Fines, lawsuits, and probably some seriously bad press; that’s what’s on the line when compliance operations fall through the cracks. Without it, cyber threats slip through, data gets exposed, teams go off the rails, and regulators come knocking.

But here’s the thing: compliance doesn’t have to be a bottleneck. Done right, it’s a competitive edge. It builds trust, accelerates deals, streamlines internal chaos, and keeps you confidently on course—even as the rules keep shifting.

Let’s discuss the key functions, roles and best practices.

📋 Quick Summary in 60 Seconds

What Compliance Operations Involve:

- Framework Implementation: Maps regulations like SOC 2 and ISO 27001 to internal controls.

- Risk & Incident Management: Tracks issues, ensures timely remediation, and reduces exposure.

- Policy & Training Oversight: Maintains up-to-date policies and educates teams on compliance best practices.

- Audit Readiness: Organizes evidence and documentation to pass audits efficiently.

Why Compliance Ops Matter:

- Minimizes risk of fines, breaches, and reputational damage.

- Builds trust with customers and partners through verified security practices.

- Improves internal accountability and operational clarity.

Top Pain Points:

- Manually managing frameworks and cross-team coordination.

- Staying current with changing regulatory demands.

- Gathering audit evidence without disruption.

How Sprinto Helps:

- Automates control mapping, evidence collection, and policy workflows.

- Offers real-time dashboards and alerts to maintain compliance 24/7.

- Scales easily with your business across frameworks and regions.

Final Note:

For faster audits, reduced manual effort, and airtight compliance operations, Sprinto is a smart choice. Book a demo to see how it fits your team’s needs.

What are Compliance Operations?

Compliance operations are the structured processes of managing and enforcing a company’s internal controls, policies, and procedures to ensure it meets regulatory, legal, and security standards.

It involves coordinating compliance across teams, maintaining documentation, monitoring risks, preparing for audits, and aligning with frameworks like SOC 2, ISO 27001, HIPAA, GDPR, etc.

We’re talking about everything from following legal regulations to ensuring your internal policies are on point, and keeping a pulse on any new laws coming down the pipeline. It’s all about risk management and making sure you are in the clear at all times.

Why is Compliance Operations Important?

Compliance operations ensure that a company consistently meets its legal, regulatory, and security obligations, reduces risk exposure, and builds customer trust.

Without it, businesses are exposed—legally, financially, and reputationally. A missing control, an outdated policy, or a failed audit can cost you more than just fines; they can tank customer deals and erode confidence.

For example, a medical center once lost $3.2 million because of a loss of PHI under HIPAA violations. Yes, non-compliance is expensive.

Scope of Compliance Operations

The scope of compliance operations includes developing compliance policies, tracking control effectiveness, managing third-party risk, preparing for audits, training staff, and continuously monitoring adherence to frameworks.

Compliance operations span every corner of your business. It’s not just about keeping your financial books in check or ensuring your data protection policies are solid.

It is a cross-functional responsibility that touches everything from your onboarding flows to your vendor contracts. This is not just a legal task. It is business-critical.

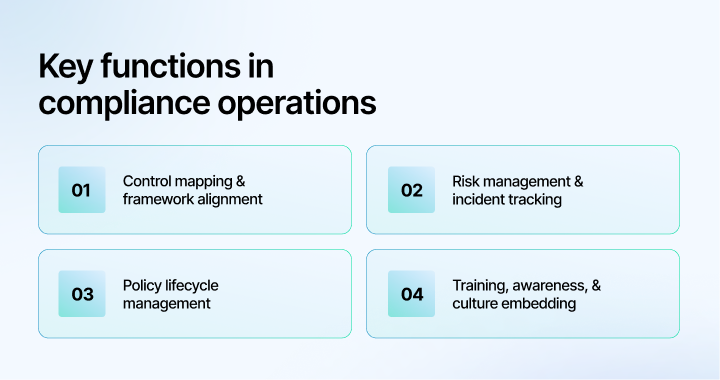

Key Functions and Activities in Compliance Operations

So, what actually happens behind the scenes of a well-oiled compliance machine?

Let us stop pretending compliance ops is just about documentation. At its core, it is how your business proves it’s operating securely, ethically, and legally – on command. That does not happen with a few policy PDFs and a signature. It takes structured, recurring, multi-layered activities that turn governance into a system.

Here is how that breaks down:

1. Control Mapping & Framework Alignment

This is ground zero. You cannot hit a target if you do not know what you are aiming for.

Control mapping translates regulatory requirements (SOC 2, ISO 27001, HIPAA, GDPR, etc.) into your operational processes. It means taking abstract controls like “access must be restricted” and breaking that into: Who? Where? What tools? What evidence proves that?

