As of 17 January 2025, potentially 50% of all organizations subject to DORA compliance in the EU and beyond have missed the deadline to comply with the Digital Operational Resilience Act (DORA). If your organization is still looking to achieve DORA certification, it’s high time! The clock is ticking, and the penalties might be climbing up faster.

Companies still playing catchup with DORA certification can lose up to 1% of their global daily revenue to fines and penalties for up to six months. The regulatory playing field is hot for businesses looking to enter the EU market.

So, let’s learn about DORA certification, who needs to comply with it, and what needs to be done to achieve it.

TL;DR:

| DORA Compliance Deadline Missed by Many – As of January 17, 2025, nearly 50% of organizations required to comply with the Digital Operational Resilience Act (DORA) have missed the deadline, risking fines of up to 1% of global daily revenue for six months. |

| Why DORA Matters – While not mandatory, DORA certification helps financial institutions prove compliance, strengthen cybersecurity resilience, standardize ICT security across the EU, and gain a competitive edge in the market. |

| Path to Compliance & Cost Implications – Achieving DORA compliance requires implementing ICT risk management, incident reporting, resilience testing, and vendor oversight. Large institutions may spend around €1 million over two years to become fully compliant. |

What is a DORA certification?

DORA certification is typically an attestation issued by external accredited auditors stating that your organization meets the regulatory standards of cybersecurity and third-party risk management set by the Digital Operation and Resilience Act. However, DORA certification is often also issued to individuals who pass DORA training. The main motive of the certification is to validate that an organization fulfills five principal requirements and that the individuals are trained to implement these principles.

Why is DORA certification required?

While the regulation issued by the EU doesn’t explicitly state that a third-party validation or certification is necessary, a certification helps prove that you comply with all the security requirements as a financial institution. Moreover, since the scope of DORA also covers third-party and fourth-party service providers, a certification from competent authorities helps businesses partner with businesses more efficiently. However, here are some detailed reasons why DORA compliance (often informally referred to as “DORA certification”) is essential:

1. Regulatory Compliance

DORA prescribes mandatory measures that financial institutions like banks, ICT providers, insurance firms, and investment firms must implement. While typically, organizations need to conduct internal audits and submit self-assessment reports, a certification by an accredited auditor offers an extra layer of protection against regulatory fines and penalties. A certificate also makes it easy to carry out business within the financial industry within the EU, even if your organization is not primarily based out of the EU but serves in the region.

2. Strengthening Cyber and ICT Resilience

DORA is designed from the ground up to ensure enhanced protection against threats unique to financial institutions. It enforces strict ICT risk management frameworks, incident reporting, penetration testing, and third-party risk management. Complying with DORA makes the assets, infrastructure, processes, and cloud systems more resilient to cyber threats that exploit vulnerabilities in vendor systems to gradually compromise partner networks and ecosystems.

3. Standardization Across the EU

As DORA standardizes ICT security standards across the financial industry, it curbs fragmentation and ensures a unified risk-based approach to managing ICT threats. This helps businesses to move faster without compromising on resilience.

4. Mandatory Testing and Incident Reporting

As DORA mandates risk assessments and incident reporting, it helps financial institutions adapt disciplined practices and foster a culture of cybersecurity. Reporting incidents also enables timely containment of the issue, enabling companies to minimize damage or disruptions, significantly improving long-term operational efficiency.

5. Competitive Advantage & Market Trust

DORA compliance gives you a real edge in the market. When clients and partners see you’ve met these standards, it shows you take cybersecurity seriously. This builds trust and can open doors to new business opportunities that might otherwise stay closed.

