Sprinto for Fintech

Sprinto guarantees compliance so you can guarantee resilience

De-risk regulatory compliance by turning complex obligations into actionable tasks. On Sprinto controls, policies, tasks, and workflows are automated for speed and accuracy, enabling fintech orgs to close the compliance loop, stay audit-ready, and meet obligations with confidence.

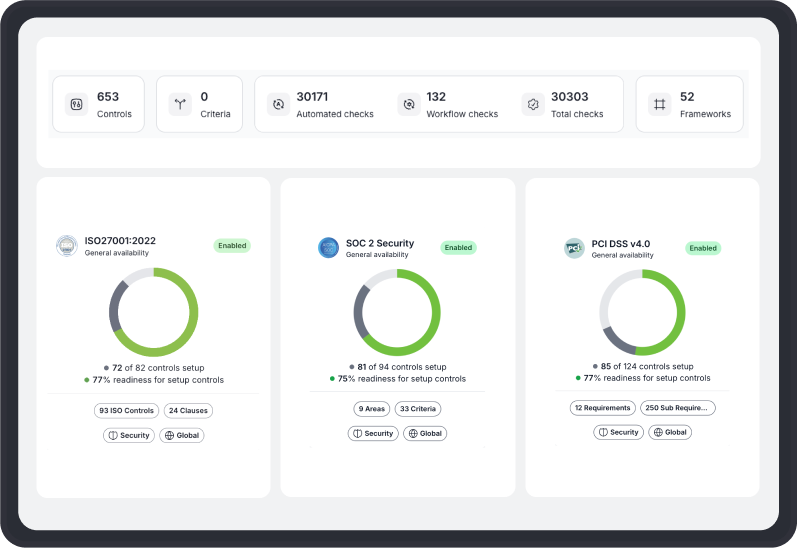

Out-of-the-box programs for PCI-DSS, SOC 2, ISO 27001, and more

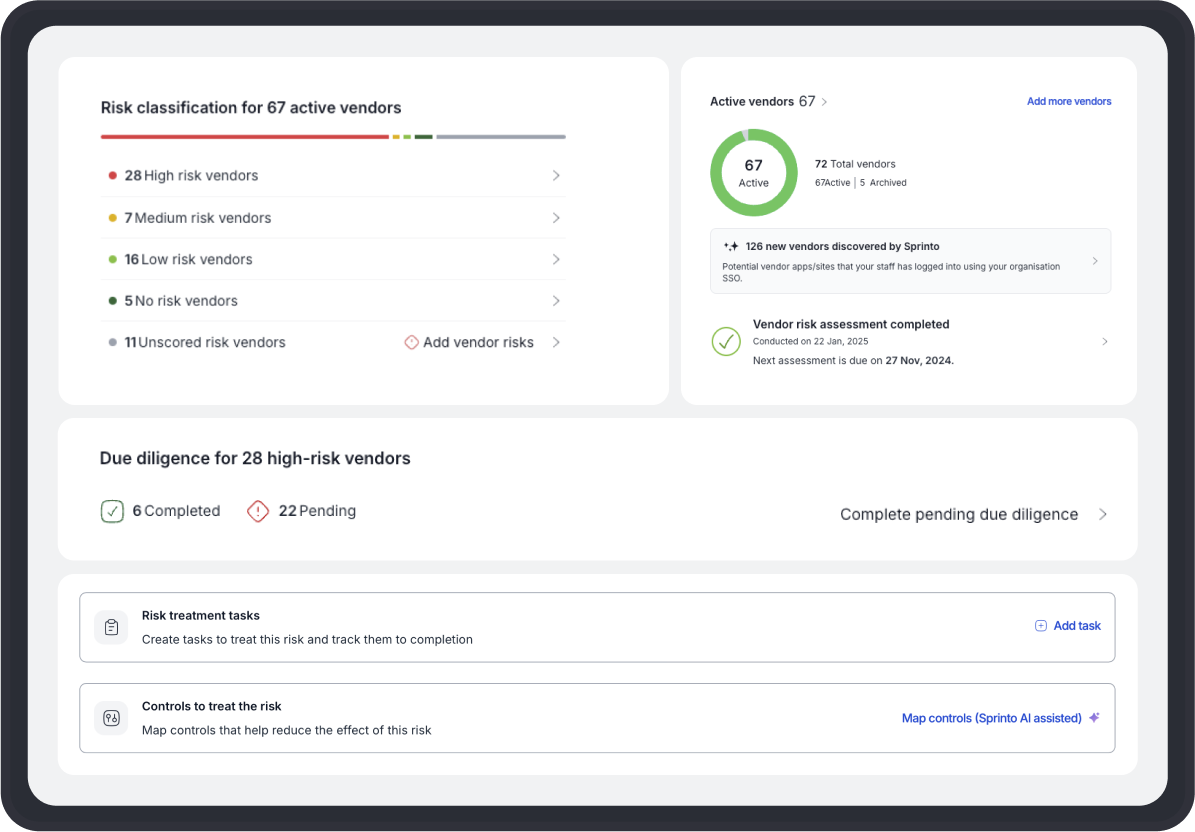

AI-enabled internal and third-party risk management

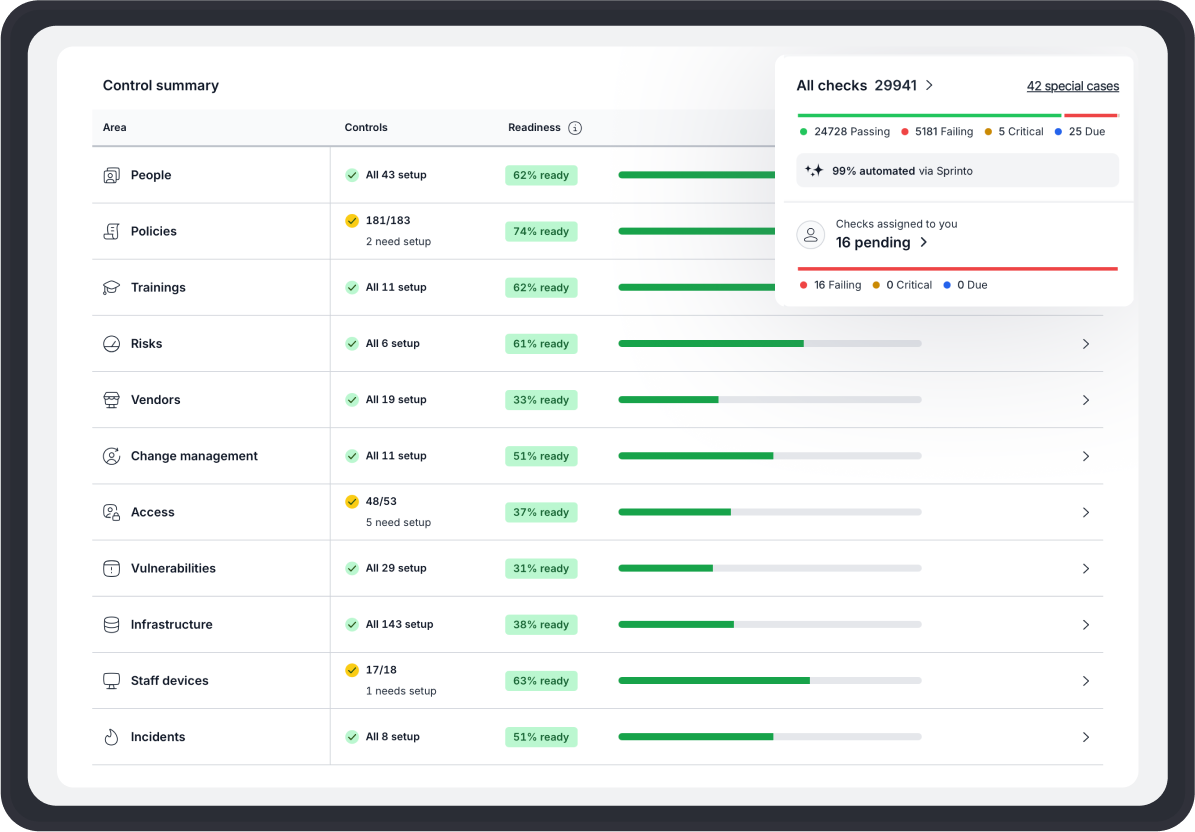

Automated risk, compliance, and asset monitoring

Hardwire compliance and win trust

Staying relevant in a volatile fintech ecosystem means moving away from bulky processes and reactive compliance, and embedding resilience at every level. Sprinto connects people, processes, and technology with compliance programs, enabling you to execute and track compliance across frameworks – from one place. With modules for asset, risk, and audit management to turn obligations into a plan of action, Sprinto puts you on the fast-track to winning trust.Cover all regulatory bases from the jump

Sprinto’s in-built controls, policy and training modules, and risk register provide everything you need for a running start to fintech compliance. Launch security programs for standard frameworks (ISO 27001, SOC 2, NIST-CSF, PCI-DSS) out-of-the-box and get the regulatory coverage you need pronto.

Stay risk-ready with built-in resilience

Manage internal and vendor risks intelligently, contextually, and in one place. Lean on Sprinto’s AI to connect risks with the right controls, score risks on a customizable scale aligned with industry benchmarks, and assign tasks directly on Sprinto for decentralized risk treatment.

Leave infosec housekeeping to the platform

Sprinto’s cloud-native integrations instantly link your assets to pre-set controls and inventory them for continuous monitoring and automated evidence collection. With controls to track policies, training, risks, and incidents – you focus on the big picture and leave busywork to the platform.

Features to build, scale, and customize fintech compliance

Utilize Sprinto’s pre-built controls to launch 80+ compliance programs right off the bat. Add on regulatory frameworks with effortless compliance crosswalks, and create custom controls and checks, or tag them to pre-existing workflows as needed.

Raise the bar with Sprinto

Sprinto ensures that you’re able to navigate and adapt to a changing risk and regulatory landscape without disruptions by building visibility and connectivity into how you manage fintech compliances.

CellPoint Digital fast-tracks PCI-DSS compliance on Sprinto

Learn how CellPoint Digital brought visibility, structure, and automation to compliance and aced PCI-DSS.