This involves:

- Auditing your existing systems

- Running a gap analysis to understand what the framework expects and what you are doing

- Mapping responsibilities and timelines to close those gaps

Most companies fail here because they treat frameworks as checklists instead of risk-based exercises. Real control mapping adapts the framework to your business, not vice versa.

2. Risk Management and Incident Tracking

Risk management is the process of identifying, evaluating, and mitigating potential threats that could harm your organization, such as regulatory penalties, cyberattacks, or system outages.

Compliance is about risk, not perfection. The question is not “Will something go wrong? Will we catch, document, and fix it before it blows up?”

This involves:

- Running risk assessments regularly (quarterly at minimum)

- Logging incidents – even small ones like access violations or suspicious logins

- Creating a remediation plan with deadlines, owners, and follow-up

- Mapping risks to specific framework controls

Bonus

This is where real-time monitoring tools like Sprinto become game-changers. They give you visibility into your risks as they emerge and proactively flag non-compliance with common industry standards.

3. Policy Lifecycle Management

Policies are not just checkboxes. They are living documents that guide employee behavior, product decisions, and vendor onboarding. But only if they are current and used.

A mature compliance ops function:

- Creates policies that align with controls and are readable (no legal jargon wall)

- Version-control updates and communicates changes

- Links policies to training and enforcement (e.g., termination clauses, onboarding compliance)

- Maps policies to control requirements for compliance standards

If your employees are breaking a policy they have never read, that is not a people problem; it is a compliance operations failure.

4. Training, Awareness, and Culture Embedding

Compliance training and awareness mean systematically educating employees about regulatory requirements, security best practices, and company policies, and ensuring they understand their role in protecting the company.

It is not just a one-time presentation; it is about embedding compliance thinking into your everyday operations. Ongoing training, real-world examples, phishing simulations, and periodic refreshers help turn your team into your first line of defense, not your weakest link.

Activities here include:

- Role-specific training (HR needs different guidance than engineering)

- Recurring awareness campaigns (phishing drills, quizzes, policy refreshers)

- Reporting adoption and comprehension (not just participation rates)

If culture eats strategy for breakfast, compliance culture eats frameworks for dinner.

5. Audit Readiness and Evidence Management

Compliance is not about saying “we do X.” It is about proving it, with time-stamped evidence that an auditor can trust.

The function here is to:

- Collect evidence automatically (access logs, screenshots, versioned policies, employee training records)

- Store it securely with metadata and audit trails

- Keep it organized by control, so when your audit window opens, you are not hunting through 67 Slack threads

This function separates reactive teams from proactive ones. If you only consider audits when they are scheduled, you are already behind.

Who Owns Compliance Operations: Roles & Responsibilities

In many small to mid-sized companies, compliance operations might start with just one person, and that is perfectly fine, especially with the right tools like Sprinto handling the heavy lifting.

The key is not the size of your team; it is about having clear systems, responsibilities, and automation in place so compliance does not become a bottleneck. Whether you are a solo compliance warrior or part of a larger squad, a structured, repeatable approach keeps everything running smoothly.

Let us break down the roles involved in compliance operations and their responsibilities:

1. Compliance Manager

The Compliance Manager is the point person responsible for coordinating and managing the organization’s compliance efforts across frameworks and regulations. They act as the bridge between auditors, leadership, and operational teams to ensure everyone is aligned.

The responsibilities of a Compliance Manager include:

- Developing and maintaining the compliance roadmap and timeline

- Preparing and organizing audit evidence

- Managing internal audits and assessments

- Tracking remediation efforts for any identified gaps

- Ensuring ongoing adherence to frameworks like SOC 2, ISO 27001, HIPAA, or GDPR

- Coordinating with legal, IT, security, and product teams

2. GRC (Governance, Risk, and Compliance) Lead

The GRC Lead oversees the broader governance, risk, and compliance strategy. Unlike a Compliance Manager, who often focuses on tactical execution, the GRC Lead operates strategically, aligning compliance efforts with business objectives and risk appetite.

The responsibilities of a GRC Lead include:

- Defining and implementing risk management frameworks

- Leading risk assessments across departments

- Ensuring governance practices are integrated into daily operations

- Aligning compliance activities with Enterprise Risk Management (ERM) goals

- Managing third-party risk and vendor compliance programs

3. Chief Information Security Officer (CISO)

The CISO (Chief Information Security Officer) is the senior executive responsible for establishing and maintaining the enterprise’s information security strategy. In compliance operations, the CISO ensures that security controls exist and map cleanly to compliance frameworks.

