Businesses operating in a post-COVID era of accelerated cloud adoption and decentralized workforces are quickly realizing the need for a security-first culture to mitigate looming security risks in the face of rising costs associated with data breaches. In fact, the average cost of a data breach in the US was 4.45 million in 2023, this figure can be a make or break for businesses faced with bootstrapped budgets and tough market conditions, hence a plan to mitigate and minimize these risks is essential for every business.

That is why an Integrated Risk Management (IRM) approach is the need of the hour. It presents a collaborative and strategic way for companies to manage risk effectively across the entire value chain.

From working with business segment leaders and other teams in sharing and visualizing information about risk and compliance to coming up with policies collaboratively to mitigate and manage it, an integrated approach helps make compliance and security a common priority across the board for the entire organization.

This guide discusses the different aspects of integrated risk management, its importance, and how to implement it in your org.

What is Integrated Risk Management(IRM)?

An Integrated Risk Management is a process that organizations follow to identify, address, and manage risks that persist across the organization by providing security teams with a holistic view of potential risks and highlighting opportunities for improvement.

The process essentially helps the company keep risk management at the center of its operations so they are able to prepare and consistently manage risks that arise. An Integrated Risk Management Program (IRMP) considers all types of risks an organization faces—strategic, operational, financial, compliance, etc. It ties risk management to the organization’s overall objectives and strategy and aims to identify and address potential risks before they become problems.

The concept of integrated risk management was first introduced by Gartner in 2017. According to Gartner, an efficient integrated risk management approach should include:

- A clear and concise risk response strategy.

- Detailed risk assessment.

- Communication and reporting.

- Risk monitoring.

- Adopting a software-based IRM solution.

What is the scope of an Integrated Risk Management Program?

The scope of an IRM program for any organization can be defined only by understanding the elements of IRM. The scope of the IRM revolves around the following six attributes:

1. Strategy

The IRM strategy needs to be aligned with your risk management process and with the business objectives. You need to strategize and implement a risk framework to determine your organization’s risk appetite.

This is done by creating risk profiles and determining the different types of risks the organization is willing to take, such as unforeseen risks, operational risks, strategic risks, cyber risks, future risks, market risks, and more. Then comes performance improvements through risk ownership and effective organizational oversight.

2. Risk Identification and Assessment

The risk assessment process encompasses identifying existing and potential risks and performing risk analysis. Based on the threat level the risk poses, organizations can prioritize the risks by taking an integrated view of risks across different business segments.

3. Response

Now that the risk identification is complete, you need to develop a risk response program based on the prioritization of the risk identified. Determine your risk response and design the risk mitigation controls accordingly. You also need to have risk management teams and compliance functions in place so that there is no question of ownership when a critical situation arises.

4. Communication and Reporting

You have to establish a proper communication channel and escalation plan to keep the stakeholders, investors, board members, and other employees informed about the risk management plans, risk mitigation workflows, and responses.

This is crucial for promoting a risk-aware culture in the organization and enables you to take strategic decisions so that risk does not endanger your business goals.

5. Monitoring

To effectively manage the risks, you need to keep monitoring the business processes and risk metrics to ensure the smooth working of controls. It includes assessing the effectiveness of mitigation measures and reviewing the risk management processes regularly.

6. Technology

Technology is the most significant part of the IRM program’s scope. In this digital-powered age, organizations need a combination of risk management solutions, risk management platforms, and tools and software to manage and monitor risk effectively.

Hence to design and implement the IRM solution appropriately, you need to choose a suitable set of software solutions that support an IRM approach and enable your risk teams, such as a Compliance Automation platform, threat detection platforms, and more.

Importance of Integrated Risk Management

An integrated risk management framework helps establish long-term information security and risk planning. It ensures that the organization is comfortable dealing with potential risks and has effective mitigation strategies to manage risk.

Let’s outline a few points to understand the importance of IRM.

Better business opportunities and efficiencies:

With an integrated risk framework, you can identify and mitigate potential risks, which makes way for better decision-making and cost savings. You can find efficiencies during risk analysis and assessment exercises, which leads to finding unexplored areas and taking advantage of them for more business opportunities.

Also, employees will be more flexible in this approach, working together to improve cross-team relationships, opening the door for new and better opportunities in the organization.

Better risk identification and mitigation:

IRM plays a crucial role in providing holistic risk analysis and risk quantification, helping the decision-making process when it comes to any risk factor, and promoting a better understanding of risk.

The identification of risks and communication between business leaders and IT teams becomes streamlined. Organizations will be equipped to deal with adverse outcomes with better planning and varied inputs as all leaders have bought into mitigating risk for their process as a key functional responsibility.

