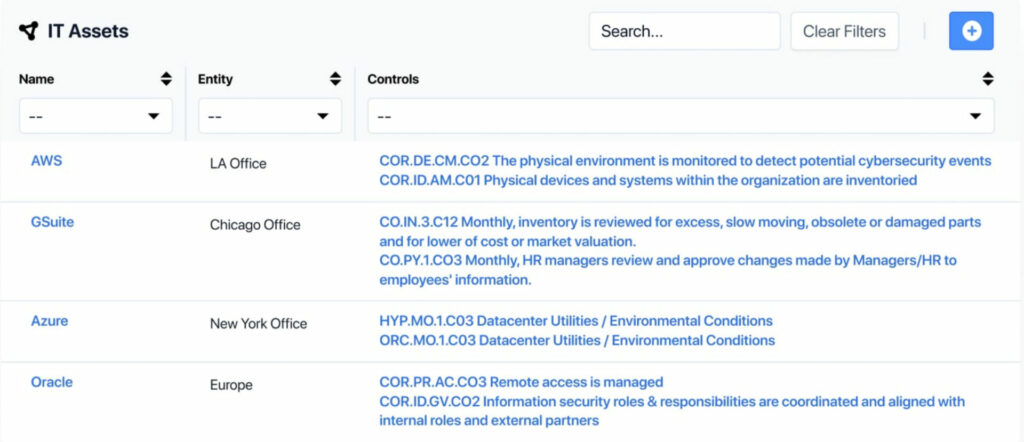

- Asset inventory: Offers a centralized location to manage, identify, and assess IT assets. Links risks and controls to build audits.

- Risk assessment: Offers risk templates to streamline risk assessment and scores risks based on level of threat and severity.

- Evidence collection: Eliminates the need for multiple evidence collection by using a single piece for all stakeholders. Shares and schedules send requests to stakeholders and collect evidence in a centralized location.

- Compliance and report management: Automates issue identification and facilitates users to easily create, test, assign, and follow up on issues. Easily built management-ready audit reports.

- Industries: Serves all industries.

5. Vanta

Vanta helps organizations improve their security posture and automate compliance. It connects to your existing system using pre-built integrations, customizing needs using auditor-approved controls, and alerting users via multiple channels to complete pending tasks.

Top PCI compliance software features:

- Continuous security: Enables businesses to gain a security-first approach through continuous security monitoring and meeting new PCI requirements.

- Faster and cost-effective module: Helps to reduce dependencies on third-party consultants and manual tasks with guided actions.

- Compliance simplification: Enables teams to understand and comply with PCI requirements. Connects business tools to kickstart actionables that prove compliance.

- Top PCI DSS clients: bolvo, flow

- Industries: Serves all industries.

Get PCI DSS compliant in no time. Talk to our experts now!

6. Thoropass (Previously known as Laika)

Thoropass is a comprehensive infosec building and automation platform that enables organizations to gain fast and efficient compliance posture. It streamlines and accelerates the PCI DSS certification process using a combination of self-assessment support and expertise.

Top PCI compliance software features:

- Compliance implementation: Build a custom compliance program with easy onboarding, guided controls, policy templates, and roadmaps.

- Continuous compliance: Stay compliant by monitoring the environment, vendor risk management, security training, and penetration testing.

- Audit management: Offers automated evidence collection, in-built audit management, and auditor-friendly monitoring to help users streamline compliance.

- Team collaboration: Facilitates easy collaboration across teams with automated notifications, project management tools, and assignment controls.

- Security assessment: Offers questionnaire syncing, auto-fill, search options, and library management tools to help organizations close deals faster.

- Industries: Serves all industries.

7. Compliance Manager GRC

Compliance Manager GRC is a risk and compliance management platform. It automates functions like data gathering, issue management, and documentation using a web-based portal.

Users can meet all PCI DSS requirements and stay compliant with IT security by accessing their solution from any device.

Top PCI compliance software features:

- End-to-end solution: Meet PCI DSS requirements, track cyber risk insurance policy, and implement IT processes from a centralized solution.

- Automate report: Automates tasks like data collection, management plans, and document generation specific to your organization.

- Easy tool: Easily manage PCI DSS specific parameters using the simple platform. Load custom requirements and controls and track the scope of your IT from a single dashboard.

