Vendors are no longer just service providers. They are part of your business’s operations. And with every new vendor, you’re adding more capability, but not without risk. Third-party risk impacts every layer of your business. It goes beyond compliance to cover customer trust, time-to-market, business continuity, and legal liability.

Here’s how the drill usually goes: create a vendor list > collect questionnaires > produce documentation for audit season.

But is such a point-in-time pathway to vendor risk enough, today?

The short answer is NO.

One-time reviews, spreadsheets, and emails may have worked when vendor ecosystems were smaller and risk was easier to contain.

But now? Instead of helping you grow at the pace you desire, vendors represent risk falls through the cracks. All because your vendor risk management program is stuck in manual mode. Moreover, your business will feel it when the consequences manifest in the form of missed contract renewals that delay procurement, and a lack of real-time visibility that hinders incident response.

If you still can’t see the connection between vendor risk and business impact, consider this:

| Vendor risk issue | Business impact |

| Third-party outages | Service downtimes, business disruptions, and potential customer churn |

| Misconfigured vendor access | Sensitive data leaks amounting to fines and clean-up costs |

| Failed certifications leading to incomplete assessments | Difficulty proving compliance, resulting in loss of client trust, and potential legal challenges and penalties |

| Manual, inconsistent reassessment processes | Higher chances of fragmented evidence collection and audit fatigue |

| Reactive breach detection | Delayed incident response, increased legal liability, and loss of client trust |

| Unmanaged vendor onboarding | Delayed product launches, unauthorized access vendors, and blind spots in your vendor risk exposure |

These issues might look like occasional slip-ups. But they are signs that your vendor risk program lacks the structure, visibility, and responsiveness your business needs. And they add up to hinder your business goals.

Let’s walk through all the warning signs that your vendor risk approach needs an upgrade.

- Third-party risk today touches more than compliance. It affects uptime, trust and speed.

- If reviews are one-time, access is unmanaged, and fourth-party risk is untracked, the cracks will start showing up.

- An automated approach helps uncover hidden exposure, align stakeholders, and stay ahead of disruptions.

The 10 Structural Red Flags That Signal Maturity Gaps

If you feel like you’re constantly playing catch-up, you have probably outgrown your vendor risk processes. It is no longer providing the coverage that’s essential for reducing risk exposure and maintaining business continuity.

Here are 10 signs that point to cracks in your current setup that might amount to costly gaps:

- Vendors Aren’t Scored by Business Impact or Data Sensitivity

Not all vendors pose the same level of risk. So when you’re using the same lens for every vendor, you lose sight of who poses real risk. Start by identifying the risk factors that matter the most to your business. Criteria should include factors like criticality to your business operations, data sensitivity, or regulatory impact

- No Automated Tiering or Portfolio Segmentation

When you don’t segment your vendors, everyone ends up in the same bucket. That means a tool with access to sensitive customer data will undergo the same review process as a low-impact service.

Without risk-based tiering, it’s impossible to prioritize. Your team might end up spending most of the time reviewing low-risk vendors, while high-risk vendors fly under the radar.

- Due Diligence is One-Time and Input-Heavy

Vendor due diligence should not be a point-in-time exercise, usually done at the onboarding stage. After that, it goes quiet with no reassessments, follow-ups, or validation.

But that doesn’t truly accommodate the nature of the threat associated with your vendor’s changing business environment and/or risk posture. If you’re not performing due diligence periodically, even small vendor risks can turn into big challenges.

Improve vendor risk monitoring and management with automation

- You Lack a Single Source of Truth for Vendor Controls

Risk assessments in spreadsheets, security reviews in shared drives, and contracts in someone’s inbox. When most of your vendor control data is fragmented across tools, inboxes, and teams, visibility breaks down.

With vendor data scattered like this, no one has the full picture. You don’t know which vendors are up to date, which ones are missing reviews, or where the risk really sits. This makes vendor risk hard to track, harder to trust, and even harder to act on.

- Exceptions, Compensating Controls, and Risk Acceptances Are Untracked

Risk exceptions can happen in unique circumstances. But here’s when things can go wrong—when such instances are not recorded or tracked. Who approved them, under what conditions, and for how long?

Without tracking exceptions, compensating controls or accepted risks, there’s no audit trail and therefore no accountability. By the time you’re in audit season, you’re left guessing.

- No SLA or Access Violation Monitoring for High-Risk Vendors

You hear about failures during incidents, not before. Maybe an SLA gets missed. Perhaps a vendor introduces a change that affects uptime or access. But unless someone reports it, there’s no early warning or heads-up.

