Compliance comes with a price tag—whether done right or neglected, and the cost of poor compliance is always higher. Cutting corners isn’t an option in today’s hyper-connected, digitized world, where resilience and regulatory adherence are non-negotiable.

But what if we looked at compliance costs differently? By understanding where these expenses come from and exploring strategies to manage them effectively, businesses can transform compliance from a burden into an opportunity for innovation and competitive advantage.

In this blog, we’ll break down compliance costs across industries and share actionable strategies to keep them under control—without sacrificing security or regulatory obligations

| Compliance expenses include direct costs (staffing, audits, technology, training) and indirect costs (productivity loss, opportunity costs, reputational risks). Costs vary by industry, with financial and healthcare sectors being the most expensive. |

| Increasing regulatory complexity, stricter enforcement, evolving privacy expectations, talent shortages, and technological advancements drive compliance expenses. However, the ROI of compliance includes cost savings, risk reduction, and new business opportunities, which is much greater than the spending. |

| A risk-based approach, automation, integration into daily operations, continuous monitoring, and scalability help businesses control costs while ensuring compliance. Non-compliance is far costlier, leading to fines, legal actions, operational disruptions, and reputational damage |

What are compliance costs?

Compliance costs refer to the direct and indirect expenses a business incurs to adhere to applicable laws and industry requirements, including audit costs, compliance staff salaries, training and education costs, and time and resources diverted from core production to compliance activities.

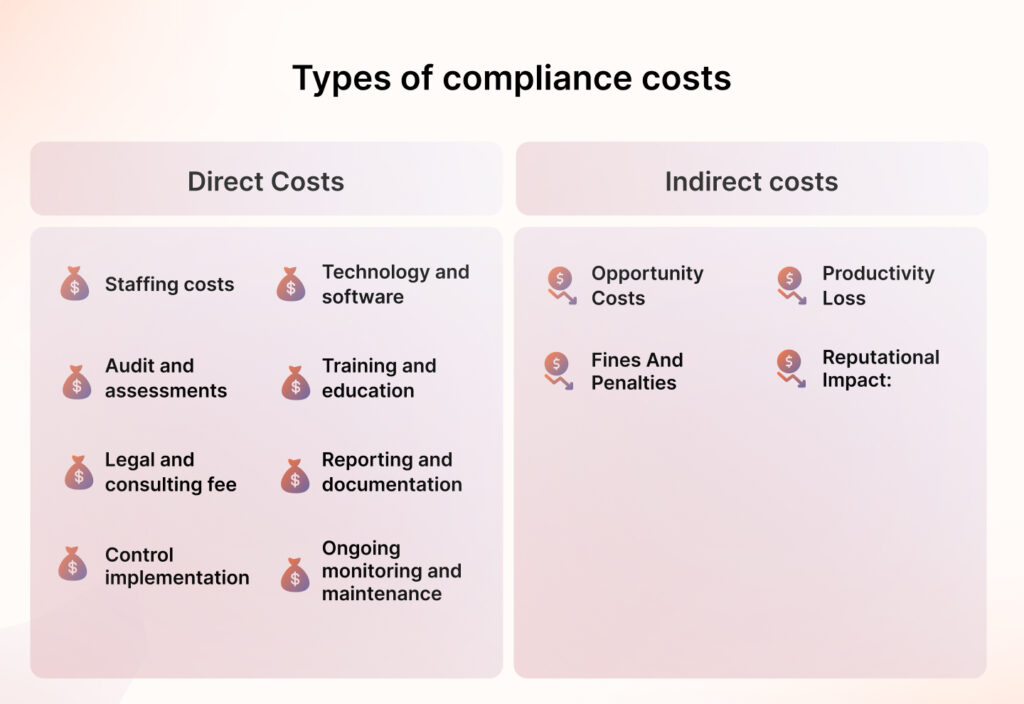

Types of compliance costs

Compliance costs are broadly divided into direct and indirect. Direct costs can be directly attributed to compliance activities, while indirect costs are usually hidden and may be overlooked by businesses.

Let’s have a look at both the types:

Direct Costs

- Staffing costs: Compensation for compliance staff, risk managers, and other dedicated personnel

- Technology and software: Costs of compliance management software, security solutions such as firewalls and encryption, and other automation tools

- Audit and assessments: Costs of internal and external audits, auditor fees, and any third-party assessments

- Training and education: Expenses on employee training and awareness programs

- Legal and consulting fee: Payment to legal advisors, compliance consultants, and other industry experts

- Reporting and documentation: Costs of record-keeping, documentation, and preparing and submitting reports

- Control implementation: Expenditure on control implementation and enforcement of policies

- Ongoing monitoring and maintenance: Costs of ongoing monitoring and maintaining compliance

Indirect costs

- Opportunity costs: Loss of resources diverted from core business activities to compliance

- Productivity loss: Time spent by employees on activities such as training instead of revenue-generating tasks

- Fines and penalties: Potential costs of non-compliance

- Reputational impact: Damage to reputation due to non-compliance or data breaches

Compliance cost based on industries

Compliance costs vary by industry because certain businesses handle sensitive data, require frequent audits, and have high compliance penalties.

