Risk Management in 2025: How to Simplify and Mitigate Infosec Risks

Companies get complex over time and are not simple. 2025 and the years previous have been among the most momentous for business, featuring not only global pandemics but also tense geopolitical events and disruptive technologies (Gen AI and high-performing ML models) with far-reaching consequences.

The effect of these events and the continuously morphing risk landscape on how organizations keep up with risks has been, luckily, predictable.

Nearly 83% of businesses say that complex, interconnected risks are emerging more rapidly, and 72% say that their risk management capabilities have not kept pace.

Due to most businesses now operating in multiple sectors and forming adjacent partnerships, organizations are now seeing risks cut across sectors, with 81% of businesses saying that cross-sector risks now affect their business.

The increasing complexity of risks also affects how organizations manage threats associated with well-established technology – 56% of risk professionals say that they aren’t confident about managing their cloud risks.

The question of how to manage a rapidly changing, complex system like the risk environment has a deceptively simple answer: contextualize your risks, figure out how big these risks are, and be proactive about controlling them.

Much like a deeply interconnected ecosystem can be modeled after simple predator-prey or parent-child relationships, risks can be effectively managed simply by understanding the source, assessing severity, quantifying impact, right-sizing liabilities, and monitoring risks continuously. The question of operationalizing risk management protocols hence becomes a question of assessment, quantification, and tracking.

Traditional risk management lacks context

The classical way of managing risks – any risk, including cyber – involves organizations approaching the task as a point-in-time activity, armed with a list of risk scenarios and common mitigation strategies.

But without a means to update risk registers and contextually assess emerging risks, you end up playing catchup, often reacting to risks hastily and a little too late instead of responding in a measured manner.

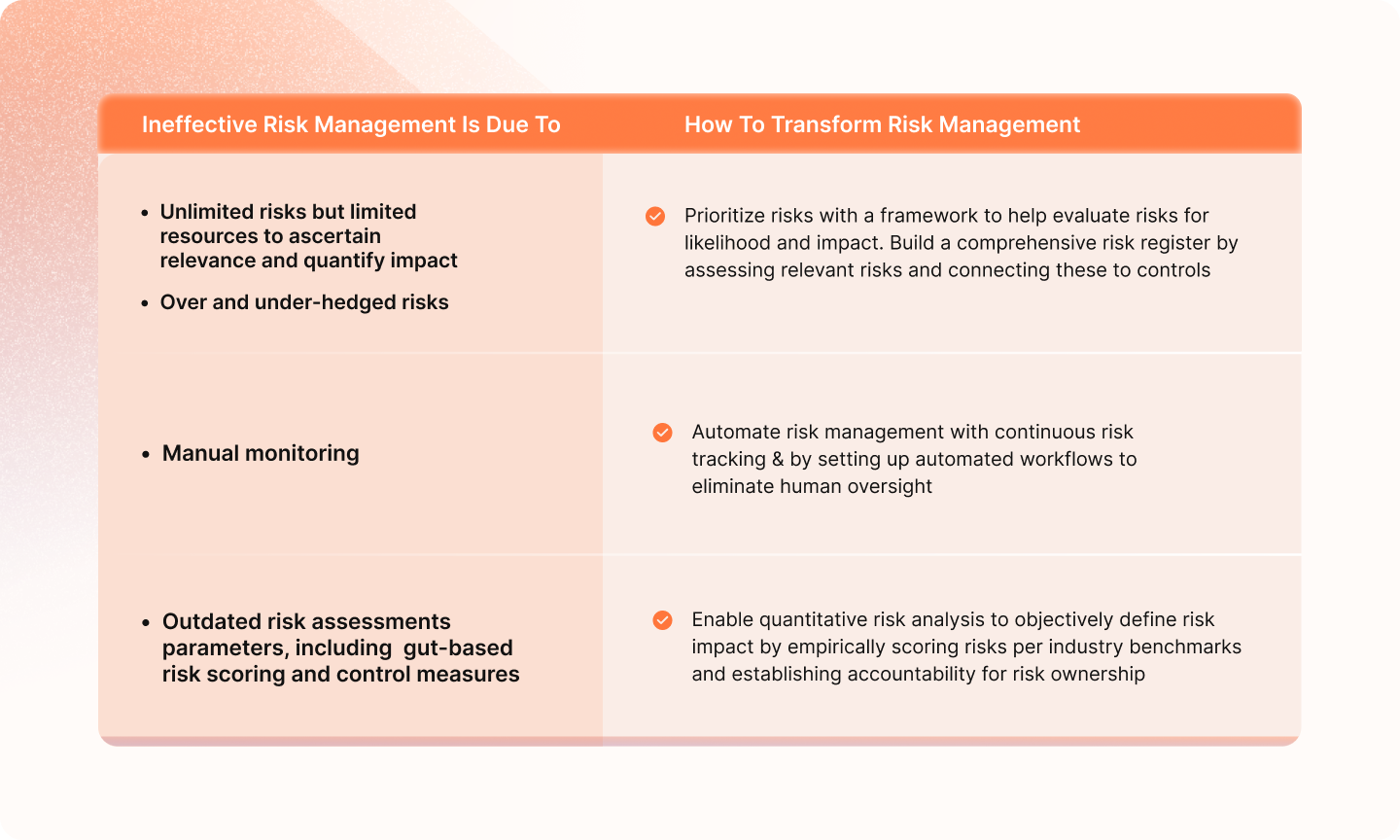

The traditional method of how to manage risk management functions fails due to a number of additional reasons.