- Industries: Serves all industries

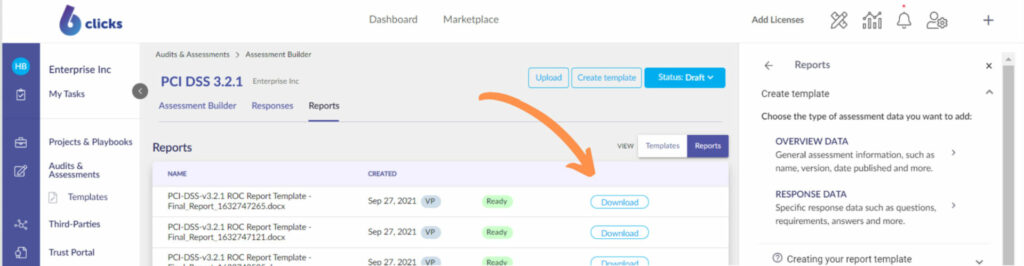

8. 6clicks

6clicks offers an easy way to implement and automate risk program and achieve compliance. Users can streamline their audits, conduct vendor risks assessment, and implement policies.

Users can streamline their PCI DSS compliance process using an easy platform to manage policies, risks, assets, and evidence.

Top PCI compliance software features:

- Risk assessment: Assess systems, clients, and vendors as per the latest PCI requirements. Help to simplify complex business processes to entity level.

- Remediation: Manage and take action on identified risks in the remediation lifecycle. Links risks and activities to the task to facilitate audit trail maintenance.

- Report builder: Enablers users to generate a delivery ready Report on Compliance (RoC) using a prep populated template based on assessment.