Here are some industry-wise compliance cost estimates:

Financial

The finance sector has stringent laws to minimize financial crime, such as Anti-money laundering (AML), and standards to protect cardholder data, such as the PCI DSS, which make it a high-cost industry. The financial crime compliance costs in Canada and the United States alone total $61 billion due to the increasing use of AI and crypto technology for illegal activities.

Global banks with over 20000 employees are spending $200 million in compliance annually.

Healthcare

Healthcare regulations such as HIPAA require organizations to implement robust data protection measures that can cost between $50000 and $150000+.

Cloud

Cloud compliance costs include expenses on certifications or reports such as SOC 2, GDPR or ISO 27001. While these costs vary based on factors such as size, complexity, choice of tool/consultancy and more, here’s an idea of what they can really cost:

- A SOC 2 Type 2 can range anywhere from $7000-$50000

- ISO 27001 can cost $30000-$60000

- GDPR can cost anywhere from $20000-$100000+

Pharmaceuticals

Even the pharmaceutical industry has high compliance costs because of the testing, documentation, and quality assurance required. The average cost of compliance in the industry is $5.47 million.

Technology

Tech is a medium-compliance-cost industry with data protection and privacy regulations such as GDPR and CCPA. The average cost for GDPR ranges from $20500 to $102500.

Manufacturing

Manufacturing is yet another low- to medium-compliance cost industry, with small manufacturers and 20 employees spending an average of $1 million annually.

Sprinto can help you control these costs and even slash them by half with automated workflows, in-built tools, readymade policy templates, training modules and much more. Talk to an expert to learn how.

Cut compliance costs by half with Sprinto

Why are compliance costs rising?

Compliance costs are rising by double digits for most firms due to evolving requirements and increasing regulatory expectations. Moreover, customers today seek assurance about their data security and expect compliance certifications as proof of best practices before entering into contracts.

Here are the key reasons for increasing compliance costs:

Increasing compliance complexity

The key driving factor for compliance costs has always been the rising complexity of regulations. New laws and standards are introduced daily, the existing ones are frequently updated, and industry-specific requirements are only getting more challenging. On top of that, as businesses go global, they are subject to laws from multiple jurisdictions, further complicating the efforts.

Changing privacy expectations

As consumers become more aware of their rights, privacy expectations worldwide are constantly growing. Regulators have started emphasizing data privacy and protection laws such as GDPR, CCPA, and PIPEDA, focusing on implementing robust security measures and enhancing transparency in data handling. The need to adapt to these frameworks and ensure privacy by design drives up compliance costs.

Stricter enforcement

Regulators enforce stricter compliance measures, and non-compliance carries financial and reputational repercussions. Increased scrutiny, frequent and comprehensive audits, and the public disclosure of data breaches have pressured businesses to invest more in compliance to avoid such consequences.

Technological advancements

As businesses adopt new technologies such as AI, ML, and cloud computing, they are tasked with ensuring the security and compliance of new tools. The EU has already introduced the AI Act, and keeping up with such changes requires investments in new resources, which can make compliance costly.

Talent shortage

The industry has a talent shortage, especially in cybersecurity, risk management, and knowledge of evolving regulations. This burdens the organization with paying more salaries to the existing staff for retention and skill gap compensation and continuously investing in their training to stay ahead of the curve.

Compliance cost Vs. Compliance ROI

We’ve seen that compliance costs include direct and indirect costs and can reach millions of dollars depending on industry, size, compliance complexity, and other factors. But what about compliance ROI?

Most compliance professionals struggle with presenting an ROI case when seeking budget approvals from top management. The Compliance Return on Investment is the value generated from compliance activities to showcase that it is not a cost center.

Compliance offers both tangible and intangible benefits, and while it can be difficult to quantify every benefit, you can make some judgments for estimation.