When your team is already stretched thin, such a lag is risky. It pushes you to respond under pressure, without context, or a clear path to resolution. This reactive loop creates more chaos than control.

- Vendor Onboarding Happens Outside GRC Oversight

It’s not unusual for vendor onboarding to happen before GRC is even looped in. It’s just how procurement and business teams operate in an effort to move quickly and avoid delays.

But when third-party risk reviews happen after the fact, important things tend to slip through the cracks. A vendor might have access to sensitive data or systems before even a single review has happened.

And by the time GRC teams gain visibility, it’s already too late to course-correct.

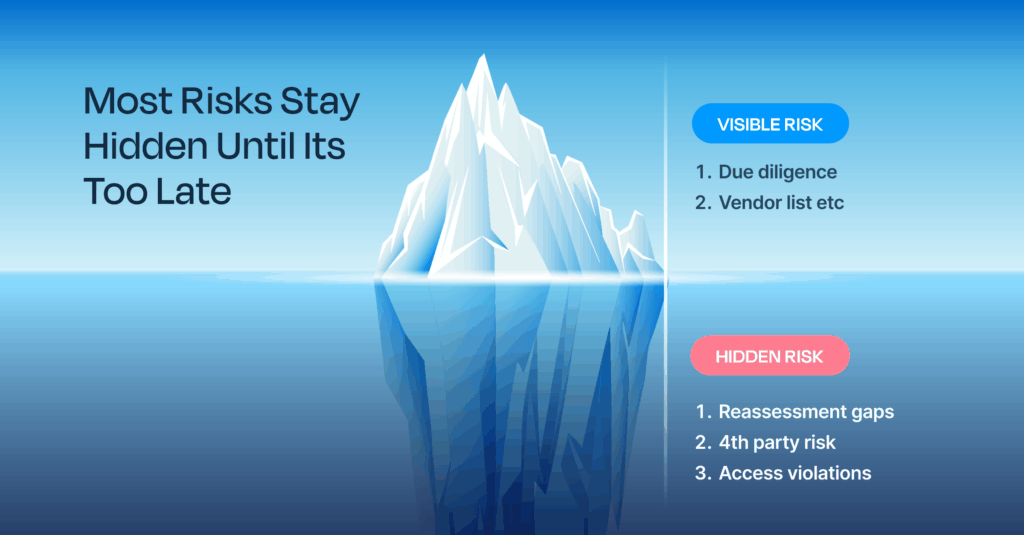

- Fourth-Party and Sub-Processor Exposure Is a Black Box

Let’s say your team has a good handle on your primary vendors. But what about the tools your vendors use or the partners they work with?

If you’re not tracking fourth-parties or sub-processors, you’re only seeing part of the risk. A vendor might be secure, but you don’t know about their dependencies. And if things do go wrong, you’re only going to be held accountable.

Without visibility into the full chain, you’re exposed to risks you didn’t knowingly take on.

- Reporting to Executives Lacks Leading Indicators

Most reports focus on what’s already been addressed. How many vendors were assessed and how many passed? It brings a backward-looking perspective.

But what your stakeholders and leaders need is a forward insight. This covers areas like your vendors’ security posture, potential disruptions that can happen, and risk observation and mitigation plans.

Without those leading indicators, it’s hard for execs to connect vendor risk with business impact and even harder to take appropriate actions.

- There’s No Measurable Improvement Year-Over-Year

Vendor risk management shouldn’t become a cycle of repeated tasks—onboarding, reviewing, and documenting without real insight into the impact.

There’s likely no baseline, no benchmarks, and no KPIs around onboarding time, shift in risk levels, or reassessment velocity. So even if your team is working hard, it’s tough to prove progress or spot areas that are falling behind.

You end up managing activity without much improvement in performance.

What a Risk-Aligned, Automated Vendor Program Looks Like

Vendor risk isn’t a security checkbox anymore. It gets complicated with multiple vendors and intricate workflows. To address all these vendor risks, you need a modern, scalable vendor risk management program that is rooted in automation. Here’s what that looks like:

Governed, Tiered Vendor Inventory

Not every vendor brings the same level of risk. A modern vendor risk management program groups vendors based on their business impact.

An automated vendor segmentation process, removes the gruntwork and guesswork and makes your job much simpler. It applies consistent criteria like data types processed, integration depth, and SLA dependency to tier vendors automatically and flags the ones that require deeper reviews.

Continuous Risk Intelligence

A vendor may be low-risk today, but what if they suffer a breach tomorrow? An automated vendor program tracks risk signals in real-time, like access changes, breach notifications, or compliance downgrades. It becomes a part of the internal reassessment workflows, so there are no delays or missed signals.