1. Broad-brush approach

Comprehensive risk management requires an equally comprehensive view of risks. However, squaring a seemingly endless barrage of risks with limited time, resources, and budgets is a major challenge.

This often forces organizations to either assume all risks are equally important or overestimate the importance of a few, leading to over and under-hedged risks.

The consequence: poor risk assessment, increased susceptibility to threats, and possible audit failure.

2. False sense of security

In a continuously evolving landscape where growth is fast and threats constantly multiply, relying on periodic risk assessments is ineffective at best.

Point-in-time risk management coupled with manual risk assessment techniques creates a false sense of security.

It allows risks to fall through the gaps and fails to deliver the necessary depth and context required to uncover vulnerabilities on time.

3. Illusion of control

Traditional risk management stops at producing a list of risks, scenarios, and mitigation techniques.

But just ticking off-line items in your mitigation strategy doesn’t guarantee effective risk management.

Instead, organizations need to be able to assess and mitigate risks on an ongoing basis.

4 Essentials to subtract chaos from risk management

Effective risk management in an evolving landscape requires that organizations get their risks right and know how to manage their risk management function.

Getting risks right is no easy task – it entails having a framework to help measure risk, the right kind of assessment mechanism, the right set of controls and checks, and embedding the right set of day-to-day behaviors conducive to keeping risks in check.

Orgs can reduce chaos in infosec risk management by adopting a data-informed, dynamic, and collaborative approach that prioritizes risk based on likelihood and impact, uses automation for continuous monitoring, and fosters a culture of shared responsibility.

The essentials required to build agile and effective risk management that can keep chaos and complexity in check are:

1. A true risk inventory

A comprehensive inventory of assets and related risks with objective scoring linked to relevant controls.

2. Clear ownership

Transparent ownership of risks and related actions to deliver a crystal clear picture of organization-wide risks.

3. Compliance-aligned controls

Implementing risk management controls aligned with compliance best practices to cover all security bases and build a robust foundation for risk management

4. Continuous risk tracking

24×7 automated risk monitoring to track the impact of risks on compliance on an ongoing basis.

With these risk management essentials in place, organizations can take on any infosec risk and manage risk management with confidence.

How to effectively manage risks on Sprinto

Sprinto is a comprehensive risk monitoring and control management platform. Its built in frameworks help rigorously interpret risks, calculate their impact with precision, map controls, and track risks continuously to build resilience. This helps organization get a strong handle on how to manage risk management protocols.

Apart from providing all the essentials for building a responsive risk management program, Sprinto empowers organizations to make risks clear, granular, and tangible.

1. Ensure healthy risk thresholds

The gamut of (infosec) risks can be consolidated on Sprinto along with assets that bear these risks. With risks corralled in one place, the platform supports empirical risk assessment of likelihood, severity, preparedness, and impact.

This helps organizations establish a risk threshold with confidence and then adjust risk tolerance levels based on how the business and landscape evolve.

2. Build a vivid risk profile

Sprinto helps produce a high-definition picture of infosec risks and controls, including those associated with processes, policies, and systems. This helps teams cut the noise and ensure clarity and transparency in risk reporting.

3. Go beyond bookkeeping

Sprinto goes beyond helping identify risks by empowering organizations to assess risk, implement controls, and track risks and associated controls in real-time, and directing stakeholders on how to fix failing controls.

This helps cultivate risk consciousness, drive continued and focused efforts related to containing risks, and prevent potential flare-ups.

Manage and mitigate risks with ease

How Sprinto brings precision to risk management

Modern risk management requires organizations to zero in on risks that are impactful, evaluate these risks according to industry benchmarks, and track their status proactively to avoid last-minute surprises.

Sprinto provides the essentials required to get risk management off the ground and the capabilities necessary to bring precision and accuracy to how to manage risk management.

- The platform’s cloud-native integrations produce a comprehensive asset inventory with capabilities to help identify associated risks. Supported by an up-to-date risk register and trusted industry risk benchmarks, the platform helps map and assess risks with precision and intention, and not just intuition.

- Sprinto’s in-built controls library automatically maps relevant controls to identified risks, streamlining the process and ensuring you have the right safeguards in place.consequently enabling the platform to collect evidence and accurately flag misconfigurations and vulnerabilities.

- Sprinto additionally allows organizations to bring accountability and transparency by assigning clear ownership of risks and their corresponding controls to relevant roles to ensure everyone’s on a level about their role in risk mitigation. The platform runs 24×7 checks on assets and risk-linked controls to ensure that there are no surprises by sounding context-rich, time-bound alerts to risk owners.