Let’s have a look:

Examples of tangible benefits

- Avoiding fines and penalties: Reduced potential regulatory fines of $400000 through robust compliance

- Efficiency gains: 500 hours saved due to compliance automation, equivalent to $50k labor costs

- Cost savings from risk reduction: Achieved savings of $2 million on remediation efforts by minimizing the risk of a data breach

- Lowered insurance premiums: Achieved 20% lower insurance premium due to efficient compliance practices

- Revenue growth due to new opportunities: Won a $5 million enterprise deal because the company was ISO 27001 compliant

Examples of intangible benefits

- Enhanced reputation and trust: Achieved 10% customer retention rate due to enhanced trust translating into $2M additional revenue

- Improved employee morale due to a better culture: Achieved a 5% reduction in employee turnover, saving $500k in hiring and training costs

Note that these are just examples, and the quantification can be difficult because some benefits are visible in the long term. Moreover, these benefits also overlap with other activities, and it can be challenging to isolate the impact of compliance.

However, in essence, compliance is a business enabler, not a cost center.

Read how Kodif achieved enterprise-readiness with compliance

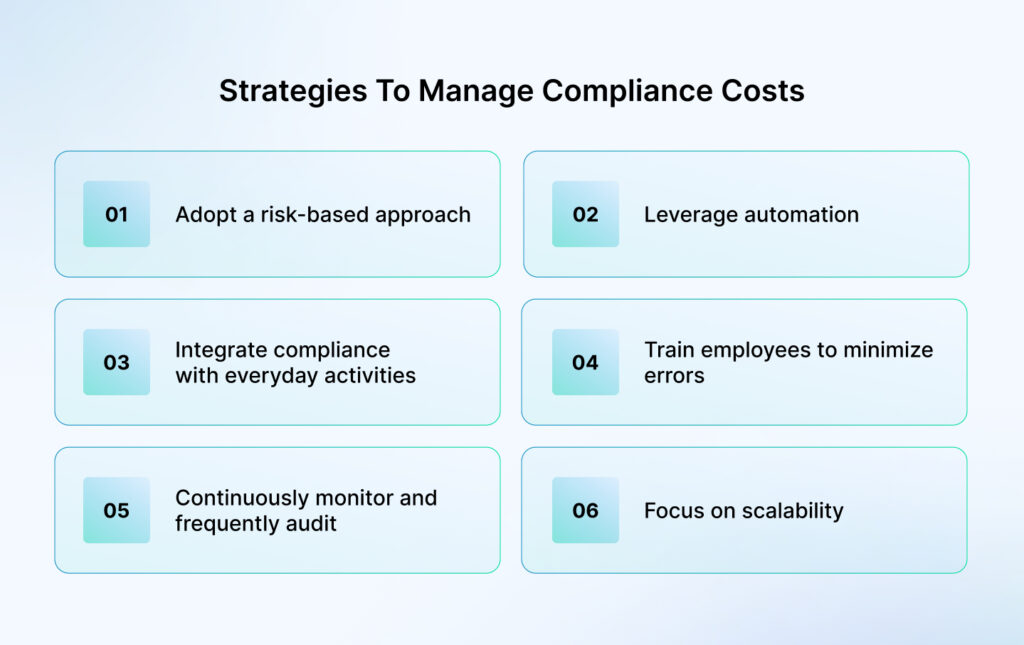

Strategies to manage compliance costs

Managing compliance costs requires a shift from a reactive to a proactive approach, a change in mindset, and adopting the right technologies.

The key strategies for managing compliance costs include:

Adopt a risk-based approach

A risk-based approach ensures that the organization stays proactive in addressing high-risk areas with higher compliance ROI. It involves conducting risk assessments and assigning risk scores to prioritize controls instead of applying the same effort across all regions.

Leverage automation

Using compliance management tools minimizes compliance effort while maximizing output. These automated solutions help centralize compliance activities, manage policy enforcement, automate evidence collection, and continuously monitor controls in real-time. They also help save labor costs, reduce rework and human error, and enhance efficiency and speed.

Integrate compliance with everyday activities

Seeing compliance as a siloed function increases adherence friction. Embedding compliance into everyday operations ensures seamless workflows and enhances cross-functional collaboration. This, in turn, reduces duplicative efforts to save costs while aligning compliance with overall business goals.

Train employees to minimize errors

Human error accounts for 80% of compliance and security misses, and training can make a difference. Tailoring training programs based on roles and phishing simulations and exercises reinforce compliance’s importance and raises awareness of attacker tactics. This proactive approach helps prevent costly violations and minimize risks.

Continuously monitor and frequently audit

Using real-time dashboards to track compliance status across multiple regulations continuously helps you stay ahead on pending tasks. This, combined with frequent audits, ensures that you fix potential gaps before they become havoc-causing incidents. It also provides data-driven insights to refine strategies and save costs on redundant activities.

Focus on scalability

Reworking compliance efforts for each framework will only increase costs and effort. Choose a scalable approach by mapping commonalities across multiple frameworks and reusing the same evidence for different requirements. Leverage tools that facilitate this process and accelerate audit readiness.

Read how Makeforms achieved compliance with 11 frameworks at half the cost.