Inculcating a risk-awareness culture:

Implementing an IRM approach helps build a more robust risk-awareness culture that keeps employees on the same page in maintaining an effective security posture. Organizations will then start viewing risk as a natural part of their operation and business strategy rather than an afterthought which is solely the responsibility of compliance and cyber security teams.

It also helps you map any regulatory compliance violation back to a function and ensure that organizational leaders see it as part of their KPI to mitigate risk.

Cost-effectiveness

By diving into the organization’s risk controls, IRM helps map individual control to multiple risk factors. This allows an understanding of business risks that hit different areas and their mitigation controls, and this can reduce costs due to compliance redundancies.

Also check out: Continuous monitoring guide

How to Implement an Integrated Risk Management Strategy

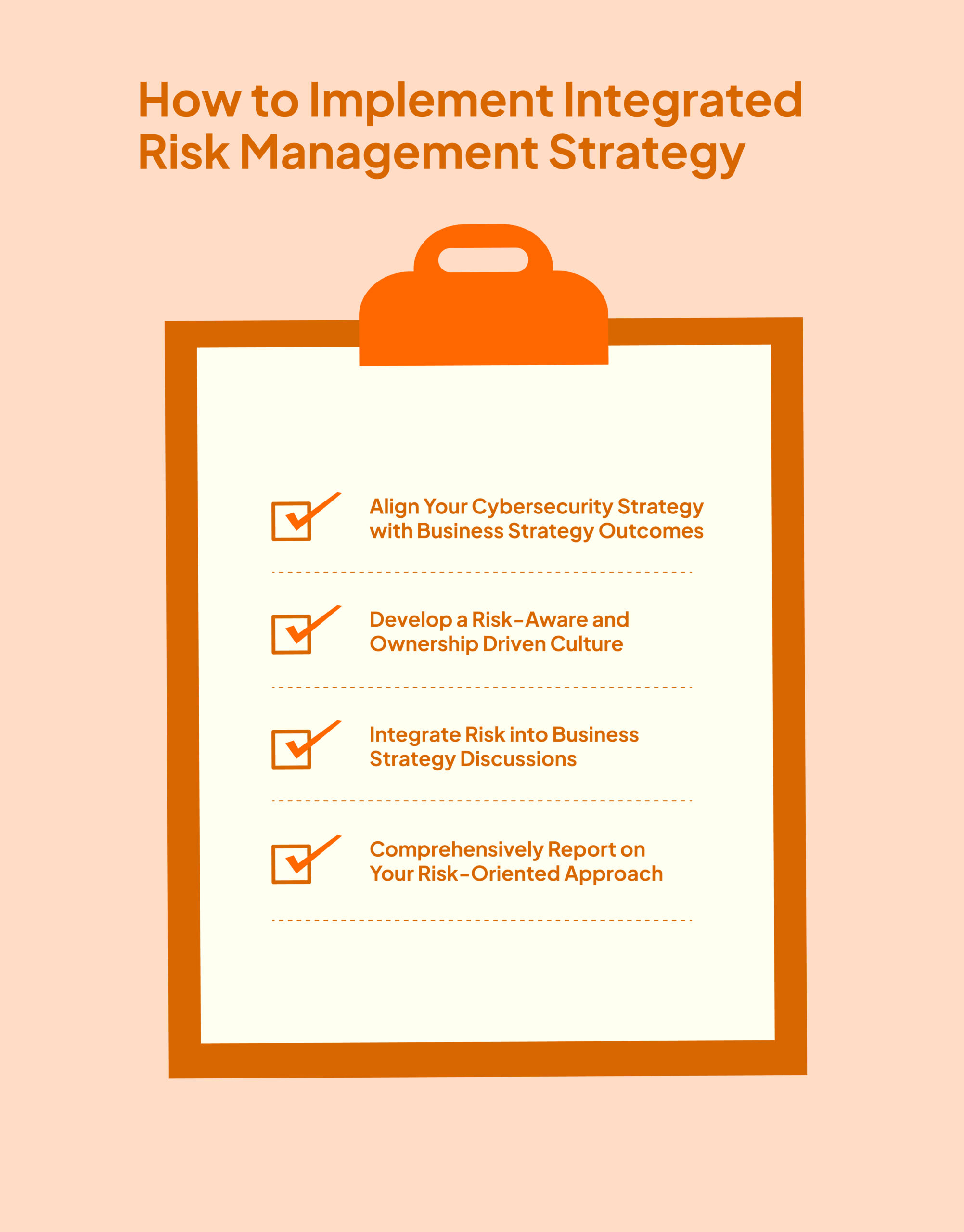

Once you have your IRM scope, implementing the IRM strategy won’t be daunting. You will have to follow the four fundamental steps to implement your IRM program.