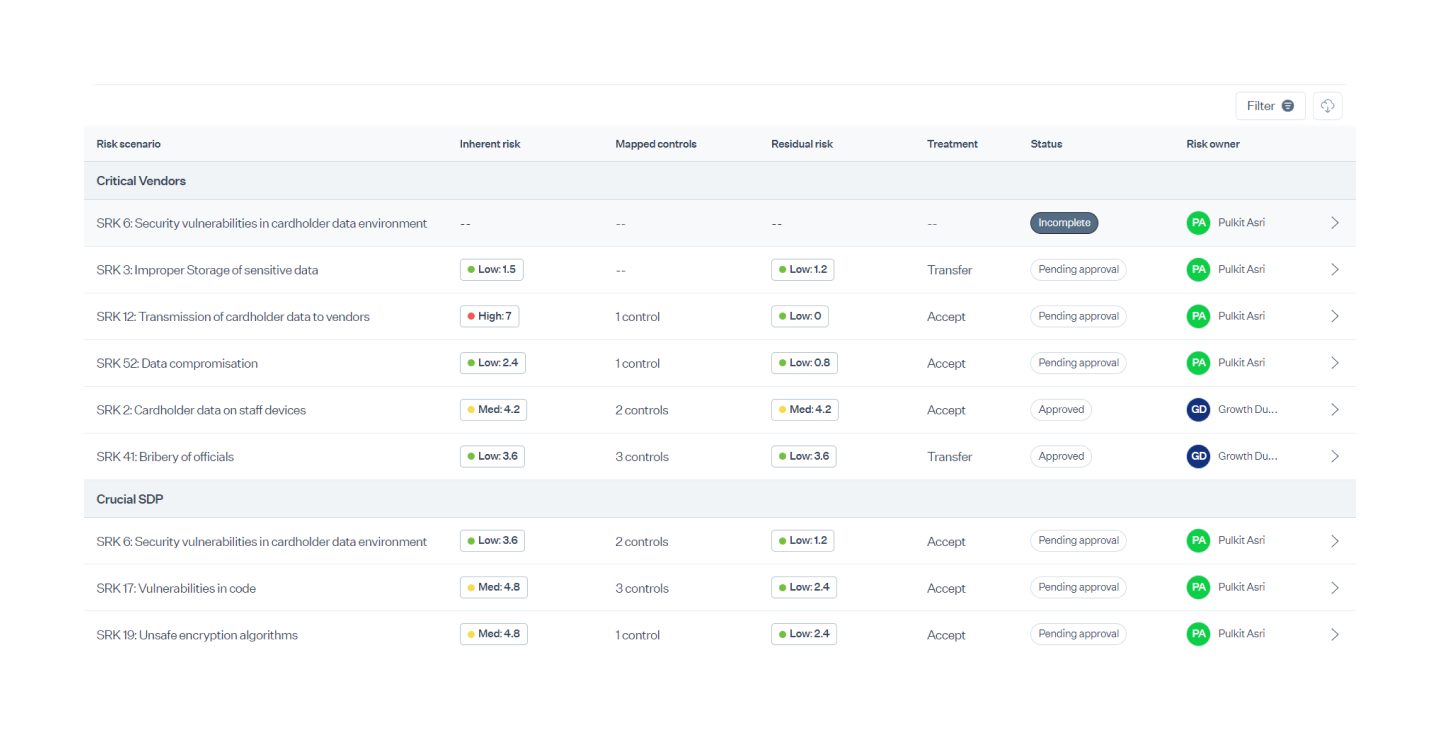

Here’s how organizations manage risks on Sprinto.

1. Accurately curate risks that impact business

Bring your own or use Sprinto’s comprehensive, in-built risk register to produce an overarching account of organization-wide risks. Add custom risks to the register and connect these with relevant controls without forgoing empirical assessment.

Update your risk library with new risks as you scale to ensure actionable data on risks at all times.

2. Apply empirical rigor to risk assessment

Empirically evaluate risks based on their likelihood, severity, and impact using industry benchmarks integrated into the Sprinto platform.

Accept, reject, or transfer risks based on internal tolerance levels and adjust the depth and severity of risk mitigation efforts as required.

To build accountability and transparency, assign risks to specific owners to manage the lifecycle of a risk.

3. Continuously monitor risks and controls

Sprinto’s pre-built control library automatically maps controls to risks as per assessment and what’s required from a compliance standpoint.

Activate automated checks to track controls and their impact on overall compliance health. Collect evidence of passing controls for audit purposes or some such.

In case of anomalies, Sprinto triggers alerts and remediation workflows for specified risk owners to close the loop and get controls back in green.

Minimize risk exposure with Sprinto

Right-size risks to streamline risk management

Due to increasing complexities and disruptions, modern businesses face a large volume of dynamic, often interconnected infosec risks. These risks can prove difficult to manage if organizations take a broad-brush and periodic approach to risk management.

The solution is to make risks more precise by taking a dynamic and data-driven approach that prioritizes risk based on likelihood, relevance, and severity.

Sprinto provides all the essentials required to create a precision-oriented risk management function capable of streamlining risk management, making risks tangible and trackable, and giving organizations the tools to better manage risk management functions.

Get in touch with our compliance experts to learn more about how you can manage risks better on Sprinto.