The costs of non-compliance

The average cost of non-compliance is more than $14 billion, including fines, penalties, revenue loss, business disruptions, and reputational damage. Since 2011, the price has risen by 45%.

Fines and penalties

Regulatory bodies charge hefty fines and penalties for non-compliance to ensure stricter enforcement. For example, in the case of GDPR, the penalties can go up to €20 million or 4% of global turnover.

Operational disruptions

Non-compliance can result in increased scrutiny and investigations, disrupting the natural flow of operations and leading to delayed projects or downtime.

Lawsuits

In certain cases, lawsuits from regulators, customers, or stakeholders may also occur. This can increase the non-compliance costs, which can include attorney fees and settlements or damages paid to affected parties.

Reputational damage

Data breaches put you in the headlines for all the wrong reasons. The resulting reputational damage erodes customer trust and can slow the sales cycle for an extended period.

Remediation costs

Once a violation is identified, the organization must implement corrective actions such as policy changes or compliance program upgrades, which can be expensive.

Revenue loss

Non-compliance can also lead to terminated partnerships and contracts due to loss of credibility and cause revenue loss.

Ensure continuous compliance with Sprinto

How will compliance management change in the future?

As compliance becomes a strategic enabler and a key requirement for businesses expanding globally, compliance management will undergo significant changes. We are at an inflection point, and the future of compliance looks far more systematic and streamlined.

Here’s what the future holds for compliance management:

Increased automation and AI integration

Compliance software will be like project management and CRM tools in the future—every company will have it, and automation will enhance efficiency. While companies are already adopting next-gen GRC tools like Sprinto, the future will see even more businesses embrace AI technology for continuous monitoring, predictive analysis, and real-time regulatory updates.

Predictive risk analysis

Many companies still use the traditional root cause analysis approach to flag potential risks. However, the future will see more data-driven and predictive risk analysis, where advanced analytics will help forecast risks, making things more forward-looking.

Embedded compliance guidance

Gartner predicts that by 2030, employee guidance will be more ‘embedded’ in employee workflows instead of delivering standalone training sessions. This shift will reduce employee burden, as they will no longer need to recall compliance instructions separately; instead, guidance will become a natural part of their responsibilities.

Stronger third-party and supply chain compliance

As risk exposure from third-party vendors and supply chains increases, vendor compliance is expected to evolve further. Regulatory pressure for enhanced due diligence and supply chain transparency has already intensified, and new measures and penalties may be imposed for full-fledged enforcement

Sourced local compliance teams

This is yet another prediction by Gartner. As companies grapple with multi-region regulations, managing all requirements from a centralized place becomes difficult. In the future, the number of remote jobs for sourcing local compliance teams will increase to support efficient compliance management.

Sprinto also offers compliance by zones to make it easy for different business units to manage compliance.

How can Sprinto help with compliance management?

We’ve already discussed how automation can be a game-changer in managing compliance costs by reducing manual effort, minimizing audit preparation time, and streamlining workflows. Now, let’s discuss why Sprinto is the number one choice for businesses looking to get compliant across multiple frameworks without significant costs.

The platform can help you stay continuously compliant while minimizing fatigue and costs in the following ways:

- Pre-built policy templates and training modules: Eliminate the need to create policies and tailor training programs from scratch

- Automated workflows: Put repetitive tasks on auto-pilot to minimize human inputs

- Real-time control monitoring: Continuously monitor compliance controls to fix gaps proactively

- Automated evidence collection: Automate gathering of evidence pieces with proper context

- Reports: Get data-driven reports for well-informed decisions

- Vendor management: Track high-risk vendor compliance centrally

- Common control mapping: Map framework commonalities with ease to accelerate audit readiness

Take a platform tour to see the product and manage compliance effortlessly.

FAQs

How much do companies usually spend on compliance?

According to a report by NorthRow State, companies spend about 25% of business revenue on compliance costs.

Large companies in the US are spending about $10000 per employee on compliance.

What are some hidden compliance costs that businesses often overlook?

Some hidden costs that businesses often overlook include system upgrades, especially legacy systems, integrations, reporting and documentation, and employee turnover due to audit fatigue.

How often should businesses budget for compliance?

Compliance is not a one-time cost, and there should be annual upgrades to compliance budgets to account for training, audits, tech updates, and new and evolving requirements.

Payal Wadhwa

Payal is your friendly neighborhood compliance whiz who is also ISC2 certified! She turns perplexing compliance lingo into actionable advice about keeping your digital business safe and savvy. When she isn’t saving virtual worlds, she’s penning down poetic musings or lighting up local open mics. Cyber savvy by day, poet by night!

Explore more

research & insights curated to help you earn a seat at the table.