1. Converge Business Strategy and Cybersecurity for Strategic Excellence

Simply put, your cybersecurity strategies and tactics need to be aligned with the business outcomes that stakeholders expect. You have to secure executive support to create a risk-aware environment in the organization.

For that, demonstrate how your IRM strategy matches the company’s vision. You can strategically bridge the gap between technical teams and stakeholders.

2. Develop a Risk-Aware and Ownership Driven Culture

A cultural shift is next on the cards for an org-wide accountability model when it comes to risk management. Rather than concentrating business risk and accountability into one Business Unit, there needs to be a push for a risk-aware and cybersecurity-oriented culture from the top management.

Business leaders and technical heads need to communicate the importance of integrated risk management to employees and stakeholders and chalk out a plan that involves the org and makes everyone’s roles and responsibilities apparent.

3. Elevate Business Strategy with Risk Consideration

As the IRM strategies are aligned with the business objectives, business leaders and stakeholders need to understand the link between business strategy and risk. Why so? Because when they make new business strategies or decisions, the organization’s risk profile might alter, and they need to consider the IRM approach with every new strategy.

4. Comprehensively Report on Your Risk-Oriented Approach

Reporting is crucial for any strategy. Set goal-based metrics to evaluate the performance and effectiveness of your IRM approach. This helps you understand whether your strategy works as intended, and you can communicate that to the stakeholders.

Reporting is generally automated with the help of integrated risk management software solutions. You can regularly review the different metrics with a live risk management dashboard. An automated solution also helps you identify new risks and concerns regarding compliance and regulations.

Also, check out: Guide to Risk mitigation strategies

Examples of Integrated Risk Management

Based on the organization’s goals and risk profiles, the IRM approach can vary from one organization to another. Some use cases/ examples of IRM implementation include:

Example 1: An organization planning to establish an enterprise-level risk management strategy will implement an IRM program that includes cybersecurity, physical security, and employee awareness to manage and mitigate risks.

Example 2: An organization looking to establish a crisis/disaster management strategy will implement a robust IRM program that lists the steps to take in the event of a disaster or a cybersecurity emergency.

Example 3: An organization focusing on business continuity will implement the IRM strategies that outline how the organization can maintain crucial business operations during a crisis/disaster.

The organization can implement multiple strategies for a holistic IRM approach. But, as the definitions suggest, no matter which strategies you implement, they will be practiced organization-wide to manage risks across the company effectively.

Difference between IRM and GRC approach

| Integrated Risk Management | Governance Risk and Compliance |

| Risk-oriented and proactive approach | Compliance-oriented and reactive approach |

| Organizations use this business-focused, forward-thinking risk management approach to get a bigger picture of risk and risk mitigation. | Organizations use this traditional, standard approach to align their business with industry regulations and compliance requirements. |

| The primary goal of an IRM approach is to help you identify and focus on all the unique risks while implementing a company-wide, risk-aware culture | The primary goal of a GRC model is to ensure that compliance needs are met. (Guide to GRC) |

Selecting the right stack for IRM

An integrated risk management approach can help you handle risks with ease while promoting a risk-aware culture in the organization. An effective IRM program stands on two pillars, the right strategy and the right tech stack.

We hope that the insights in this blog help you get started on defining and creating an IRM strategy that is right for your org, when it comes to the tech stack, choosing a Compliance Automation Tool with a strong risk module and automated evidence collection can help do a lot of the heavy lifting when it comes to implementing an IRM strategy.

If you need help implementing an IRM strategy for your team, we can help you automate up to 80% of the journey. Sprinto puts your compliance program on autopilot and allows you to monitor risk controls regularly. Get a demo to learn more about the Sprinto way of getting IRM ready!

FAQs

What are the elements of integrated risk management?

There are six elements of integrated risk management (IRM):

- Strategy

- Assessment

- Response

- Communication & Reporting

- Monitoring

- Technology

What is the difference between ERM and IRM?

The difference between Enterprise Risk Management (ERM) and Integrated Risk Management (IRM) is that ERM is a top-down approach focusing on risks involved in high-level business decisions, while IRM is a bottom-up approach that helps mitigate the threats that can arise during daily business operations.

Gowsika

Gowsika is an avid reader and storyteller who untangles the knotty world of compliance and cybersecurity with a dash of charming wit! While she’s not decoding cryptic compliance jargon, she’s oceanside, melody in ears, pondering life’s big (and small) questions. Your guide through cyber jungles, with a serene soul and a sharp pen!

Explore more

research & insights curated to help you earn a seat at the table.