This blog is part of Sprinto’s GRC Top Voice series — where we bring you candid conversations with GRC Leaders.

Watch the full episode here →

Every organization wants to be data-driven. Yet in many boardrooms, risk discussions still sound vague: “That’s a high risk,” “This one’s medium,” and so on.

The problem? That kind of labeling doesn’t drive action. It doesn’t indicate who should decide, what trade-offs exist, or how a risk relates to business goals.

Joseph Haske, Risk Manager at Pipedrive, saw this gap firsthand. When he joined, the company relied on spreadsheets and annual reviews. “We used to tag something as high, medium, or low and move on,” he says. “But those labels didn’t actually help anyone make a decision.”

Risk ratings are only helpful when they encode business impact and trigger the right owner. That realization shaped a better approach. This blog unpacks that shift and shows how impact-based risk thinking helps teams turn subjective risk ratings into clear, accountable decisions.

From Describing Risk to Driving Business Impact

Traditional qualitative methods have long been criticized for being subjective and detached from business reality. Two people could assess the same risk and end up with different colors on the chart.

“It’s not that qualitative assessment is bad,” Joseph explains. “It’s that we use it wrong. We treat it as a verdict instead of a signal.”

In his model, a risk rating triggers decision authority:

- High = executive approval required

- Medium = department-level approval

“I stopped thinking of risk scores as ratings,” he says. “They’re decisions waiting to be made.”

When assessments map to who decides and why, based on projected impact on revenue, timelines, or trust, teams stop debating colors and start clarifying accountability. “It’s easier to get people on board,” Joseph adds. “It’s no longer personal judgment, it’s business structure.”

The 2025 Deloitte Risk Management Survey found that 82% of leaders use risk appetite statements to define levels of decision authority, turning appetite into action and linking risk ratings directly to accountability.

While this sounds like a small linguistic shift, it has had a significant impact: risk ratings now tell people who owns the choice, not just how serious something sounds.

Here’s a side-by-side comparison of how descriptive vs decision-based risk thinking differ in practice:

| Label-First Approach | Impact-First Approach |

| Labeling risk as high/medium/low | Defining ownerships (manager, CISO, exec) |

| Vague description | Focusing on business impact and accountability |

| Subjective and open to debate | Objective and tied to governance thresholds |

| Static snapshots | Integrated into live decision workflows |

Making Qualitative Risk Actionable

If you’re still using red-yellow-green charts, here’s how to make qualitative risk genuinely useful inside your organization.

1. Speak the language of the business

Instead of tagging a vulnerability as “high risk,” explain why it matters:

- “If left unpatched, this could impact our Q4 product launch.”

- “This exposure could delay a $2 million customer deal.”

“Executives don’t react to colors,” Joseph says. “They react to consequences.” Stakeholders listen when you frame risks in business terms, such as revenue, timelines, and customer trust. According to the FAIR Institute’s 2025 World Economic Forum Global Cybersecurity Outlook, effective CISOs view cyberthreats as business risks rather than purely technical challenges.

By contextualizing cyber incidents in terms of business continuity, reputation, and financial impact, they enable CEOs and boards to view cybersecurity as part of the broader risk landscape.

2. Pair intuition with data

Qualitative doesn’t mean guesswork. Support intuition with data-driven context, such as potential loss ranges, likelihood estimates, or control health scores. “You don’t need a Monte Carlo simulation,” Joseph notes. “You just need enough context to make the next right call.”

Your register might read: High risk (~$5 million potential loss; 20% likelihood; requires CFO approval). That small detail bridges perception and proof, building trust with leadership.

The 2024 Delinea “Aligning Cybersecurity and Business Goals” survey found that leaders who integrate business risk into security decisions see 30-40% higher business stakeholder buy-in and alignment compared to those who rely solely on technical metrics.

3. Embed risk appetite into everyday workflows

Tie qualitative thresholds directly to governance triggers. “Once people know exactly when to escalate,” Joseph says, “risk management becomes part of how the business runs, not an afterthought.”

For example:

- If an issue exceeds appetite, it automatically routes to the CISO

- If within appetite, it stays with the team lead

This clarity speeds decisions, especially in mid-market companies with lean teams but growing exposure.

4. Surface trade-offs transparently

Every risk decision carries a trade-off. Instead of hiding that, make it explicit. For example: “Fixing this vulnerability will delay feature launch by two weeks but reduce exposure by 40%.”

