A report by Bloomsberg states that companies are spending 6-10% of their revenue solely on compliance! Furthermore, over 50% of executives see cybercrime as a top five risk now and in the next three years, with concerns rising.

The above statistics are pieces of evidence that in the absence of compliance, you can lose money for your business and customer confidence. Are regulatory body’s requirements for compliance enough? No. You have to understand potential risks and how to approach them too.

Therefore, this article will delve into depth about compliance and risk management, their differences, and how you can manage both effectively with a holistic approach.

What is compliance?

Compliance is the process by which an organization consistently follows the rules, laws, and standards applicable to its business processes. It determines if a company abides by regulations set by national and international bodies.

Why is compliance important?

Compliance allows businesses to extend their reach into larger markets where they may target security-conscious customers. More trust can also be gained, and thus attract more mature clients.

Consequently, through being compliant an organization can minimize financial fines; and damage the brand’s reputation; among other things that come as a result of data breaches or non-compliance.

What is risk management?

Risk management is a continuous process that identifies evaluates controls and predicts potential threats or opportunities that could pose any danger to your business. It finds ways to mitigate such risks and shares knowledge about its impact on your organization.

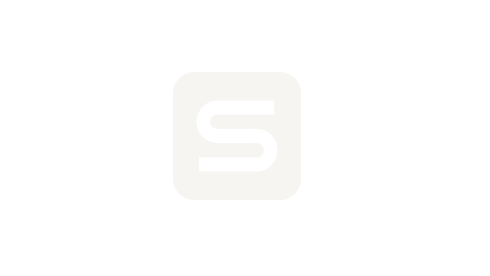

The process of risk management includes five key steps:

- Identify the risk

- Evaluate the risk

- Mitigate the risk

- Control the risk

- Monitor the risk

Why is risk management important?

Risk management is important for any company as it protects finances, keeps operations running smoothly, and safeguards your reputation. It works by predicting and analyzing risks for the future and identifies problems even before they occur.

Risk activities should be conducted throughout the lifecycle of any project in a business to find threats in their early stages and mitigate them.

What are the differences between compliance and risk management?

Let’s understand the fundamental differences between compliance and risk management with a table.

| Factor | Compliance | Risk Management |

| Focus | Adhere to established standards. | Identify, analyze, and mitigate future risks |

| Goal | Showcase trustworthiness to customers. | Mitigate and minimize the impact of future risks. |

| Scope | Particular: Pre-defined regulations | Broad: All possible risks |

| Strategic Approach | Reactive: response to updates | Proactive: preparing for future events |

| Timeframe | Prescribed | Predictive |

| Risk Tolerance | Risk-averse | Evaluates risk |

| Crisis Management | Limited (only legal aspects) | Central (minimizing impact) |

1. Compliance vs. Risk Management: Approach

While compliance follows external mandates and often triggers action only after requirements are defined, risk management prepares ahead — designing controls and safeguards even when no regulation demands it.

2. Compliance vs. Risk Management: Outcome

Compliance is about checking existing boxes to meet obligations. Whereas risk management is about building strategic resilience and competitive advantage by controlling potential vulnerabilities.

3. Compliance vs. Risk Management: Timeframe

The time required by a company to comply with a specific framework is usually prescribed and fixed beforehand in the given guidelines. The same is not true for risk management. The timeframe of a risk management process is mostly predictive and gives an approximate account.

4. Compliance vs. Risk Management: Risk Tolerance

Known as zero-risk in mindset, compliance does not engage with the idea of acceptable risk. Whereas, risk management sees risk as a spectrum. Some are tolerable, some need mitigation, and some present an opportunity.

5. Compliance vs. Risk Management: Crisis Management

While compliance can support crisis management from a legal defense angle, risk management owns the full scope. It coordinates people, processes, and resources to minimize damage and accelerate recovery.

Top 3 compliance management tools

Compliance management tools consist of software that helps organizations reach their compliance requirements through automated controls and dashboards. Furthermore, such tools help businesses maintain compliance through efficient workflows.