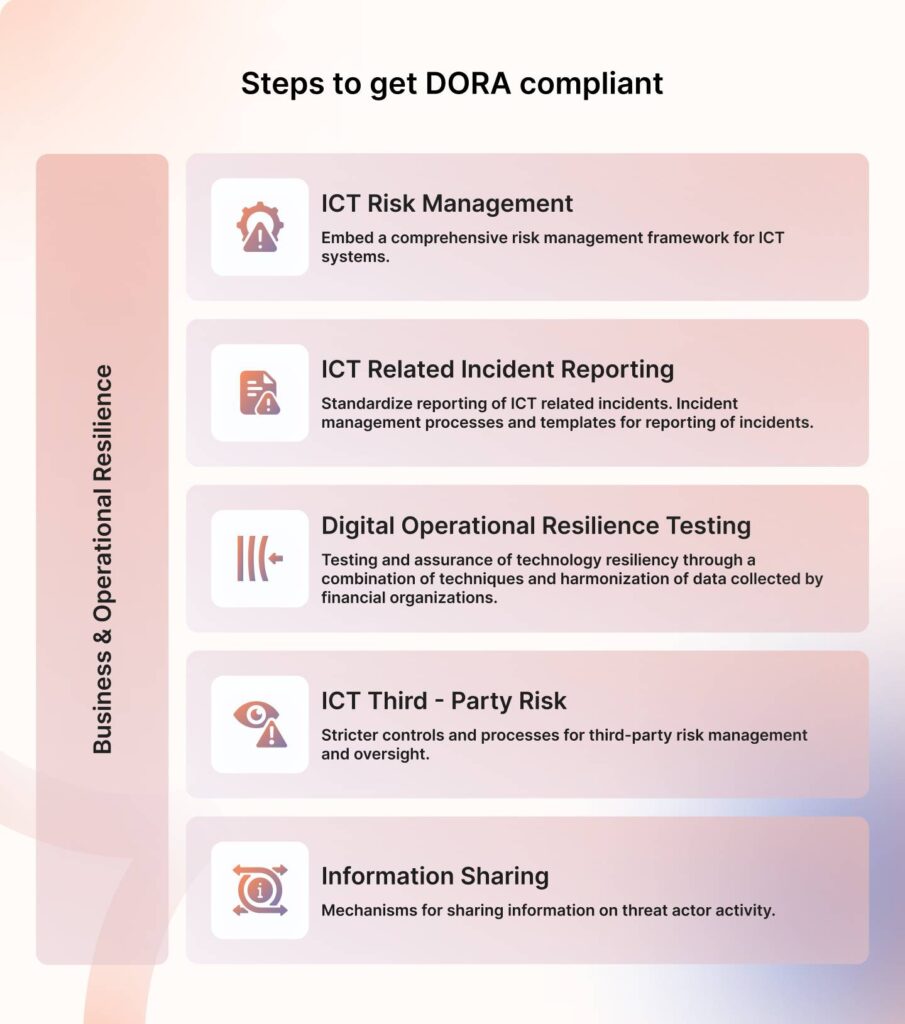

Steps to get DORA certification

Getting DORA compliant involves identifying regulatory requirements, assessing risks, implementing controls, testing resilience, and ensuring continuous monitoring and reporting.

Here’s an overview of the steps to get your DORA certification:

Now that you have a clear overview, let’s dive deeper into each step to navigate DORA compliance effectively.

1) ICT Risk management

A comprehensive risk management program revolves around aspects like ensuring the protection of assets and cloud systems, detecting and reporting threats, implementing measures to neutralize and contain threats, and documenting the lessons learned to make your practice more resilient.

This framework is integral to maintaining the security and stability of financial services within the European Union.

Here are key steps to Implement ICT Risk Management under DORA:

1. Establish a solid foundation for managing and mitigating risks:

Resilience is a team sport, and policies, governance, and oversight unite the entire team to set foundational practices that will define the organization’s resilience tomorrow. Think of it like:

- Strategies and Policies: Well-defined and far-sighted policies address all the objectives and guidelines to manage ICT risks.

- Deploy ICT protocols and tools: Tools and protocols reduce the chances of human error while also improving overall efficiency.

2. Federate accountability

By federating accountability, security becomes a shared responsibility, embedding resilience across every business function. Here’s how to make that happen:

- Designate a control function: Assign a primary function to absorb the responsibility of controls guided by the policies. This function can work with a certain degree of independence to resolve conflicts and enforce the set guardrails.

- Ensure clear boundaries between duties: Keep your risk management teams, control functions, and internal auditors in separate lanes. This is like having checks and balances—each group needs to do its job without stepping on each other’s toes. This separation helps ensure everyone can work objectively, and no one’s trying to grade their homework.