- Industries: Serves all industries

- Pricing: Fill out a form in the pricing page to get pricing details

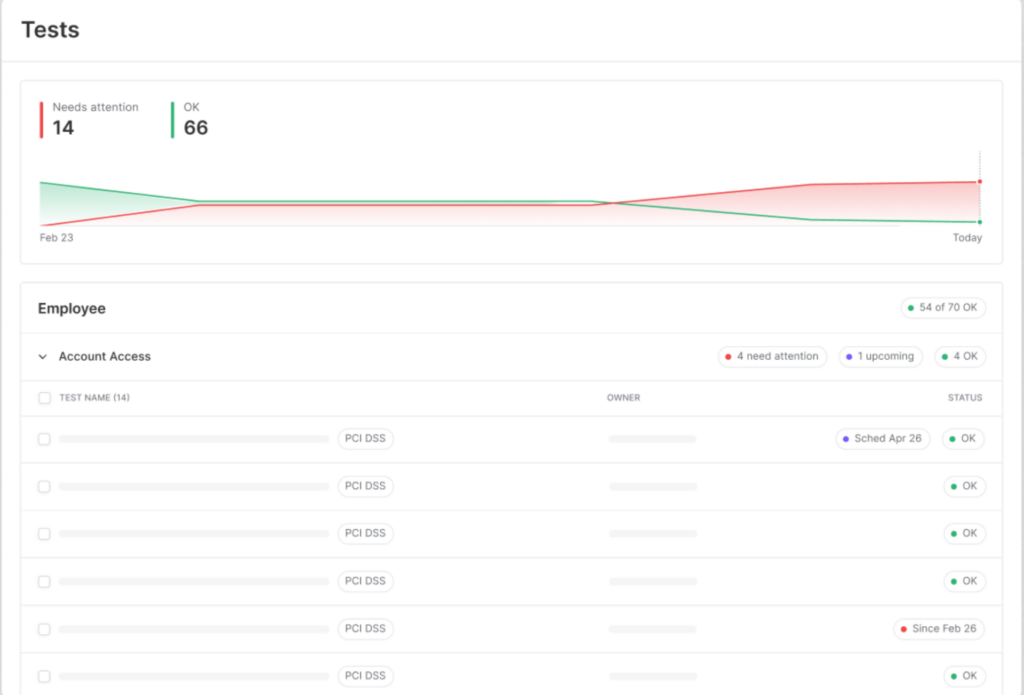

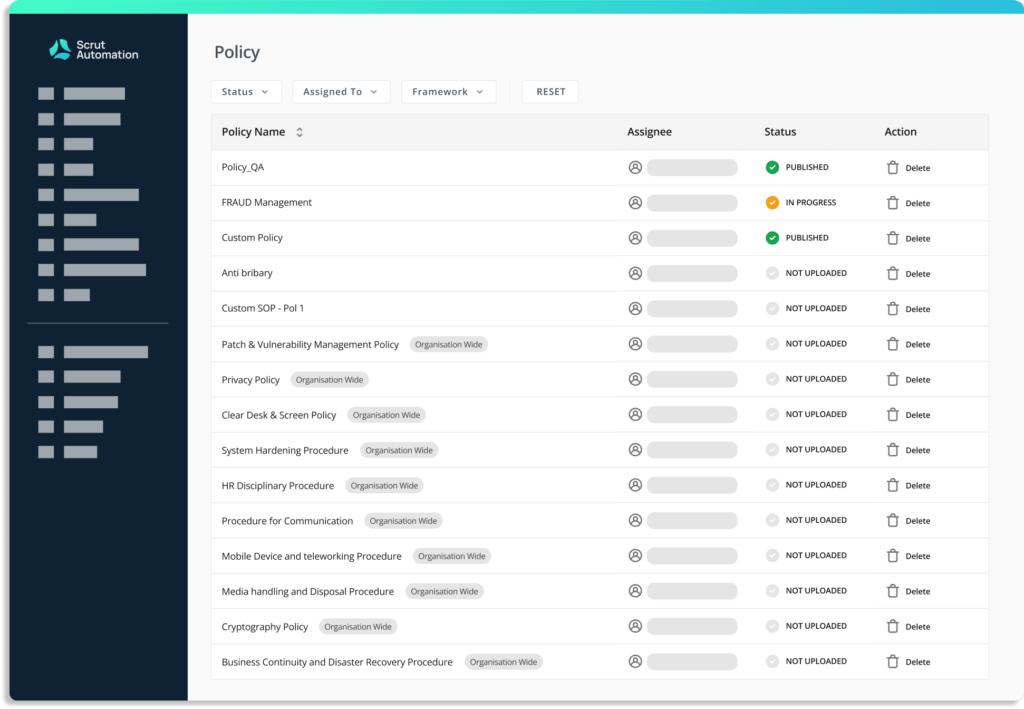

9. Scrut Automation

Scrut Automation is an all-in-one automation platform that monitors the environment, collects security control evidence, and streamlines compliance to make it audit-ready. Users can strengthen their PCI DSS compliance posture using pre-built controls and around-the-clock monitoring.

Top PCI compliance software features:

- PCI DSS readiness: Offers a comprehensive view of compliance posture to help understand the readiness level.

- Pre built policies: The policy library offers pre-built controls to set up an infosec program quickly. Create custom policies and get them vetted by experts.

- Monitor controls: Monitors the environment in real-time using automated control monitoring. Configurable alerts help users prevent compliance issues.

- Evidence collection: Easily integrates with common applications to automatically collect evidence across the infrastructure against pre-mapped controls.

- Industries: Serves all industries.

- Pricing: Fill out a form in the Schedule a Demo page to get pricing details.

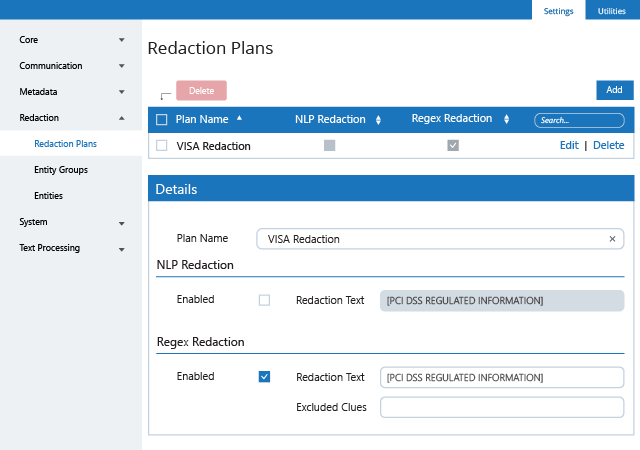

10. Netwrix Auditor

Netwrix Auditor is a visibility platform that facilitates user behavior analysis and risk mitigation. Users gain control over changes, pre-set configurations and access controls to protect data wherever deployed.

Users can achieve and maintain PCI DSS compliance requirements through deep visibility into systems and applications, implement security controls to protect cardholder data and create evidence for compliance.

Top PCI compliance software features:

- Risk assessment: Identifies security gaps, prioritizes remediation based on level of security, and leverages security intelligence to address gaps to data threat.