The responsibilities of a CISO include:

- Overseeing all information security initiatives and programs

- Ensuring technical controls (encryption, MFA, endpoint protection) meet compliance standards

- Leading incident response planning and post-incident reviews

- Driving alignment between cybersecurity and compliance goals

- Supporting audits by providing security documentation and evidence

4. Security Lead / Security Engineer

Security Leads or Security Engineers are the technical experts who implement and manage the organization’s security controls daily. They work under or alongside the CISO to enforce best practices at a ground level.

The responsibilities of a Security Lead include:

- Implementing and monitoring technical security controls

- Managing identity and Access Management (IAM) systems

- Conducting vulnerability scans and remediations

- Managing endpoint protection and network security

- Supporting the control evidence collection for audits

5. Legal Counsel / Risk Counsel

Legal Counsel or Risk Counsel ensures that the company complies with laws, regulations, and contractual obligations. They translate complex regulatory requirements into practical policies and risk management strategies.

The responsibilities of Legal Counsel include:

- Monitoring and interpreting updates to laws like GDPR, CCPA, HIPAA, etc.

- Advising on legal risks associated with business practices

- Reviewing and updating privacy policies and terms of use

- Ensuring vendor contracts align with compliance and security requirements

- Supporting breach response from a legal standpoint

6. Engineering / IT Team

The Engineering or IT team is responsible for building, maintaining, and securing the systems that support compliance controls. Without them, compliance remains theoretical.

The responsibilities of the Engineering / IT team include:

- Implementing secure system configurations

- Monitoring system logs, network activity, and user access

- Maintaining backup policies, disaster recovery, and incident logs

- Executing tasks like key rotations and vulnerability patching

- Providing technical documentation and evidence during audits

7. Executive Leadership (CEO, CFO, COO)

Executives are the champions of compliance culture. Their visible support and resource allocation determine whether compliance is seen as a strategic priority or an afterthought.

The responsibilities of Executive Leadership include:

- Allocating the necessary budget and personnel to compliance initiatives

- Publicly endorsing security and compliance priorities

- Embedding a culture of risk-awareness into company values

- Ensuring compliance is treated as a business enabler, not red tape

- Staying informed about key compliance risks and progress

Why Compliance Operations Pay Off: Benefits

So why invest in compliance operations at all? What does “doing this right” actually earn you?

Here are the main benefits of implementing effective compliance operations:

1. Achieving Audit Readiness on Autopilot

No more sleepless nights before audits. When compliance operations are dialed in, you are:

- Always collecting evidence in the background

- Responding to audit requests in hours, not weeks

- Getting certified faster and renewing without pain

That means faster sales cycles, especially in small startups where security reviews are challenging.

2. Gaining Customer Trust (and Revenue)

Trust is the currency of modern business, especially in SaaS, fintech, and healthcare.

String compliance shows customers:

- You take data protection seriously

- You are future-proofing their investment

- You are not a liability on their risk register

Want to close more deals? Start showing your compliance posture upfront.

3. Increasing Risk Tolerance Across the Board

Increasing your organization’s risk tolerance means building confidence, internally and externally, that your business can handle uncertainty, regulatory scrutiny, and evolving threats without falling apart. It does not mean you are immune to risk. It means you have robust systems in place to identify, mitigate, and respond to risks in a way that minimizes damage and keeps stakeholders reassured.

Here is what solid compliance helps you avoid:

- Regulatory penalties and fines become rare because your policies and controls are actively maintained and regularly audited.

- Thanks to proactive monitoring and incident response plans, data leaks and breaches are minimized or swiftly contained.

- Downtime due to unmitigated risks drops dramatically because you have already mapped out and tested disaster recovery procedures.

4. Increasing Operational Clarity and Cross-Team Alignment

Good compliance ops create clear answers to:

- Who owns what?

- What happens when X goes wrong?

- Are we covered if a new hire or vendor introduces risk?

That clarity reduces internal conflict, improves onboarding, and helps teams make more intelligent decisions faster.

Best Practices for Compliance Operations That Work

Now for the part that makes or breaks it: compliance best practices. You can have the best frameworks in the world, but they are useless if they are not embedded into how your business runs.

Here are the five best practices for compliance operations:

1. Treating Your Compliance Controls Like Product Features

So do your compliance controls if a customer-facing feature needs to be scoped, documented, tested, and monitored. That means writing a specification for every control, defining its “acceptance criteria” (what success looks like), and assigning an “owner” who is responsible for its ongoing performance.

Take it further and integrate control testing into sprint planning or OKR cycles. For example, if you commit to quarterly access reviews, they should live in the same system (e.g., Jira or Notion) as your engineering backlog.

2. Creating a Living Compliance Workspace, Not a Static Folder

Compliance is often buried in a shared drive graveyard: 37 versions of the same policy doc, missing timestamps, “draft_final_FINAL.pdf” files. This kills audit readiness. Instead, use a compliance automation tool with a dynamic and live dashboard of your controls, risks, and framework requirements.