3) Document and conduct annual reviews:

Keep good records of your risk management system – consider it a detailed maintenance log for your car. You want to document all your strategies, tools, and processes thoroughly. Then, make it a habit to give everything a deep review at least once a year, like an annual pulse check of your security practices.

4)Foster clear communication between stakeholders:

Ensuring stakeholder alignment is critical for effective risk and cybersecurity management as, ultimately, every security initiative needs to tie to the overall business strategy. So, identify your organization’s risk appetite and tolerance, communicate it across the board, enable employees to understand policies properly, and outline action plans to implement them.

2) Incident reporting in hours

Incident reporting in DORA isn’t just a compliance checkbox—it’s a strategic weapon against operational disruption and chaos. It serves three key purposes:

- Business accountability: Financial institutions must actively monitor, contain, and resolve threats before they escalate into significant disruptions.

- Trust and security: Ensuring businesses only partner with resilient vendors minimizes the risk of threats spreading through third-party networks.

- Industry-wide resilience: The ultimate goal is to create a financial sector that can withstand disruptions and recover quickly.

DORA sets one of the strictest standards for incident management and reporting. Here’s what it requires:

- Major ICT-related incidents must be reported within 24 hours of discovery.

- An intermediate report with further details must be submitted within 72 hours of the initial notification.

- A final report, including a full resolution plan and key lessons learned from the incident, is mandatory.

3) Implement resilience testing

DORA mandates organizations to prove their resilience by attesting the results of periodic penetration testing in self-assessments. Thus, a testing program is built to leverage various penetration testing methodologies to identify different kinds of attack vectors and vulnerabilities in the system.

Here are a few effective pen-testing methods you can use:

- Threat Intelligence Integration: Operationalize up-to-date threat intelligence to emulate genuine threat actors’ tactics, techniques, and procedures (TTPs). This way, your system vulnerabilities get explored under different scenarios, giving you a fair idea of which controls to implement, what policies to enforce, and what containment measures to plan.

- Comprehensive Attack Simulation: Not all attacks are equal; some have attack vectors that escalate with human input triggers, adjacent networks, and even social engineering. Pen-testing for such cases enables organizations to pinpoint exactly what makes them vulnerable and why.

- Implement threat-led penetration testing (TLPT): Methods like threat-led Penetration Testing (TLPT) are a cornerstone requirement for DORA certification as they validate the results of the resilience tests. TLPT simulates real-world attacks with real-world complexities and records how different parts of the organizations fare against the set benchmarks. It usually follows active exploits’ TTPs (tactics, techniques, and procedures), making it more relevant for financial institutions.

4) Tighten third-party vendor management practices

DORA certification demands tighter compliance requirements for vendors across the supply chain, which means that the puck doesn’t stop at third-party vendors but expands to fourth and fifth parties. Thus, it asks for an organization to:

- Comprehensive supply chain mapping: Here, organizations are advised to clearly identify the assets that vendors can access and risk vectors that can come from third-party vendors, fourth parties, and beyond. This typically requires a deep understanding of the entire supply chain.

- Continuous monitoring and vendor testing: Companies need to set up controls to ensure any anomalies in suppliers’ security posture are flagged promptly and mitigation workflows are triggered timely. This approach offers more comprehensive coverage than periodic assessments, which only showcase point-in-time security posture.

- Enhanced Contractual Obligations: When working with vendors and service providers, make sure your contracts clearly state they must follow DORA’s security requirements. Think of this as extending your security standards throughout your supply chain—everyone needs to be on the same page about keeping things secure and resilient.

5) Information and intelligence-sharing guidelines

Financial institutions can better protect themselves and others by sharing what they know about cyber threats. Everyone benefits when banks and other firms share threat intelligence, revealing attempted breaches, successful attack vectors, and defense strategies. The DORA certification makes sharing information one of its core principles – the fifth pillar. The idea is simple: if one institution learns how to stop a particular attack, sharing that knowledge helps protect the entire financial system. This team approach means the industry can develop better security measures more quickly than if each institution worked alone.

How much does a DORA certification cost?