- Access management: Secures sensitive files by implementing role-based access. Conducts privilege attestations to comply with PCI requirements. Keeps a log of access to card data and detects repeated failed access attempts to identify suspicious behavior.

- Data masking: Hides card numbers when not required and shows the information needed only for employee productivity.

- Accessibility: Interactive search feature allows users to surface specific information, identify suspicious behavior, and find answers to auditor questions.

- Industries: Serves all industries.

- Pricing: Fill out the form on the Schedule a Demo page to receive pricing details.

Also Check: PCI DSS compliance checklist

Benefits of PCI compliance software

Like every regulation out there, the requirements of PCI DSS are rigorous – implementing it all correctly is easier said than done. Things can get really messy without external help and tools to streamline the process.

PCI DSS compliance software helps to monitor your control environment to check for non-compliance. We can guarantee multiple misses across the infrastructure if you try to secure your controls manually.

PCI DSS requires merchants to implement strong access control measures. While most computers allow you to set up a basic access control system, it does not offer adequate protection. With PCI software, you can launch a strong program to manage access and also create an audit log.

Moreover, merchants must eliminate existing and potential risks to cardholder data. You can achieve this more quickly and easily with an automated risk assessment program that detects and investigates threats.

The bottom line – PCI software helps you manage all components and operational requirements that would be very difficult, if not impossible to handle manually. In short, a PCI compliance tool puts your to dos on autopilot and completes them significantly faster.

Also check out: PCI compliant hosting providers

How to select the right PCI tool?

If you are looking for a solution that helps you get PCI compliant, ensure that it comes equipped with these capabilities and features:

- Scan CDE: Continuously monitors the cardholder data environment for vulnerabilities and non-compliant activities. Alerts the right individuals if a suspicious activity is detected.

- Policy templates: Offers a pre-built yet fully customizable library of policy templates to help the engineering team launch faster without having to create policies from scratch.

- Faster audit: Helps to implement auditor grade and fully automated PCI program that enforces controls and maintains continuous compliance against PCI standards.

- Connects with external consultants: To comply with PCI, you need to complete vulnerability scans, an attestation of compliance, and a report of compliance. Choose a tool that connects you to QSAs, ASVs, and VAPT partners.

- Common control console: You may have to comply with more frameworks in the future and duplicate the effort. A common control control reuses the controls from your existing framework to help you launch faster and save money.

What Next?

That was a long list! We hope we helped to have a better understanding of the top players in the PCI DSS Compliance Software market. As we stated already, the best tool depends on your specific business needs. Before making a final decision, ask your vendor to show a free demo.

Having said that, tools like Sprinto have helped thousands of businesses get compliant with minimal effort. It offers a customized PCI compliance solution, powered by an automation engine that handles most of the work required for compliance validation. It continuously monitors each business entity at a granular level, ensuring controls and checks are in place for a seamless audit.

Sprinto flags any edge cases and automatically catalogs evidence, submitting it to the auditor via the Sprinto Auditor dashboard. The dashboard provides auditors with a single, segmented view of the audit report, detailing controls, documentation, and people processes.

Still confused? Need more information? Want a real human to talk to? Let our PCI wizards know your requirements and get a free demo.

FAQs

If the software manages, stores, transacts or handles customer payment card data, it should comply with PCI requirements.

In order to get PCI compliant, know the 12 PCI DSS requirements, analyze your organization’s needs, conduct risk and gap assessments, and complete relevant questionnaires. For a stepwise detailed guide, click here.

The best PCI compliance software is the one that meets the requirements specific to your business. Some PCI compliance solutions trusted by customers are Sprinto, 6Clicks, and NetWrix.

You can automate PCI compliance using a software like Sprinto that continuously monitors your system for threats, triggers alerts for non-compliance, and facilitates custom policy settings to reduce human involvement.

The Sprinto solution runs fully automated checks, notifies system administrators for security issues, and identifies malicious behavior before it infects.

Sprinto is a cost-effective PCI compliance software that offers continuous compliance, employee training, automation, audit logs, risk assessment, and more from an easy-to-use custom dashboard.

Anwita

Anwita is a cybersecurity enthusiast and veteran blogger all rolled into one. Her love for everything cybersecurity started her journey into the world compliance. With multiple certifications on cybersecurity under her belt, she aims to simplify complex security related topics for all audiences. She loves to read nonfiction, listen to progressive rock, and watches sitcoms on the weekends.

Explore more

research & insights curated to help you earn a seat at the table.