Choose a platform that seamlessly connects/integrates with your existing tool stack.

Sprinto, with its 200+ integrations and open API integration, does that while alerting you on non-compliance with remediation action items.

3. Building a Compliance Automation Layer That Connects to Your Stack

You do not need 12 tools to manage compliance, but you need the right ones to speak to each other. Compliance automation only works when it pulls live data from your systems of record: HRIS, SSO, cloud infrastructure, and ticketing tools. That means building integrations that sync in real-time, not relying on outdated screenshots.

For example, automate offboarding by syncing your HRIS (like BambooHR) and your identity provider (like Okta) with a powerful GRC tool like Sprinto. When someone exits, access logs and termination evidence are instantly collected and stored. If there is a compliance breach, Sprinto, your automation layer, will immediately notify you.

4. Building Role-Based Training That Connects Directly to Controls

Generic compliance training is worse than no training; it creates false confidence. Role-based training means engineers understand secure coding and access management, sales teams know how to handle sensitive data in emails, and HR knows the rules around privacy during hiring. Everyone gets what is relevant to their responsibilities, not a one-size-fits-all slideshow.

And here is the kicker: link your training modules directly to the control they support. That way, if an auditor asks how you ensure employees understand your data retention policy, you can show a timestamped record of the exact training tied to that policy and who completed it.

5. Embedding Continuous Monitoring into Your Incident Response and Risk Reviews

Most companies think of monitoring not as a compliance but as a Security Operations Center (SOC) dashboard. In this centralized hub, security teams track real-time cyber threats, vulnerabilities, and suspicious activities.

However, continuous monitoring means alerting when controls fall out of scope, like a missed quarterly review, a failed backup verification, or an unapproved tool making its way into your stack. Use real-time alerts to flag deviations before they show up during an audit.

Instead of reporting open risks during quarterly reviews, you should have real-time visibility into the performance of every control across your organization, and that is precisely where Sprinto steps in.

Sprinto is a GRC (Governance, Risk, and Compliance) automation platform that takes the guesswork out of risk monitoring. It connects seamlessly with your existing tech stack through 200+ integrations, continuously tests your systems against risk-mapped controls, and gives you a real-time, bird’s-eye view of their performance.

Implement Compliance Operations Principles with Sprinto

The real value of compliance operations goes far beyond passing audits or checking boxes. A well-structured compliance function builds customer trust, reduces operational risks, strengthens security, and ultimately, accelerates business growth.

If you are serious about scaling, compliance operations should not feel like an afterthought—they should feel like an integral part of your company’s success.

And the good news? You do not have to tackle it manually or reinvent the wheel.

Sprinto automates the heavy lifting, keeps you audit-ready year-round, and gives you deep visibility into your risk posture.

Take the example of MakeForms, a Sprinto customer who achieved compliance with over 11 frameworks – including SOC 2, ISO 27001, HIPAA, and GDPR. MakeForms reduced compliance costs by 50% and decreased the effort to close compliance gaps by 93%. This enabled them to scale their compliance programs efficiently without increasing team size, ensuring continuous audit readiness across multiple standards.

Frequently Asked Questions

1. What is the difference between compliance operations and traditional compliance?

Traditional compliance is reactive, focused on documentation and audits. Compliance operations are proactive and continuous, focused on real-time control enforcement, automation, and embedding compliance into daily workflows.

2. How do I know when to hire a dedicated compliance manager?

Suppose your company is pursuing certifications like SOC 2, ISO 27001, or HIPAA, and compliance is pulling over 20% of someone’s time across multiple departments. In that case, you need a dedicated compliance role to centralize accountability and drive efficiency.

3. Can a startup automate compliance without hiring a whole team?

Yes, with the correct tooling. Platforms like Sprinto automate evidence collection, policy enforcement, and monitoring so lean teams can manage enterprise-grade compliance without hiring a large GRC department.

4. How often should controls and policies be reviewed or updated?

Controls should be tested and validated quarterly at a minimum. Policies should be reviewed annually or whenever a significant change occurs (new tools, new regions, legal/regulatory updates).

5. What happens if a compliance control fails before an audit?

The key is documentation and remediation. You are not expected to be perfect, just to be accountable. If a control fails, log the issue, document what happened, and provide evidence of a remediation plan. Auditors want transparency, not spin.

Pansy

Pansy is an ISC2 Certified in Cybersecurity content marketer with a background in Computer Science engineering. Lately, she has been exploring the world of marketing through the lens of GRC (Governance, risk & compliance) with Sprinto. When she’s not working, she’s either deeply engrossed in political fiction or honing her culinary skills. You may also find her sunbathing on a beach or hiking through a dense forest.

Explore more

research & insights curated to help you earn a seat at the table.