DORA certification isn’t just a checkbox activity—it’s a significant financial commitment for the organization. You would need to spend time and money on training and certification, build resilience infrastructure, purchase compliance automation tools, and invest in third-party risk management tools.

Moreover, the cost of your DORA certification can vary depending on factors like the size of your company. Large institutions are estimated to spend around €1 million over two years to become DORA certification-ready.

However, if you need to estimate the cost to get your company DORA certified, then here are factors you would want to consider:

- Infrastructure Upgrades: Maintaining DORA certification requires continuous monitoring tools, incident response systems, and cloud infrastructure risk management solutions, all of which can add up to costs.

- Operational Resilience Testing: You must constantly test for weaknesses through penetration tests and vulnerability scans. This takes real commitment – both in terms of money and people. Thus, investing in the right tools, bringing in testing services, and having skilled staff who can handle this ongoing work adds up to way more than companies estimate in terms of cost.

- Workforce Expansion and Training: For DORA certifications, organizations must build compliance teams, appoint officers, and train executives to meet DORA’s regulatory demands and avoid costly missteps. Hiring senior staff with knowledge of DORA can be costly, costing companies anywhere from 500k to a million Euros in a year.

- Third-Party Risk Management: ICT third-party service providers must ensure their vendors meet DORA’s resilience standards, requiring constant oversight, contractual safeguards, and risk assessments.

- Regulatory Fees: Critical ICT service providers must pay oversight fees, starting at €50,000, adding another layer of compliance costs.

Sprinto can help all financial entities comply with DORA faster

Sprinto fast-tracks your DORA compliance with three core features: continuous control monitoring, implementing the Secure Controls Framework, and automatic evidence collection. You only have to integrate Sprinto into your environment, cloud systems, and assets, and Sprinto provides you with a ready-to-launch compliance program that includes policy templates, pre-mapped controls to criteria, and much more.

Our implementation partners can help you identify the proper controls required for DORA, cutting down your time to being compliant. These experts assess your infrastructure, processes, and policies to design right-sized controls that align with DORA’s requirements.

Sprinto transforms these controls into actionable tasks, automating compliance checks to ensure real-time monitoring while minimizing manual effort.

However, If you already adhere to other cybersecurity standards like SOC 2 or ISO 27001, Sprinto’s Common Control Framework (CCF) streamlines compliance by identifying overlaps, eliminating redundant work, and accelerating your DORA readiness.

Get DORA compliant faster with automation

FAQs

What are the penalties for DORA?

DORA violations can be costly. Financial institutions face fines up to 2% of global annual turnover, with individual employees risking €1 million in penalties. Tech service providers face even steeper consequences – up to €5 million in fines and potential operational suspensions. Individual workers at these firms could be fined up to €500,000. These penalties protect against both financial and reputational damage.

What is TPRM under DORA certification?

Third-party risk management (TPRM) under DORA involves ongoing oversight and control of critical vendors—those handling sensitive data or operating essential systems. It requires rigorous background checks, regular security audits, and real-time monitoring. Instead of annual reviews, DORA mandates continuous monitoring, ensuring rapid detection and response to issues. Additionally, clear plans must be in place for accountability, problem resolution, and contingencies if a vendor fails to deliver, making TPRM a proactive and resilient approach to vendor risk.

Who does DORA certification apply to?

DORA applies to all financial sector entities. Also, critical third-party providers (CTPPs) offering ICT services to these entities are included and will be subject to an EU oversight framework.

Can individuals get a DORA certification?

Yes, individuals can obtain DORA (Digital Operational Resilience Act) certification through various training programs designed to equip professionals with the necessary knowledge and skills for compliance. Professionals can attend training and take online exams to receive their accreditation. Here are some notable training providers:

Virgil

Virgil is a marketer at Sprinto who combines his media savvy with his cybersecurity expertise to craft content that truly resonates. Known for simplifying complex cybersecurity and GRC topics, he brings technical depth and a storyteller’s touch to his work. When he’s not busy writing, he’s likely exploring the latest in cybersecurity trends, debating geopolitics, or unwinding with a good cup of coffee.

Explore more

research & insights curated to help you earn a seat at the table.