Here are the three best compliance tools:

1. Sprinto

Sprinto is a GRC automation tool that helps tech companies stay continuously compliant and complete security audits quickly and successfully. Built on a smart, scalable architecture, it helps businesses stay compliant at each growth phase. A few of the top features of Sprinto are:

- Dedicated auditor-friendly dashboard

- Integrated trust center

- Ready-to-use policy templates

- Built-in training modules for security

- 200+ Integrations

- Role-based compliance management

Continuous Compliance for 24/7 Peace of Mind

2. Auditboard

AuditBoard is a compliance automation platform designed to streamline and centralize various aspects of compliance management. It helps businesses with automated workflows and report generation to ensure consistency in compliance management.

The platform facilitates communication and collaboration between teams involved in compliance activities. This fosters transparency and allows for real-time tracking of progress on compliance goals.

3. Libryo

Libryo is a regulatory compliance management software that helps businesses understand what frameworks are necessary for a certain geographic location. It adheres to legal regulations and helps with faster management decisions.

The platform provides compliance training programs for the whole organization or specific departments. They also help with traditional on-site audits, remote audits, and area-specific audits.

Top 3 risk management tools

Risk management tools use automation and algorithms to identify risks, track them and their likelihood, and how severely they can affect your business. Since the cost of not tracking your risks is so high, having such a tool handy is a good option.

Here are the three best risk management tools:

1. Sprinto

Sprinto’s software is designed to streamline and strengthen your company’s risk management activities, especially in terms of information security risks.

Sprinto helps you stay ahead of security risks by analyzing your cloud environment and industry trends. It prioritizes threats, suggests solutions, and integrates compliance requirements, all to empower smarter security decisions.

It does not just tell you that there is a risk, but it also tells you how to tackle it and avert it from happening again. Plus, it is designed for companies of all sizes!

Comprehensive Risk Monitoring & Mitigation

2. Resolver

Resolver provides enterprise risk management with a comprehensive range of tools. It helps identify and assess risks and allows you to prioritize risks effectively. It also deals with incident management and helps identify any gaps present in your risk management framework.

As a bonus, take control of incidents with ease using our Sample Incident Management Policy Template.

Simplify incident response with our Sample Incident Management Policy Template

Resolver goes beyond basic risk management by providing advanced analytics. It helps you understand the interconnectedness of risks and identify emerging threats before they become major problems.

3. nTask

If you are a small team that is new to the concept of risk management, nTask can be a good option as it offers a more user-friendly approach to risk activities.

nTask makes risk management a team effort. It’s like a central hub where you can easily spot risks, assign risk owners, and track progress on solutions.

Unifying compliance and risk management

Compliance and risk management go hand in hand. In fact, compliance is a subset of risk management. It is usually more effective when organizations take a more holistic approach when dealing with these two entities.

Compliance deals with specific rules you must follow, while risk management looks at the bigger picture of anything that could harm your business. By following compliance rules, you’re automatically reducing certain risks.

A single shared platform for both

Having a single platform for both compliance and risk management frees you from data silos and allows you to have a more integrated approach. This saves time and effort for your business.

Generating compliance reports and risk reports on two different platforms would take double the time. But having them united could create a holistic view of your business allowing you to gain deeper insights.

Here’s some help: Cut out busy work for compliance and risk teams with Sprinto. Help your team focus on more important things while Sprinto takes over manual tasks with clear and well-organized assessments.

Stay Ahead with Automated Continuous Compliance

Bridging the gap

Compliance and risk management are like two sides of the same coin, both crucial for a healthy business strategy. However, while they work together, their approaches differ significantly.

By following compliance regulations, you automatically address certain risks. However, a strong risk management program goes beyond just ticking compliance boxes. It delves deeper to identify and address other potential threats that might not be explicitly covered by regulations.

The best approach combines both compliance and risk management. Having a robust compliance program ensures you’re operating within the legal boundaries. However, a forward-thinking risk management strategy takes it a step further, proactively protecting your business and creating a more secure foundation for future success.

Pansy

Pansy is an ISC2 Certified in Cybersecurity content marketer with a background in Computer Science engineering. Lately, she has been exploring the world of marketing through the lens of GRC (Governance, risk & compliance) with Sprinto. When she’s not working, she’s either deeply engrossed in political fiction or honing her culinary skills. You may also find her sunbathing on a beach or hiking through a dense forest.

Explore more

research & insights curated to help you earn a seat at the table.