Most security issues are exposed at the right time, and you’re acting on the latest vendor risk picture.

Control Mapping Across Frameworks and Risk Domains

Third-party risk shows up across security, availability, integrity, and privacy. Each of these risks may be tied to multiple frameworks like SOC2, ISO 27001, or GDPR. Manual mapping will lead to missed controls, duplicated efforts, and inconsistent reporting.

An automated vendor risk management system maps each vendor’s controls to relevant frameworks and risk categories. This gives you full visibility into how your program ladders up to your compliance posture and business obligations.

Lifecycle Governance from Intake to Exit

Vendor reviews don’t stop at onboarding. Real risk may show up at any point during the lifecycle of a vendor relationship.

Automation brings full lifecycle governance, right from intake forms and initial assessments to exceptions handling, renewal reviews, and decommissioning. Each step is timestamped, linked to evidence, and mapped to internal policies.

Fourth-Party and Concentration Awareness

Without visibility into fourth-party relationships or vendor concentration, you risk ignoring systemic gaps or failures. A truly aligned third-party risk management program will fill these gaps.

It automatically surfaces these dependencies and highlights exposure points before a fourth-party incident can impact your customer experience or compliance standing. This expands your risk lens beyond the surface and helps catch the potential points of failure early on.

What does better look like: The strategic outcomes of vendor risk management

When your vendor risk management runs on automation, the outcomes shift from reactive fire-fighting to forward momentum. Here’s how that translates in practice:

- Onboarding is no longer a bottleneck: You are compliant by design with automated vendor risk management. This means vendors move through intake faster with built-in reviews and control-mapping.

- Better prioritization and reassessment of high-impact vendors: You know where to focus. With risk tiers and automated signals, you can zoom in on vendors that actually affect compliance or business continuity.

- Reduced legal, reputational, and operational exposure: Exposure doesn’t stay hidden. From internal and vendor risk exposure to fourth-party exposure, early alerts and mapped controls limit the potential for incurring fines and reputational damage.

- Data-backed confidence for execs and regulators: Automated vendor risk management adds a layer of security that helps build stakeholder and regulator trust.

- Stronger alignment between risk management and procurement, legal, and IT: A good vendor risk management program provides centralized access to all vendor activity. Risk, procurement, legal, and IT align on one system of record, reducing internal friction.

How Sprinto Enables Risk-Aligned Vendor Oversight

These strategic outcomes can become your reality with Sprinto. It brings speed, structure, and clarity to every layer of oversight, allowing you to scale without slipping.

Vendors are automatically segmented by business impact, data access, and risk level. If a vendor’s risk exposure changes, Sprinto flags it and triggers a reassessment, helping you stay ahead of exposure.

The best part is that it automatically maps controls to compliance frameworks. So you’re always catching red flags early, not after the fact. Plus, with a centralized dashboard, legal, procurement, and GRC stay on the same page without having to chase updates.

Sprinto brings your entire vendor risk lifecycle under one roof, with built-in complex context. Curious how it works? Get an in-depth tour of our vendor risk management platform with our experts.

FAQs

- How do we link vendor risk to enterprise risk registers and impact models?

To link vendor risk with enterprise risk register, map vendor risk categories to your broader risk management framework. Then use impact modeling to evaluate how a vendor’s failure could affect critical business functions, customer trust, or compliance posture.

- What maturity frameworks or benchmarks exist for vendor risk automation?

Use frameworks like NIST’s cybersecurity framework, Vendor Risk Management Maturity Model, or RIMs Risk Maturity Model. These help you benchmark your progress across areas like continuous monitoring and compliance alignment.

- How do we measure year-over-year improvement in vendor program effectiveness?

You can measure year-over-year improvement in vendor program effectiveness by tracking KPIs like onboarding time, reassessment frequency, percentage of tiered vendors, and audit readiness.

- Can automation help us meet DORA, NIS2, or upcoming AI Act vendor requirements?

Yes, automation using platforms like Sprinto enables ongoing monitoring, audit trails, and fast risk response. It supports multiple compliance frameworks and automatically maps controls to frameworks. What are the top KPIs that boards care about in third-party risk oversight?

Boards are primarily concerned with KPIs associated with financial impact, risk exposure, and alignment with business impact. These include TRPM coverage, SLA breaches, response time, compliance with SLAs, and financial exposure.

Raynah

Raynah is a content strategist at Sprinto, where she crafts stories that simplify compliance for modern businesses. Over the past two years, she’s worked across formats and functions to make security and compliance feel a little less complicated and a little more business-aligned.

Explore more

research & insights curated to help you earn a seat at the table.