When leaders see impact and opportunity cost, decisions become less about emotion and more about informed prioritization. That transparency also helps CISOs position security as a business enabler rather than a blocker.

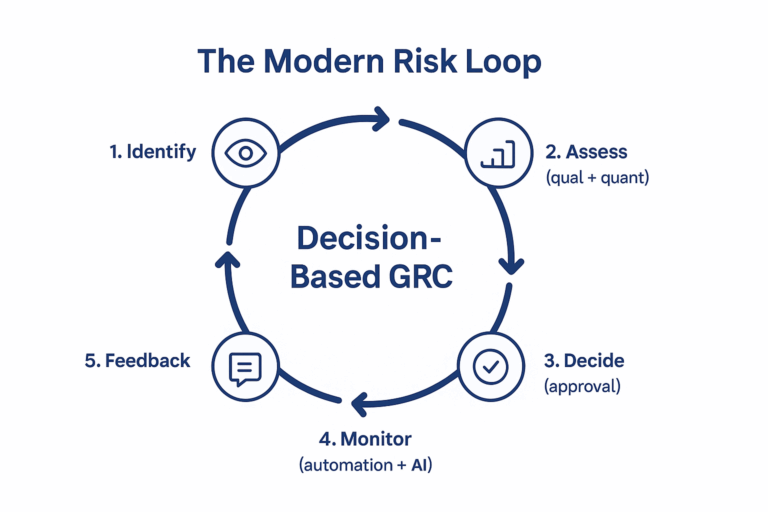

The Modern Risk Loop: Continuous, Contextual, Connected

Risk management is no longer a quarterly exercise; it’s a continuous proces that’s data-fed and dynamic. Modern GRC platforms integrate automation, monitoring, and AI, ensuring risk remains current.

For example, Etihad Airways’ Flight Deck app visualizes operational and risk metrics in real time. Similarly, Pipedrive aggregates qualitative insights across departments to create a live risk picture. These examples highlight a simple truth: risk today is a living system, not a static report.

But automation is what makes this evolution scalable. Platforms like Sprinto embed decision-based logic into everyday operations:

- Controls are continuously tested, and drift is automatically flagged.

- Risk thresholds trigger workflows for review or escalation.

- AI-powered evidence collection ensures every action is audit-ready.

This automation keeps programs responsive without adding manual overhead. “Once you build a program that runs on context, not checklists,” Joseph reflects, “you realize risk management never really ends, it just keeps improving.”

As AI matures, its role is clearer—not to replace human judgment but to augment it. Machine learning models can simulate cyber events, identify cascading risks, and predict the most effective mitigation sequence. “AI can’t understand all the business nuances,” Joseph says, “but it can help us test scenarios faster.”

That’s the future of GRC based on business-impact, where people steer intent, automation drives scale, and intelligence keeps decisions improving over time.

From Risk Reporting to Risk Leadership

This shift from measurement to meaning marks the next stage of GRC maturity. It’s not just about how risk is tracked. It’s also about who makes decisions and on what basis. When qualitative risk analysis maps directly to decision authority, it stops being a reporting task and becomes a leadership function.

“If a risk assessment doesn’t tell someone what to do,” Joseph says, “it’s just decoration. If it clarifies who decides, it becomes governance in action.”

At Sprinto, we see this transformation every day. Decision-based frameworks built into automated workflows help security and compliance leaders:

- Move from reactive audits to proactive control

- Track accountability across teams and systems

- Build confidence in decisions backed by real-time data

Looking ahead, decision-based GRC will only become more adaptive. Dynamic thresholds, AI-assisted risk modeling, and real-time policy updates will allow organizations to make smarter, context-aware decisions, not just compliant ones.

The organizations that master this reframing will not only manage risk better but also make better decisions faster.

Watch the full episode on our GRC Top Voice series here.

Sriya

Sriya is a strategic content marketer with 5+ years of experience in B2B SaaS, helping early- and growth-stage companies build and scale content engines from scratch. She specializes in long-form storytelling, thought leadership, and content systems that grow traffic and drive pipeline. Passionate about solving messy, early-stage challenges, she loves figuring out what to build, how to say it, and who it’s for.

Explore more

research & insights curated to help you earn a seat at the table.